GBP/USD Forecast: Likely To Eye Unfinished Target Of 1.30 On Below-forecast UK CPI

The latest UK political turmoil, led by reports that a significant number of Conservative MPs were ready to sign a letter of no confidence, weighed heavily on the British Pound at the start of a new trading week. The GBP/USD pair tumbled closer to early-November lows near mid-1.3000s, touched in the aftermath of dovish BOE rate hike, but managed to recover back above the 1.3100 handle. The recovery move was supported by BOE Chief Economist Andy Haldane's comments that UK CPI is likely to stay above the target 'for the next few years'.

The pair, however, seemed lacking any follow through momentum as focus shifts to the latest UK inflation figures, due to be released during the European session and expected to show headline CPI increased 3.1% y-o-y in October. Against the backdrop of a deadlock on the Brexit settlement bill, easing inflationary pressure would scale back market expectations for any additional BOE rate hike and might trigger a fresh round of GBP weakness.

Meanwhile, an uptick in the CPI might provide a minor boost to the British Pound, but would force BOE Governor Mark Carney to write an open letter to the Chancellor of Exchequer Philip Hammond, explaining reasons for inflation moving away from the central bank's upper band and what actions ought to be taken to bring inflation back to target.

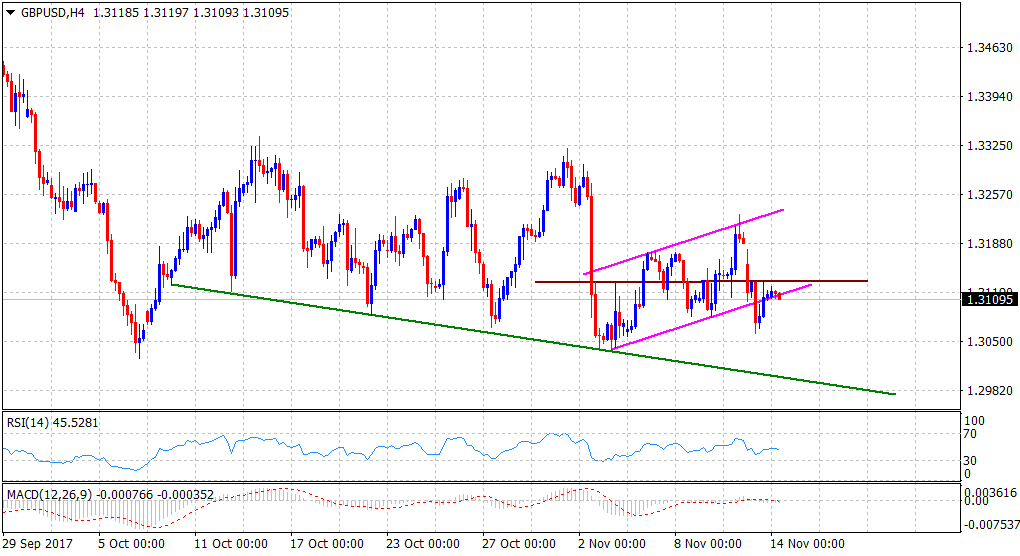

From a technical perspective, the pair on Monday confirmed a bearish break below a short-term ascending trend-channel. Moreover, the subsequent recovery confronted fresh supply near the 1.3135 region, which now becomes an immediate hurdle. A clear break through the mentioned barrier could trigger a short-covering bounce towards 1.3175 horizontal resistance but might still struggle to lift the pair back above the 1.3200 handle.

On the flip side, weakness back below the 1.3100 handle, leading to a subsequent break below 1.3080 level, might continue dragging the pair towards an unfinished target of 1.30 mark.

This article was submitted by an external contributor and may not represent the views and opinions of Benzinga.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: FXStreet FXstreet.comForex Markets