As US Dollar Sinks, Top Economist Warns 10% Slide Could Spark New Inflation Spike

The United States is bracing for a potential acceleration in inflation, with a significant depreciation of the dollar now identified as a key contributing factor, according to a new analysis by Torsten Sløk, the chief economist at Apollo.

What Happened: As per Sløk’s analysis, a 10% depreciation in the U.S. dollar is projected to boost inflation by 0.3 percentage points.

This comes at a time when inflationary pressures are already building from multiple fronts, including ongoing tariffs, rising oil prices, and existing immigration restrictions.

Sløk emphasizes that “The bottom line is that we should see inflation move higher over the coming months; that is what the consensus expects, what the Fed expects, and what we expect.”

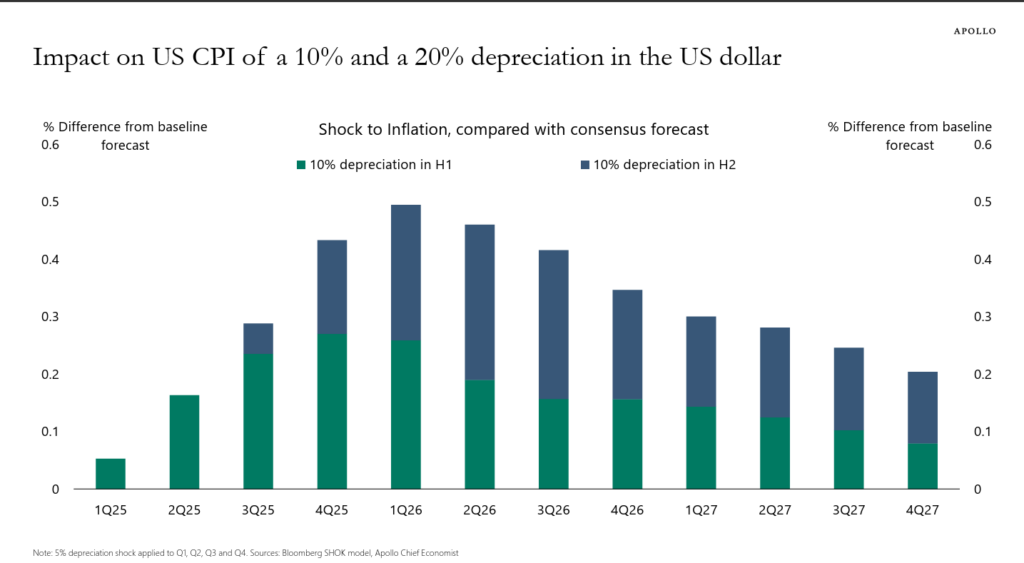

As the U.S. Dollar Index Spot has already declined by 10.29% on a year-to-date basis, a chart tracking the “Shock to Inflation, compared with consensus forecast” illustrates the projected impact.

A 10% depreciation occurring in the first half of a year (H1) shows a noticeable upward bump to inflation, as does a 10% depreciation in the second half (H2).

The chart also details the impact on U.S. CPI from both a 10% and a 20% depreciation in the dollar, relative to baseline forecasts, stretching from the first quarter of 2025 through the fourth quarter of 2027.

See Also: Stocks Just Hit Rare Golden Cross For 1st Time Since 2023 — Here’s What It Means For Investors

Why It Matters: During a discussion with Blomberg Television, Sløk was asked about the business environment being stronger than consensus expectations in terms of hiring, without the inflationary impulse.

He said, “That brings us back to a discussion around what are the effects of the trade war? Are tariffs not going to have an impact? So far, it’s remarkable, where you have inflation still steady, and now the job growth still strong. So in that sense, there is literally very little sign of the trade war having a macroeconomic impact at this point.”

The U.S. Dollar Index Spot was up 0.19% at the 97.3660 level during the publication of this article.

While, the SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were lower in premarket on Monday. The SPY was down 0.13% at $624.54, while the QQQ declined 0.25% to $554.81, according to Benzinga Pro data.

Read Next:

Image via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Apollo CPI DXY Economy hiring Inflation inflationaryNews