Marriott Rewards Shareholders With 30% Dividend Hike

Marriott International, Inc. (NASDAQ: MAR) recently announced a 30% hike in its quarterly dividend payout which reflects its intention to utilize free cash to boost shareholders' returns.

MAR raised the quarterly dividend to 52 cents per share (or $2.08 annually) from the previous payout of 40 cents (or $1.60 annually). The hiked dividend will be paid out on Jun 30, to shareholders on record as of May 26. Based on the closing price of $174.10 per share on May 12, the stock has a dividend yield of 1.2%.

Along with boosting shareholders' returns, dividend hikes raise the market value of a stock. Companies often attract new investors and retain old ones through this strategy. Year to date (through Apr 28), Marriott has paid approximately $1.5 billion to its shareholders in the form of cash dividends and repurchases of common stock.

What's Driving the Dividend Policy?

Marriott has been gaining from pent-up leisure demand, increased cross-border travel and lenient travel restrictions. Throughout first-quarter 2023, the company witnessed a steady increase in demand in the United States, Canada and Europe. Also, it reported a strong RevPAR recovery in Asia pacific.

Group demand in the United States and Canada increased sharply during the quarter, leading to improved occupancies and strength in ADR. With global trends improving, MAR expects the recovery momentum to continue. Attributes such as pent-up demand for all types of travel, the shift of spending toward experiences versus goods and the lifting of travel restrictions (particularly in Greater China) are likely to add to the positives.

MAR is benefiting from robust growth in its loyalty program. With nearly 182 million members globally, the company's loyalty program Marriott Bonvoy is supporting its marketing strategies. Also, Marriott is engaging its customers with promotional offers such as grocery and retail spending accelerators on its co-branded credit cards.

During first-quarter 2023, digital revenues increased 26% year over year. Mobile app users were up 31% year over year, while digital room nights rose 17% year over year. Backed by solid customer acceptance for credit card programs and a rise in credit card average spending, the company anticipates higher contributions from credit card fees in 2023.

Meanwhile, Marriott is consistently trying to expand its presence worldwide and capitalize on the demand for hotels in international markets. On May 1, it completed the acquisition of the City Express brand portfolio. The initiative involved the addition of approximately 150 properties located in Mexico, Costa Rica, Colombia, and Chile. The transaction also paved a path for entry into the high-growth mid-scale segment.

We believe that the initiatives are likely to strengthen MAR's business and drive the sustainability of its cash flows in the upcoming periods.

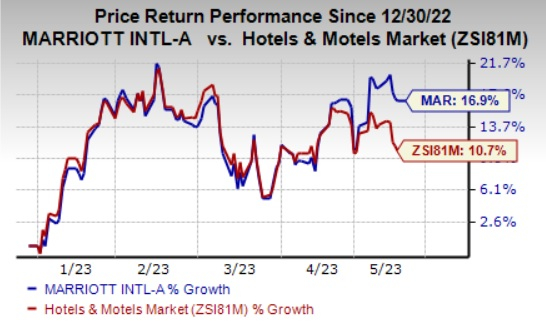

Image Source: Zacks Investment Research

So far this year, shares of Marriott have gained 16.9% compared with the Zacks Hotels and Motels industry's 10.7% growth.

Zacks Rank and Stocks to Consider

Currently, Marriott sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the Zacks Consumer Discretionary sector are MGM Resorts International (NYSE: MGM), Boyd Gaming Corporation (NYSE: BYD) and Crocs, Inc. (NASDAQ: CROX). While MGM flaunts a Zacks Rank #1, BYD and CROX carry a Zacks Rank #2 (Buy).

MGM Resorts has a trailing four-quarter earnings surprise of 81%, on average. The stock has increased 19.7% in the past year.

The Zacks Consensus Estimate for MGM's 2024 sales and EPS indicates rises of 2.2% and 31%, respectively, from the year-ago period's estimated levels.

Boyd Gaming has a trailing four-quarter earnings surprise of 13.7%, on average. Shares of BYD have gained 24% in the past year.

The Zacks Consensus Estimate for BYD's 2023 sales and EPS indicates improvements of 2.3% and 3.8%, respectively, from the year-ago period's levels.

Crocs has a trailing four-quarter earnings surprise of 19.6%, on average. Shares of Crocs have surged 104.3% in the past year.

The Zacks Consensus Estimate for CROX's 2023 sales and EPS indicates gains of 13% and 5.8%, respectively, from the year-ago period's levels.

Image by Alexander Mils on Unsplash

Latest Ratings for MAR

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Feb 2022 | Loop Capital | Maintains | Hold | |

| Jan 2022 | Morgan Stanley | Maintains | Equal-Weight |

The preceding article is from one of our external contributors. It does not represent the opinion of Benzinga and has not been edited.

Posted-In: Latin America News Dividends Dividends Travel Markets Analyst Ratings Trading Ideas