Boeing Projects Demand For 43,600 Jets Over Next 20 Years—Asia, Single-Aisle Planes To Lead The Charge

Even as its troubles refuse to die down, aviation giant Boeing Co. (NYSE:BA) remains optimistic about the future and continues to bet on a surge in global air travel over the next two decades.

What Happened: On Sunday, Boeing released its 2025 Commercial Market Outlook, forecasting global demand for commercial aircraft through 2044.

The report, which spans the period from 2025 to 2044, anticipates that the global in-service fleet will nearly double, driven by steady growth in passenger traffic and a rising middle class across emerging markets. It expects demand for 43,600 new commercial airplanes during this period.

A bulk of this demand will be driven by Asia, according to the report, specifically India and China, with single aisle aircraft, such as the 737 Max, leading the way. These planes are essential for supporting the short and medium-haul routes that dominate the aviation markets in these fast-growing regions.

The report states that the 787 and the upcoming 777X widebody jets will account for just about 7,800 new deliveries, with the rest consisting of single-aisle jets, at 33,285. Dedicated freighter demand is pegged at 955 jets over the forecast period. The cargo segment, which while slowing from its pandemic highs, is still expected to grow at 3.7% annually.

Fleet replacement remains a significant driver of demand in mature markets. Boeing said nearly half of all deliveries globally will replace older, less efficient aircraft.

It’s worth noting, however, that this marks a decline from the company’s outlook last year, at 43,975 total deliveries, primarily due to the cut in its wide-body delivery forecasts, as the post-COVID recovery in long-haul travel has been slower, alongside its own delivered capacity that is still 20% below pre-pandemic levels.

Why It Matters: This comes as the company continues to face scrutiny over multiple crashes, whistleblowers, and multi-billion-dollar fines.

The most recent incident was the crash of a Boeing 787-8 Dreamliner in Ahmedabad, India, last week, just minutes after take-off, resulting in 274 deaths.

Experts and analysts, however, predict a turnaround for the company, with the bad news now firmly behind it, and the company having taken several measures to ensure safety. Leading up to 2025, Boeing also hinted at ramping up the production of its 737 Max aircraft, which has been at the center of this storm.

Price Action: Shares of Boeing were down 1.68% on Friday, trading at $200.32 per share, and are up 0.14% after hours.

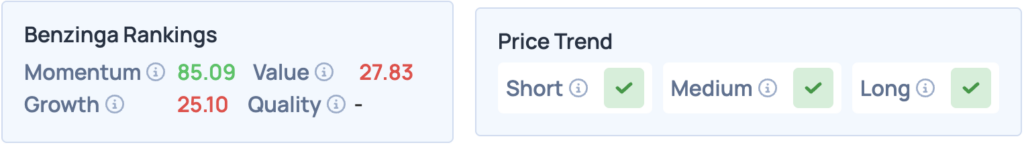

According to Benzinga’s Edge Stock Rankings, the stock has a favorable price trend in the short, medium, and long term. Click here for deeper insights.

Read More:

Image via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.