OpenDoor Is The Next Carvana? Stock Surges 43% On Activist Investor's Take On Company: 'I'll Saddle Up'

Shares of Opendoor Technologies Inc. (NASDAQ:OPEN) have been surging this week following renewed interest from activists and fresh enthusiasm from retail investors.

What Happened: On Wednesday, the company’s shares rallied 43.27%, resulting in weekly gains of 91% and 161% over the past month.

The stock's sharp move followed public comments from EMJ Capital founder Eric Jackson, who suggested the real estate tech firm, which pioneered instant cash offers for properties, could be worth as much as $82 per share if it executes effectively and restores investor confidence.

“If standing between a 50¢ stock and an $82 one is what it takes — and shareholders want it — I'll saddle up again for OPEN,” Jackson posted on X, referring to his prior stints as an activist investor at Yahoo, while expressing his willingness to reengage, if his efforts can lead to substantial upside in a stock.

Jackson criticized the notion of a quick acquisition or capital restructuring as a path to value creation. “You don't get to $82 through M&A. You get there by grinding, executing, and proving the model,” he added, calling instead for a stronger operational focus.

He further urged the company’s CEO, Carrie Wheeler, to instill confidence among investors by buying shares in the open market, citing similar moves by Carvana Co. (NYSE:CVNA) CEO, Ernest Garcia III.

Jackson also outlined a step-by-step plan to restore investor trust, including scrapping any potential reverse stock split and bringing back company co-founder Keith Rabois, who echoed Jackson’s statements, while referring to Wheeler as “utterly incompetent,” in a post on X.

Why It Matters: Opendoor’s shares are down 96% from their all-time high in early 2021, and this is after the 161% rally over the past month.

Jackson, who calls himself “the Carvana hedge fund guy,” referring to his early bet on the used car retailer at $21, which now trades up 1,576%, draws parallels between the two, with both having been beaten down from their all-time highs.

Price Action: Shares of Opendoor were up 43.27% on Wednesday, trading at $1.49, and are up another 8.72% after hours.

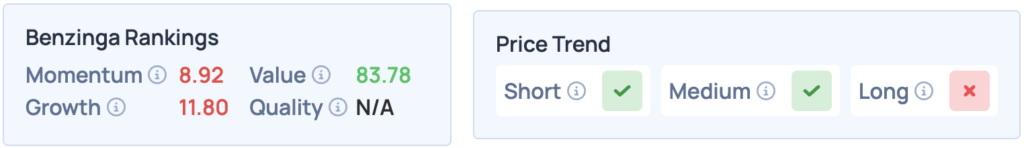

Opendoor shares score well on Value, but are poor on Momentum and Growth, with a favorable price trend in the short and medium terms. Click here for deeper insights into the stock.

Photo Courtesy: Tada Images on Shutterstock.com

Read More:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Equities Markets Tech Real Estate