Market Direction Depends On Amazon, Meta, Microsoft, And Apple Clearing The High Bar

To gain an edge, this is what you need to know today.

Big Tech Earnings

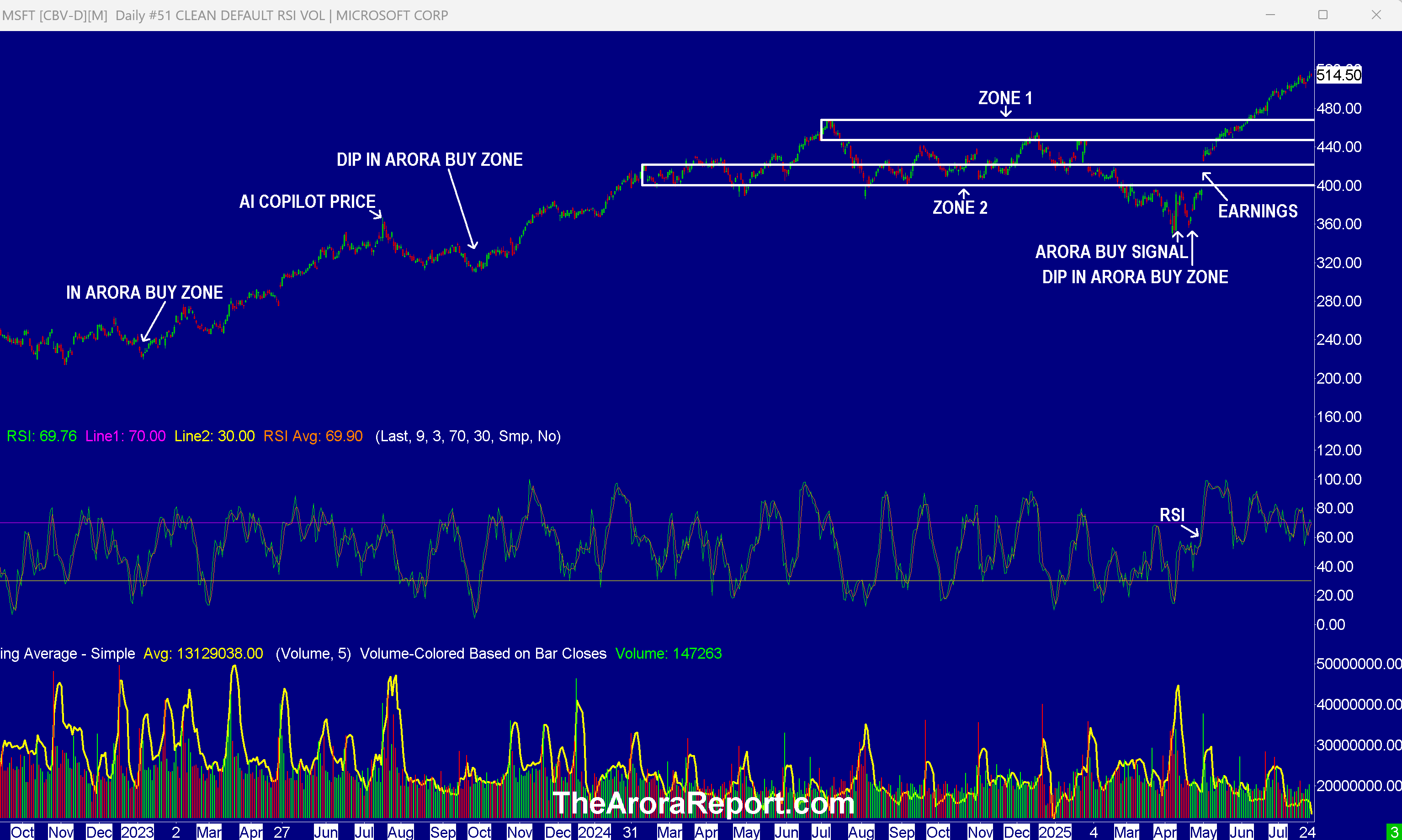

Please click here for an enlarged chart of Microsoft Corp (MSFT).

Note the following:

- This article is about the big picture, not an individual stock. The chart of Microsoft Corp (MSFT) stock is being used to illustrate the point.

- The chart shows our buy signal on MSFT on the April drop. The chart also shows MSFT stock dipping into our buy zone.

- The chart shows the gap up in MSFT stock on its previous earnings report.

- The chart shows the run up in MSFT stock since then.

- The chart shows MSFT stock hitting new highs after it broke out of zone 1 (previously resistance, now support).

- RSI on the chart shows MSFT stock is not overbought despite its rapid rise.

- The near term direction of the stock market will depend on big tech earnings reported this week.

- Microsoft and Meta Platforms Inc (META) report earnings on Wednesday after the regular session close. Apple Inc (AAPL) and Amazon.com, Inc. (AMZN) report earnings on Thursday after the regular session close.

- The bar is high for Microsoft, Meta, Apple, and Amazon earnings. Whisper numbers are higher than consensus numbers. Whisper numbers are the numbers analysts privately share with their best clients. Whisper numbers are often different from consensus numbers published by the same analysts for public consumption. Analysts typically provide whisper numbers only to their best clients, and not the public.

- Of note, Amazon CEO Jeff Bezos sold more AMZN stock, nearly $1B worth.

- There is buying in the early trade on optimism about the trade deal with Europe. Please see the section below.

European Union

Trade between the U.S. and the E.U. accounts for nearly a third of global trade. The E.U. and the U.S. have agreed on a framework for a trade deal which will impose a 15% tariff on most goods from the U.S. The E.U. will also purchase $750B in energy from the U.S. in addition to a separate $600B investment.

China

U.S. and Chinese officials are meeting in Sweden to extend the deadline for reaching a trade deal.

Magnificent Seven Money Flows

In the early trade, money flows are positive in AAPL, AMZN, NVIDIA Corp (NVDA), MSFT, Alphabet Inc Class C (GOOG), META, and Tesla (TSLA).

In the early trade, money flows are positive in SPDR S&P 500 ETF Trust (SPY) and Invesco QQQ Trust Series 1 (QQQ).

Oil

There is speculation that Saudi Arabia is looking at a price hike in September for Asia.

Bitcoin

Bitcoin (BTC) is range bound.

What to do now

Consider continuing to hold good, very long term, existing positions. Based on individual risk preference, consider a protection band consisting of cash or Treasury bills or short-term tactical trades as well as short to medium term hedges and short term hedges. This is a good way to protect yourself and participate in the upside at the same time.

You can determine your protection bands by adding cash to hedges. The high band of the protection is appropriate for those who are older or conservative. The low band of the protection is appropriate for those who are younger or aggressive. If you do not hedge, the total cash level should be more than stated above but significantly less than cash plus hedges.

A protection band of 0% would be very bullish and would indicate full investment with 0% in cash. A protection band of 100% would be very bearish and would indicate a need for aggressive protection with cash and hedges or aggressive short selling.

It is worth reminding that you cannot take advantage of new upcoming opportunities if you are not holding enough cash. When adjusting hedge levels, consider adjusting partial stop quantities for stock positions (non ETF); consider using wider stops on remaining quantities and also allowing more room for high beta stocks. High beta stocks are the ones that move more than the market.

Traditional 60/40 Portfolio

Probability based risk reward adjusted for inflation does not favor long duration strategic bond allocation at this time.

Those who want to stick to traditional 60% allocation to stocks and 40% to bonds may consider focusing on only high quality bonds and bonds of five year duration or less. Those willing to bring sophistication to their investing may consider using bond ETFs as tactical positions and not strategic positions at this time.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

**

Please click here to sign up for a free forever Generate Wealth Newsletter.

Posted-In: contributors Expert IdeasEquities Market Summary Opinion Markets Trading Ideas