Activist Short Seller NINGI Says Marex Group Uses Off Balance Sheet Funds To Inflate Results, Calls It 'House Of Cards' Built On Fake Profits

Activist short seller NINGI Research has released a report on Marex Group PLC (NASDAQ:MRX), a London-based financial services company, alleging it is "a financial house of cards built on a multi-year scheme of accounting manipulation, intercompany transactions, and fake profits."

Check out MRX’s stock price over here.

What Happened: The report highlighted by ‘The Bear Cave‘ on Substack and detailed in a thread on X, by NINGI Research, states that it has taken a short position on the company’s stock.

The report highlights several key claims, including the alleged use of off-balance-sheet vehicles to conceal trading losses. NINGI Research points to the “Marex Fund,” an opaque fund in Luxembourg holding at least $930 million in derivatives with Marex as the sole counterparty.

“Since Marex execs determine the ‘fair value’ for both sides, they can book massive, non-cash gains out of thin air,” the short seller claims. A significant finding was the resignation of group auditor Deloitte from this specific entity, a “material event Marex never disclosed.”

Further allegations focus on Marex’s cash flow and leadership. NINGI contends that Marex’s reported Operating Cash Flow (OCF) is a “sham,” claiming that when debt issuance is removed, the company’s 2024 OCF of $1.2 billion was actually a negative $150 million.

The report also highlights a connection between Marex's CEO, Ian Lowitt, and Lehman Brothers, where he was CFO and allegedly “embroiled in an accounting scheme that concealed leverage” shortly before its collapse.

Why It Matters: Additionally, NINGI Research points to alleged insider behavior, noting that C-suite executives adopted trading plans just a week before the 2024 annual report and have sold $30.2 million in stock.

In response, Marex Group has rejected the report as a “malicious” and “transparent effort to manipulate the share price to enable NINGI to profit.” The company announced it would address the claims during its second-quarter earnings report on Aug. 13.

According to Benzinga Pro, the consensus expects MRX to report earnings of $0.912 per share on revenue of $467.87 million on Wednesday before the opening bell.

Price Action: MRX stock fell 0.31% on Friday and advanced 0.28% in after-hours. It was up 8.89% year-to-date and 71.98% higher over the past year.

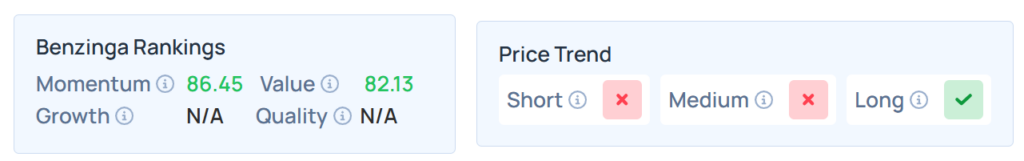

Benzinga's Edge Stock Rankings indicate that MRX maintains a strong price trend in the long term but weaker momentum over the short and medium terms. However, the stock scores well on value rankings. Additional performance details are available here.

Price Action: The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended higher on Friday. The SPY was up 0.78% at $637.18, while the QQQ advanced 0.93% to $574.55, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Equities