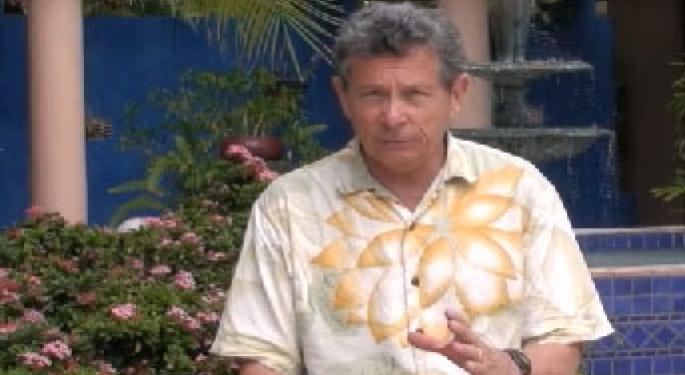

Making Millions With Commodities - Benzinga's Exclusive Interview With Larry Williams

Famed commodities trader Larry Williams came on the Benzinga podcast to weigh in on everything from board games to getting rich with soybeans. Larry is the winner of the 1987 World Cup Championship of Futures Trading and has trained several of his pupils to go on to do the same.

Below is an abridged transcription of the interview. You can listen to the full interview as an episode of the Benzinga Podcast, or you can email brian (at) benzinga (dot) com for the full text transcription.

Q: Everyone wants to know about your famous performance at a 1987 trading competition in which you turned $10,000 into $1.1 million in 12 months for a roughly 11,000% return. Can you walk us through how you were able to do that?

A: Fortunately, I had a hot hand in the market. And even more fortunately, I used a tremendously aggressive money management style. I got a lot of my bankroll in virtually every single bet. And if you look closely at the equity there were a lot of down moves too. At one point the account was $2.2 million, went down to $750,000 and rallied back at the end of the year to $1.1 million. As you can see, it was some very aggressive money management.

Q: Your daughter won the same competition years later. Is it something in the family genes, or can mere mortals accomplish the same thing?

A: Actually, something like 7 of 10 of my students won the competition. Including this year the winner is someone I’ve been working with for quite awhile. Obviously, not everyone can trade the market. Not everyone can be a carpenter. My dad was a carpenter and tried to teach me, and I was just terrible.

My daughter just followed a system with semi-aggressive money management. She didn’t have any trading skills. That was before all the movies she’s been in like Brokeback Mountain. It was just a home school assignment to learn a little bit about the markets.

Q: What would you say the advantage of trading in commodities futures themselves is versus trading in commodity backed ETFs or that track commodity indexes?

A: I learned a long time ago that when you’re in business you want to deal with the principal not the agent. You want to deal with guy that has the power. And if you’re trading with these ramifications of a commodity, then you’re not trading the commodity. You might get into a delivery problem, or this guy shorts this and this guy shorts that, or it’s a thin market, but that’s not really what’s happening in the commodities markets themselves.

You have a lot more volume and liquidity in the futures markets. It’s more real. I want to be as close as I can to reality. I mean, I get a great bang for my buck already, so what advantage do I get trading the others. I don’t think I get any.

Q: All over the news nowadays you hear the talking heads on TV alternate between worrying about inflation and worrying about deflation and going back and forth. As a commodities trader, tell us how those twin worries affect how you trade, and which one we really have to worry about, if either.

A: Neither of them. I only worry about the trade I’m in right now. The long-term inflation/deflation I don’t carry about. All I care about are the trades and the positions I have right now. My average trade is 12-15 days, sometimes longer, sometimes shorter. Does inflation matter? Does President Obama the socialist matter? No. You have to trade what’s actually there. That’s how I got to be a successful commodities trader: Not trading what I want something to be or looking for something to be.

Q: If you were tasked with rewriting the rules for the financial sector would you do nothing or is there something they aren’t doing right now that you think they should?

A: I would go to the people that I really respect in the industry and ask, “Who are the bad guys?” They know who they are. I know who the bad guys in the commodities business are. You don’t have to write all these regulations you just find out who the bad guys are and go after them. But that’s not how government works. It’s all a bandage after everything happens. I can see right now where some things are going to happen. I use to work for some of those people but maybe now they’ll get their financial education and get burned.

Q: Would you like to let Benzinga listeners know where those bad things are going to happen in the future?

A: Well, I think the Forex market is an opportunity for disaster. People have been told that it’s free commission and it’s not. I trade the same thing on the globex for a few bucks and they’re paying 30-40 dollars for the same trade. It just strikes me as unfair to the public.

Q: The staff here at Benzinga have really taken an interest in the Million Dollar Challenge, the board game about the financial markets we found on your website. Can you tell us a little bit about what you wanted to accomplish with this game?

A: Actually, it wasn’t my idea or message. I had a couple of students of mine who been to my Million Dollar Challenge, where I trade a million dollars real time and give away 20% of the profits to the people that are there. One of the kids went home and told his dad about it and said, “Hey, let’s make a game out of it.” So they actually made this game called the Million Dollar Challenge. I had nothing to do with it. They showed it to me and I just said, “God that’s a lot of fun, this is really cool.” So they said, “Well, we’d like to get your permission and we’ll pay you royalties.” I told them, “Nah give whatever royalties you make to the University of Oregon.” That’s where I have my scholarship fund. And so they did and they marketed their product and they sold quite a few of them. People really liked the game. It’s really a neat, fun thing to do.

Q: Our final question is something we ask to all our guests on the Benzinga podcast. Benzinga is a fairly new company but it has taken a big bite out of the financial media market in its relatively short time on the web. What advice would you give Benzinga to help grow its business?

A: Providing honest, impeccable news and then on an editorial/perspective side having people that have enough great contacts to tell people hey here’s something you may not know about. I have my degree in journalism so I know a little bit about your issues, but it’s really about the quality of your news. You can make an incredibly fancy web page but it doesn’t mean anything. Look at Drudge’s web page. It’s a disaster if you look at it. But he’s number one because he’s got the news. You guys stay on track with that and you’ll be smashingly successful.

Q: And how do you think we’re doing on that so far?

A: I think you’re doing great. I mean you interviewed me, right? And more importantly, you interviewed my buddy Tom DeMark, so I know you’re on track.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Benzinga Podcast Larry WilliamsFutures Movers & Shakers Markets General