EUR/USD Analysis: Increased Risk Of A Corrective Rally To 1.1660-1.1680

The EUR/USD is having a tough time holding above 1.16 handle.

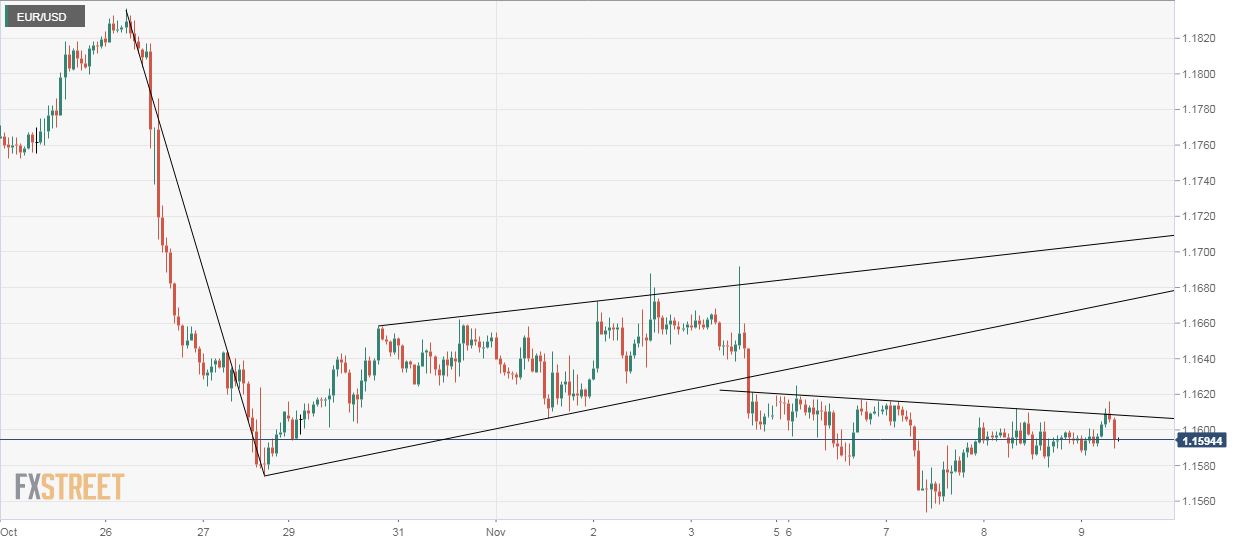

1-hour chart

The upswings of this pair are being restrained around 1.1620 since Monday. Add to that, the failed inverse head and shoulders breakout on the 1-hour chart, and the prospects of an up-move start looking grimmer.

Furthermore, the 5-day MA and 10-day MA favor the bears as well (slope downwards). So, it is logical to expect a drop to 1.15 (psychological level + falling channel support).

However, it is easier said than done-

- The leading indicator, RSI, is flatlined below 50.00 on the dailies and holds above the 50.00 levels on the weekly terms, which is a "call for caution" for aggressive bears.

- On the 1-hour chart, the 50-MA and 200-MA have bottomed out as well, hence a failed inverse head and shoulders breakout may not yield serious consequences. On the daily chart, the 100-MA is still sloping upwards.

- It is worth noting that the dips below 1.1570 have been short-lived since Oct. 27. Furthermore, the dollar index is having a tough time breaching the key descending trendline hurdle as discussed earlier today. Also, the treasury yield curve has turned flattest since Oct. 31, 2007, which is USD negative.

View

A quick drop to the 1.15 handle is necessary to keep the bears in the game. The longer the time taken to fall below 1.1570, the higher the odds of a bullish move to the downward sloping weekly 200-MA level of 1.1660 and weekly 5-MA level of 1.1682.

As noted, the weekly 200-MA favors the bears (sloping downwards), thus potential spikes above the same are likely to be short-lived.

On the downside, an end of the day close below 1.15 would mark a bearish breakdown of the falling channel and shall open up downside towards 1.13-1.12 levels.

This article was submitted by an external contributor and may not represent the views and opinions of Benzinga.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Forex FXStreet FXstreet.comForex Markets