Albany International: Caution Warranted As Structure Weakens

Albany International (NYSE:AIN) is currently in its phase 16, navigating through a critical zone of its Adhishthana cycle. The combination of weak Guna Triads and a continued descent from its Adhishthana Himalayan formation points to sustained caution. Here’s a full breakdown.

Albany International’s Weak Guna Triads Suggest No Nirvana Ahead

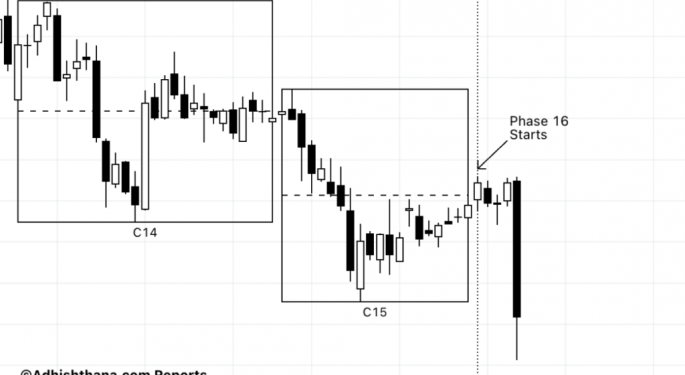

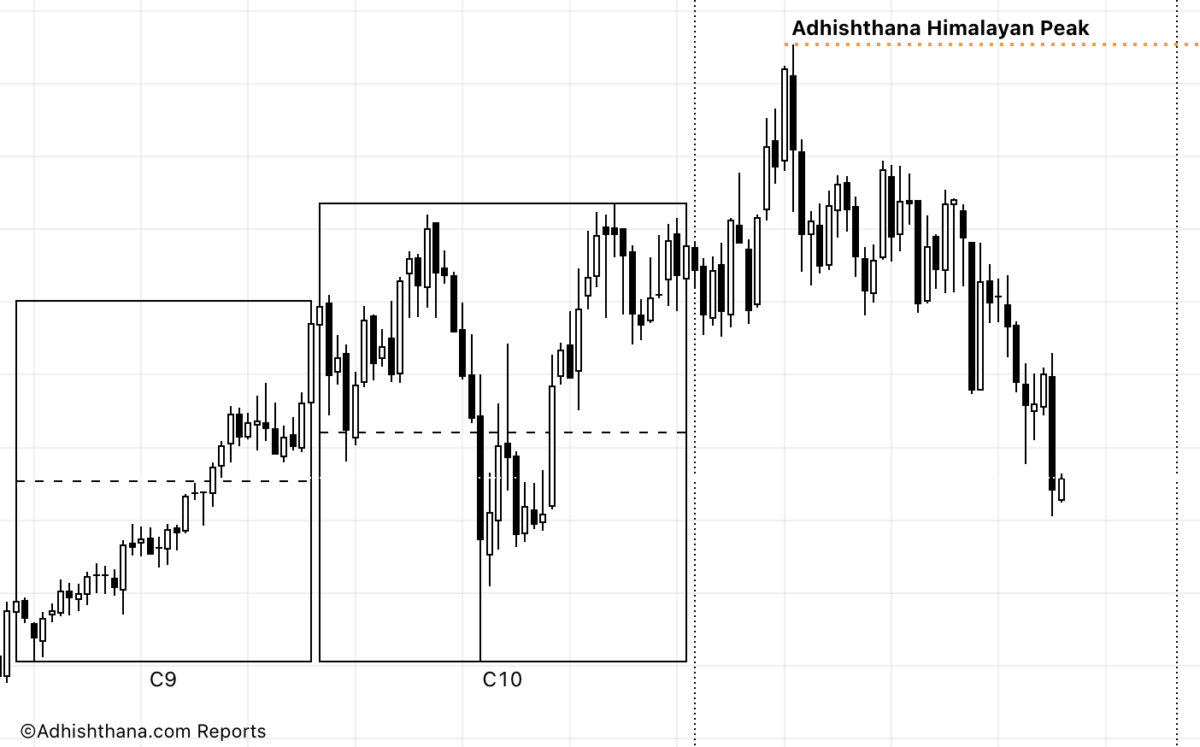

Under the Adhishthana Principles, phases 14, 15, and 16 together form the Guna Triads. These are essential in determining whether a stock will achieve Nirvana in its final phase 18, the highest point in the cycle. For a Nirvana move to materialize, the triads must show the presence of Satoguna, which reflects a clean and sustained bullish structure.

"A lack of noticeable Satoguna in any of the triads leads to no Nirvana in Phase 18."

— Adhishthana: The Principles That Govern Wealth, Time & Tragedy

In Albany International's case, phase 14 and phase 15 both lacked any significant bullish structure and showed weakness. Phase 16, still ongoing, has also seen a 30% decline so far. If this continues, it will mark the triads as fully devoid of Satoguna, signaling no Nirvana move in phase 18, which is set to begin in June 2026 and run until December 2027. This points to a prolonged period of underperformance.

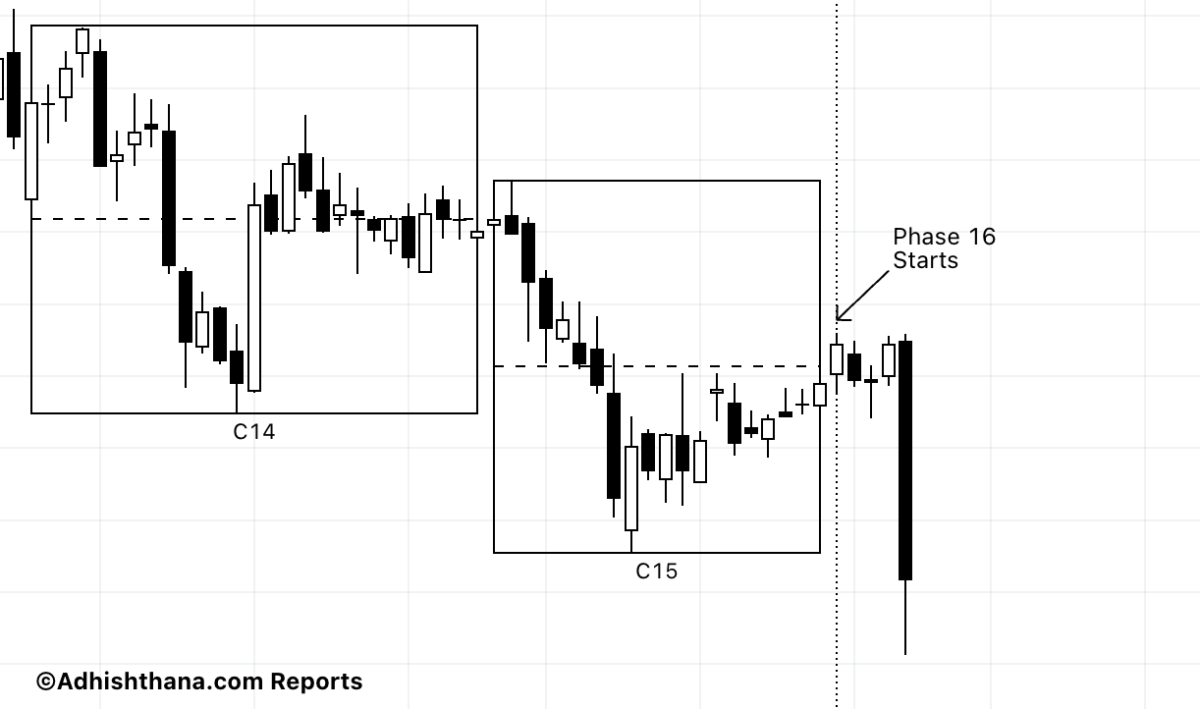

Monthly Chart: Descent of the Himalayan Formation

Albany International also mirrors a textbook Himalayan formation on the monthly chart. As per the Adhishthana model, stocks break out of a long Cakra formation in phase 9, initiating a powerful rally and beginning the Himalayan ascent.

Albany followed this structure closely. From phase 4 to phase 8, the stock remained range-bound for nearly 15 years. In phase 9, it broke out and rallied ~111%, as expected during this phase of the supreme move.

Phase 10, however, began with erratic price action, which might have seemed like a potential top. But the principles caution against such assumptions. Quoting from my book;

"At times, before the 18th bar, the price action may appear deceptive, as the moves appear treacherous creating a false sense of peak formation." — Adhishthana: The Principles That Govern Wealth, Time & Tragedy

As expected, the real peak came in phase 11 at around the $115 mark. Since then, the stock has entered the descent leg of the Himalayan formation, a phase marked by sharp drawdowns. The stock has already fallen to the $55 range, giving up more than 50% of its gains, with the descent still ongoing.

Investor Outlook

The combination of weak triads on the weekly chart and a continued descent on the monthly chart suggests a bearish structure through at least 2027. The recent disappointing earnings have only added to the downside momentum. Investors should avoid new positions until the structure realigns under the lens of the Adhishthana Principles.

Benzinga Disclaimer: This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Posted-In: contributors Expert IdeasEquities Technicals Opinion Signals Trading Ideas