A Microcap Positioned To Profit From The AI Datacenter Boom

The $215 Billion Datacenter Boom

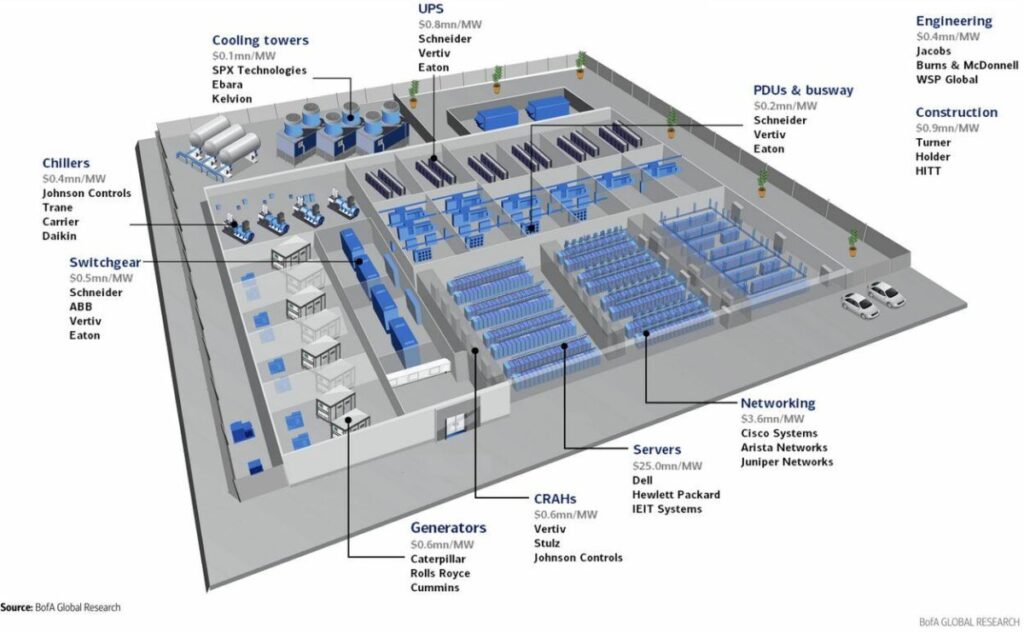

In an X post this week, ZeroHedge reshared a piece from last year about companies involved in the buildout of datacenters to support the surge in AI.

In the graphic included in the X post above, you can see chillers mentioned as a datacenter component.

New Cash, New Options, Same Thesis

In a post earlier this month ("Finding Alpha on X") I mentioned why Tecogen Inc.'s (NYSE:TGEN) gas‑engine chillers could become a surprise beneficiary of the AI datacenter build‑out.

Since then two meaningful updates have landed:

1. Capital Raise @ $5.00

- 3.5 million shares (plus full 485 k over‑allotment) sold on 18 July at $5.00.

- ≈ $19.9 million gross proceeds closed 21 July.

- Management earmarked use of funds for working capital, product development, and — explicitly — expansion into the data‑center market.

Bottom line: the raise extends runway well into 2026, easing "going‑concern" fears for potential customers who need multiyear service support.

2. Options Finally Listed

As of last Friday TGEN has a chain out to January 2026. Liquidity is thin but workable, which lets us monetize patience instead of chasing spot.

Quick Thesis Refresher

- AI's heat dilemma: GPU racks now swallow 50‑70 kW; electric chillers compete for the same power budget.

- Gas‑engine chillers (Distributed Thermal Exchange): Off‑grid cooling plus optional cogeneration = lower operating cost and resilience during peak‑pricing events—think ERCOT (Electric Reliability Council of Texas) summer afternoons).

- "First logo" domino: One 20‑unit datacenter order would roughly double annual revenue and validate the tech across the sector.

- Credibility de‑risked: Vertiv partnership + NYSE uplist were big steps; this fresh equity raise tackles the remaining balance‑sheet worry.

With options trading, we have a new way to add exposure to this name, while using its volatility to our advantage.

Our Follow Up Trade On Tecogen

What we did on Monday is sell the $5 strike puts on it expiring on January 16th, for $1.10.

One of two things will happen with that trade by January 16th: either those puts will expire worthless, and we’ll keep $110 per contract, or we’ll end up own more shares of of TGEN at an effective price of $3.90 (the $5 strike price of the puts minus the $1.10 premium we got for selling them). Either outcome would be acceptable.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

**

Our Next Trade

A stock with the highest short interest as a percentage of its float is a top ten Portfolio Armor name as of Tuesday’s close. A bullish bet on that one is going to be our next trade. If you’d like a heads up when we place it, you can subscribe to our trading Substack/occasional email list below.

And if you’d rather add downside protection here, you can use our website or iPhone app.

Posted-In: contributors Expert IdeasEquities Options Opinion Trading Ideas