Late Evening S&P500 Futures Update (SPX)

Today was another winner for fade the Sunday night ramp crowd... If you remember last night I was harping about the ridiculous 50 handle ramp in the Dow futures off the heels of Chinese PMI, looks like the harping was not to far out of left field considering at 15:15hrs the market was down .45%, over a 1% move from trough to trough.

We opened today at 1186ish with light volume the first

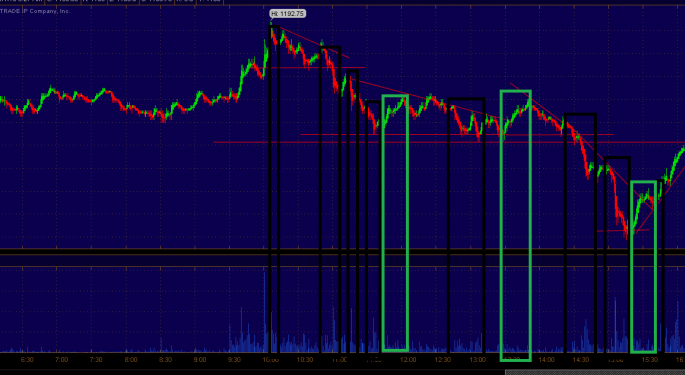

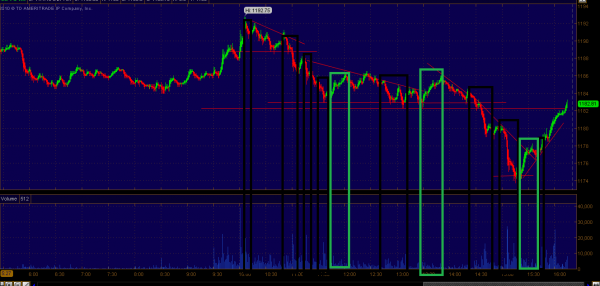

15 minutes, then the buying started taking us to 1188 then more buying launched us straight off 1188 to 1192.75 after ISM was released at 10 am. From that point on the fade game was on. We slowly melted down to 1188 where a descending triangle completed its pattern sending the spooz down to 1182 even. We chopped in what looked like a large descending triangle for about 2 hours on the 1 min chart as you see above, before failing to the 1186 level on absolutely paltry volume.

The low volume = buy buy buy equation was clearly on the chalkboard at 1184 as false failure of the descending triangle had begun, taking us from 1184 to 1188. 1188 failed with the next stop 1178.75 which again failed on volume all the way down to 1173.75. This second leg down was was precipitated by the JPM news of an SEC investigation. I knew we were fairly extended down here as we gave back nearly a percent in 30 minutes or so, and i was right. XLF ramping had begun.

Though what happened next was as mind boggling as you can get. The Spooz bounced from 1174 all the way to 1183.50 without even so much as ticking down one handle until the futures market closed at 4:15. Take a look at the chart above you should notice the black boxes are highlighting the selling volume, green is the buying volume.... notice how many black boxes there are.... Yes quite a bit.

The massive move higher of 10 handles off 1173.75 was on pathetic volume, the buying was simply so systematic no one could even offer anything of size because the speed at which contracts were being bought was staggering. It was the velocity of buying not the size of the buying that moved the market.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: S&P 500 ($SPX)Futures Intraday Update