Trump Calls For 'Highly Conflicted' Intel CEO's Resignation: 'There Is No Other Solution'—Stock Falls Nearly 4% In Pre-Market

President Donald Trump called for the immediate resignation of Intel (NASDAQ:INTC) CEO, Lip-Bu Tan, citing a conflict of interest.

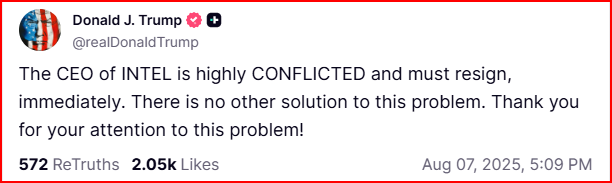

Trump took to his Truth Social on Thursday to express his opinion on the current situation at Intel. He stated that the CEO of the chipmaker is in a conflicted position and should step down. The post read, “The CEO of INTEL is highly CONFLICTED and must resign, immediately. There is no other solution to this problem.”

Check out the current price of INTC stock here.

Trump’s comments come in the wake of growing Republican concerns about Tan’s alleged ties to China. Senator Tom Cotton (R-Ark.) has previously demanded answers from Intel regarding potential national security risks posed by Tan’s Chinese investments. These concerns have been amplified by Intel’s recent $8 billion federal grant under the CHIPS Act.

SEE ALSO: Tom Lee: Ethereum Is Having A ‘2017 Bitcoin Moment’, Could Hit $15,000 By End Of 2025

Intel’s 18A Chip Woes Deepen Foundry Loss Concerns

Trump’s call for Tan’s resignation adds to the growing pressure on Intel’s CEO. The company has been facing a series of challenges, including a recent quality setback in its high-stakes 18A chip project. This setback has raised concerns about Intel’s ability to profitably produce advanced chips, a critical part of its plan to become a top-tier foundry rivaling Taiwan Semiconductor Manufacturing Co (NYSE:TSM).

The controversy surrounding Tan has been fueled by Intel’s financial struggles. Despite receiving $8.5 billion in U.S. CHIPS Act subsidies, Intel reported a staggering $18.8 billion loss in its foundry division in 2024. CNBC’s “Mad Money” host Jim Cramer has questioned the sustainability of domestic semiconductor manufacturing in light of Intel’s losses.

During the pre-market trading session on Thursday, Intel stock fell 3.72%. Over the past month, it fell 7.23%, according to data from Benzinga Pro.

READ MORE:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: News