Tim Cook's New Job Is Keeping Trump 'Happy,' Says Economist Justin Wolfers: 'Innovation Takes A Back Seat To Political Favoritism'

According to University of Michigan economist Justin Wolfers, in recent months, Apple Inc. (NASDAQ:AAPL) CEO Tim Cook has been spending far more time managing politics than pursuing new innovations.

Check out the current price of AAPL stock here.

What Happened: Appearing on The Contrarian podcast on Wednesday, Wolfers said that Trump’s trade and tariff wars have shifted corporate priorities in damaging ways. “Tim Cook's most important job right now? Keeping Trump happy. Quite literally,” he says.

Wolfers contrasts Cook with his famed predecessor, Steve Jobs, whom he praised as relentlessly focused on product excellence, technology and design.

See Also: Trump’s Tariffs Are A ‘$500 Billion’ Tax On US Businesses That Wipe Out His 2017 Corporate Tax Break

“Jobs was focused on making the greatest phone ever made,” he says, while Cook is now “figuring out whether to build a factory in India or China, and how visible he needs to be at Mar-a-Lago.”

He frames this shift as a broader turn toward crony capitalism, where business leaders are rewarded or punished based on their relationship with the president.

Wolfers pointed to the early exemptions from Canadian and Mexican tariffs that were quietly extended to the Big Three automakers, signaling to top CEOs that favorable treatment was available if they stayed in President Donald Trump’s good graces.

“This is not just bad economics,” Wolfers says. “It's a system where innovation takes a back seat to political favoritism.”

Why It Matters: Economist and managing partner at the Collaborative Fund, Craig Shapiro, had echoed similar concerns a couple of months ago, when he said that Trump was running the American economy “like a mafia don.”

According to Shapiro, Trump was summoning the nation’s largest companies to his office, “to beg him to support their efforts, give them exemptions, remove competitors, etc.”

Early this year, Shapiro said that Apple was forced to “kiss the ring” after meeting with Trump, and announcing a $500 billion investment in the country over the next four years, referring to it as “state-imposed capitalism.”

Price Action: Apple shares were up 0.50% on Wednesday, trading at $210.16, and are down 0.06% after hours.

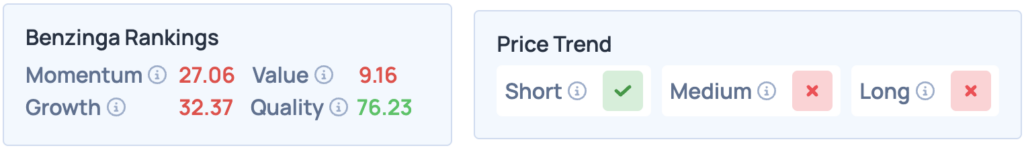

According to Benzinga’s Edge Stock Rankings, Apple shares score high on Quality, but poorly on all other metrics. They have a favorable price trend in the short term, but it’s unfavorable in the medium and long terms. Click here for deeper insights into the stock.

Photo Courtesy: Ringo Chiu on Shutterstock.com

Read More:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Government Macro Economic Events Regulations Politics Economics Tech