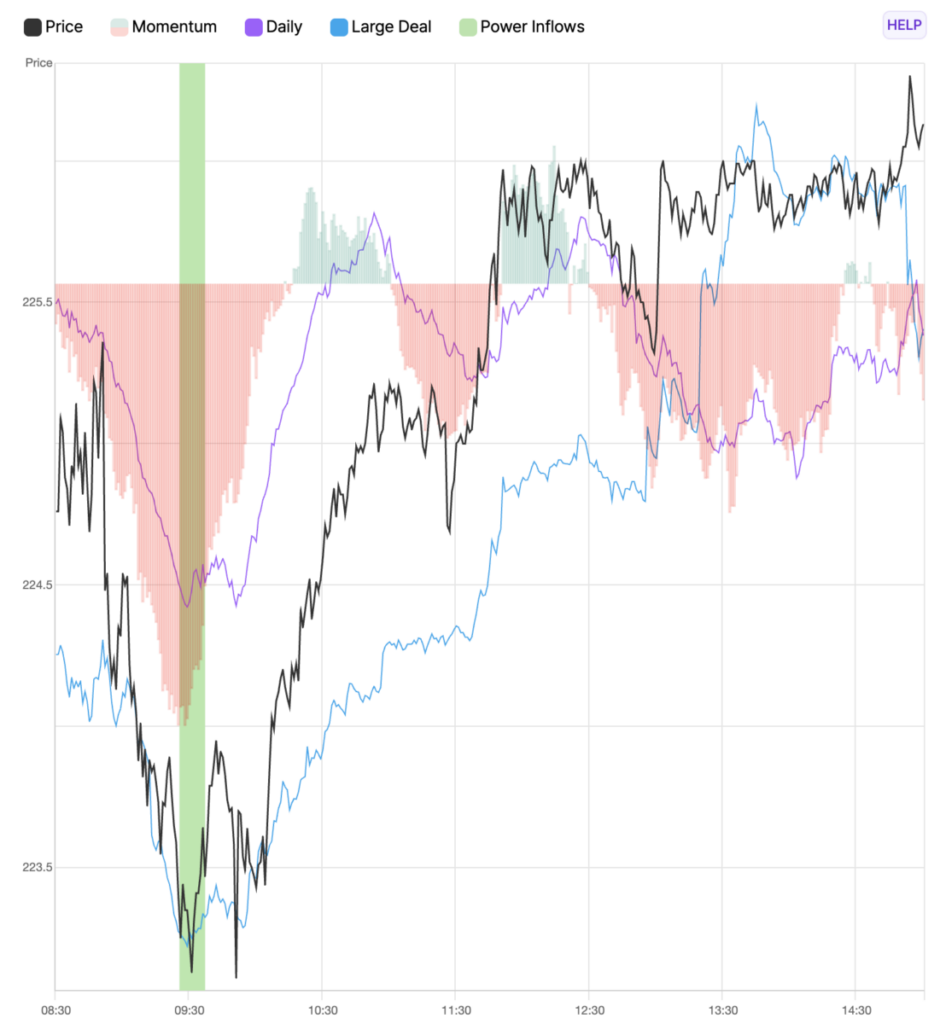

Amazon Shares Up 1.3% After Key Trading Signal

AMZN climbs rest of session after reversal

Amazon.com Inc. (NASDAQ:AMZN) today experienced a Power Inflow, a significant event for those who follow where smart money goes and value order flow analytics in their trading decisions.

Today, at 10:35 AM on July 18th, a significant trading signal occurred for Amazon.com Inc., (AMZN) as it demonstrated a Power Inflow at a price of $223.48. This indicator is crucial for traders who want to know directionally where institutions and so-called "smart money" moves in the market. They see the value of utilizing order flow analytics to guide their trading decisions. The Power Inflow points to a possible uptrend in Amazon's stock, marking a potential entry point for traders looking to capitalize on the expected upward movement. Traders with this signal closely watch for sustained momentum in Amazon's stock price, interpreting this event as a bullish sign.

Signal description

Order flow analytics, aka transaction or market flow analysis, separate and study both the retail and institutional volume rate of orders (flow). It involves analyzing the flow of buy and sell orders, along with size, timing, and other associated characteristics and patterns, to gain insights and make more informed trading decisions. This particular indicator is interpreted as a bullish signal by active traders.

The Power Inflow occurs within the first two hours of the market open and generally signals the trend that helps gauge the stock's overall direction, powered by institutional activity in the stock, for the remainder of the day.

By incorporating order flow analytics into their trading strategies, market participants can better interpret market conditions, identify trading opportunities, and potentially improve their trading performance. But let's not forget that while watching smart money flow can provide valuable insights, it is crucial to incorporate effective risk management strategies to protect capital and mitigate potential losses. Employing a consistent and effective risk management plan helps traders navigate the uncertainties of the market in a more controlled and calculated manner, increasing the likelihood of long-term success

If you want to stay updated on the latest options trades for AMZN, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs and include firms, like https://tradepulse.net/?utm_source=Benzinga&utm_medium=Article&utm_campaign=brand_awareness_July2025

which are responsible for parts of the data within this article.

After Market Close UPDATE:

The price at the time of the Power Inflow was $223.48. The returns on the High price ($226.30) and Close price ($226.13) after the Power Inflow are respectively 1.3% and 1.2%.

Past performance is not indicative of future results

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Posted-In: contributors Expert IdeasEquities Technicals Opinion Signals Trading Ideas