Uber-Lucid Robotaxi Deal 'A Forced Marriage' By The Saudis, Says Ross Gerber — Slams It As A 'Weak Response' To Waymo, Tesla

Former Tesla Inc. (NASDAQ:TSLA) bull Ross Gerber is pushing back against a reported partnership between rideshare service Uber Technologies Inc. (NYSE:UBER) and automaker Lucid Group Inc. (NASDAQ:LCID).

What Happened: On Thursday, in a post on X, Gerber referred to the partnership as being driven by external pressure, rather than market logic.

“Uber is partnering with Lucid to launch some sort of robotaxi of its own,” Gerber says, referring to the company’s plans to deploy 20,000 or more Lucid vehicles over the next six years.

Gerber, however, believes that this is “basically a forced marriage from the Saudis to get Uber to buy their cars,” since the Middle-Eastern state’s Public Investment Fund (PIF) has been the majority stakeholder in the U.S.-based automotive startup since 2019.

He calls this an obvious “weak response” to the growing competition from Tesla and Waymo by Alphabet Inc. (NASDAQ:GOOG), as competition intensifies in autonomous ridesharing.

Why It Matters: Shares of Lucid Motors surged 36.24% following the announcement of this partnership on Thursday, and it is currently trading at $3.12 per share.

According to the company’s interim CEO, Marc Winterhoff, the deal validates the company’s technology and its suitability for autonomous ridesharing.

Investor Gary Black posted on X, saying that Uber benefits the most as autonomous tech advances, as it would allow the company to “eliminate the cost of a driver from the cost of ridership, which could lower the price by half and significantly expand TAM [Total addressable market].”

Price Action: Uber shares were down 0.28% on Thursday, trading at $90.50, and are up 0.59% after hours.

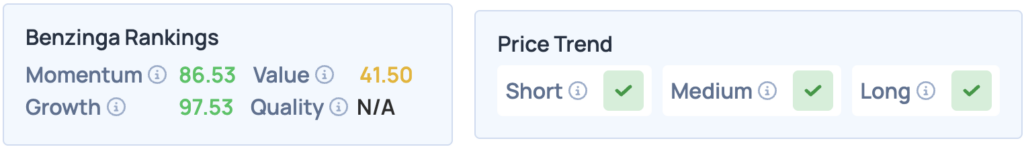

According to Benzinga’s Edge Stock Rankings, Uber scores high on Momentum and Growth, and has a favorable price trend in the short, medium and long terms. How does it compare with Lucid, Tesla and Alphabet? Click here to find out.

Read More:

Photo courtesy: DenPhotos / Shutterstock.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Tech