Tesla Powers Up, But Clean Energy Stocks Are Stuck In Death Cross Rut

Tesla Inc. (NASDAQ:TSLA) has been riding a wave of mixed fortunes in 2024. The electric vehicle giant is down more than 19% year-to-date, but recent gains of about 3% over the last month have offered some respite.

The company’s second-quarter earnings report on July 23 brought a glimmer of hope. Revenue hovered at around $25.5 billion — a modest 2% increase year-over-year — beating Wall Street’s expectations of $24.73 billion, according to Benzinga Pro.

However, Tesla’s earnings per share (EPS) told a different story, falling 43% year-over-year to 52 cents. They missed the Street’s consensus estimate of 62 cents. Despite the earnings miss, the stock found a technical lifeline, forming a Golden Cross on July 29.

Chart created using Benzinga Pro

A Golden Cross occurs when the 50-day moving average crosses above the 200-day moving average, signaling a potential bullish trend. This pattern has sparked optimism among investors, suggesting Tesla could be poised for a rebound.

While Tesla is basking in the glow of its Golden Cross, the broader clean energy sector isn’t faring as well.

Read Also: Tesla FSD Test Drive Terrifies Analyst’s Son: ‘Third Time Not The Charm’

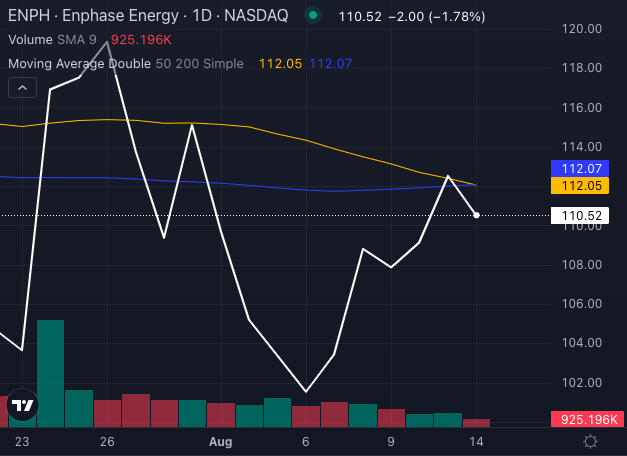

Enphase Energy Inc. (NASDAQ:ENPH), a leader in energy management technology, is down 15.69% YTD and teetering on the brink of a Death Cross.

Chart created using Benzinga Pro

This bearish signal, where the 50-day moving average falls below the 200-day moving average, indicates potential further declines.

Blink Charging Co. (NASDAQ:BLNK), another key player in the EV space, is also struggling.

Chart created using Benzinga Pro

With its stock down 35.49% YTD, Blink is rapidly approaching a Death Cross, casting a shadow over its short-term prospects.

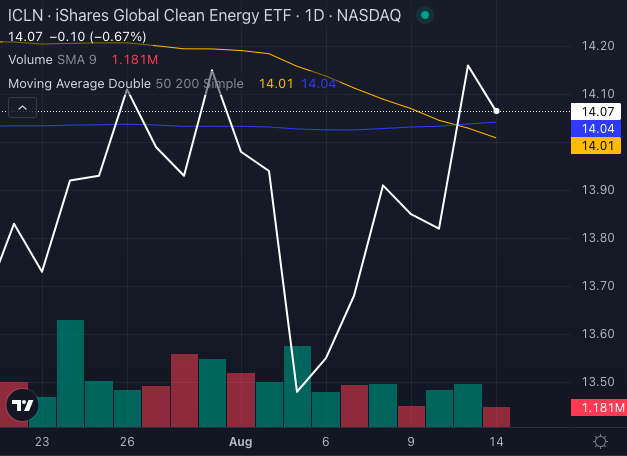

The iShares Global Clean Energy ETF (NASDAQ:ICLN), which tracks the performance of clean energy companies worldwide, has already succumbed to a Death Cross, reflecting the sector’s broader struggles.

Chart created using Benzinga Pro

The ETF is down 8.54% YTD, signaling that clean energy stocks face an uphill battle despite Tesla’s technical rebound.

As Tesla powers up with its Golden Cross, clean energy stocks remain stuck in a Death Cross rut, highlighting the sector’s contrasting fortunes.

Read Next:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: clean energy Death CrossESG Technicals Top Stories Markets Tech Trading Ideas