Opendoor Stock Pops 4.5% After-Hours Ahead Of Q2 Earnings

Opendoor Technologies Inc. (NASDAQ:OPEN) experienced a 4.47% surge in after-hours trading on Monday.

Check out the current price of OPEN stock here.

What Happened: The stock of the San Francisco-based real estate technology company rose to $2.57 during after-hours trading on Monday. This surge comes ahead of the company’s second-quarter earnings report, which is scheduled to be released after the market closes on Tuesday.

The stock’s after-hours performance is a continuation of the recent trend. Opendoor’s stock has been on a meteoric rise, gaining almost 290% over the last 30 days. This surge has been attributed to the company’s strong first-quarter performance and high short interest.

According to the Benzinga Pro data, OPEN stock closed at $2.46, marking a 17.14% increase during regular trading session on Monday, followed by a 4.47% gain in after-hours trading.

With a market cap of $1.79 billion and an average volume of 278 million shares, Opendoor's stock is trading within an annual range of $0.51 to $4.97.

Why It Matters: Opendoor has recently gained meme-stock status, attracting the attention of retail investors. The company’s stock price surge has also impacted several exchange-traded funds, including the Vanguard Russell 2000 ETF (NASDAQ:VTWO), the Invesco S&P SmallCap Momentum ETF (NASDAQ:XSMO), and the iShares U.S. Real Estate ETF (NYSE:IYR).

Despite the recent surge, some analysts have raised concerns about Opendoor’s fundamentals, especially given the current softening housing market and rising borrowing costs. The company’s second-quarter earnings report is expected to provide clarity on whether the recent surge is a short-term phenomenon or a sign of a more significant trend in real estate disruption.

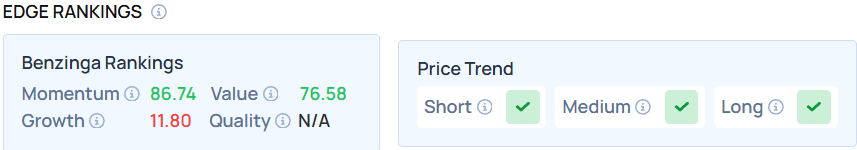

With Momentum in the 86th percentile, Benzinga’s Edge Stock Rankings highlight OPEN Stock has positive price trends across all time frames. Track the performance of other players in this segment.

Photo Courtesy: ZikG on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: why it's movingEquities Markets