Alphabet Set For Strong Q2 Earnings — But Analysts Warn: 'AI Search Remains Google's War To Lose'

Alphabet Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG) is set to release its second-quarter earnings on Tuesday. Analysts anticipate robust results, despite concerns over the impact of AI on the company’s core search business.

What Happened: Alphabet, along with other Big Tech companies, continues to invest billions in AI development and infrastructure. However, the rise of AI-backed chatbot alternatives poses a significant threat to Alphabet’s core search business, according to a report by MarketWatch.

Check out the current price of GOOG stock here.

Truist analyst Youssef Squali pointed out that despite the concerns, search demand likely remained strong in the second quarter, supported by solid results from YouTube and the company's cloud division.

“Concerns over AI evolution in Search (and regulatory pressures to a lesser degree) have weighed on [Alphabet],” stated Squali. However, he added: “we believe that current valuation reflects much of those concerns, and that AI Search remains Google’s war to lose.”

Despite these positive predictions, there are concerns about the long-term impact of AI on Alphabet’s search business. More bearish investors, as noted by BofA analysts, suggest that AI-powered chatbots like OpenAI’s ChatGPT and Anthropic’s Claude provide alternatives to traditional search engines, which “could show up in near-term click results.”

They also raise questions about Alphabet’s future, particularly after losing some antitrust cases and its ability to monetize AI overviews appearing in search results.

Why It Matters: Earlier this month, Alphabet made a strategic move to bolster its AI capabilities. The company finalized a $2.4 billion deal with AI coding startup Windsurf, which included licensing technology and hiring Windsurf’s CEO and key employees. This move was seen as a significant step in Alphabet’s AI development strategy.

Alphabet’s investment in AI is also reflected in its efforts to attract top AI talent. The company revamped its pay structure to offer substantial salaries to software engineers, a move aimed at retaining and attracting top-tier AI professionals.

Despite several challenges, optimists believe that Google’s deep relationships with publishers, its vast first-party data, and the underappreciated businesses outside of search, such as its cloud segment, YouTube, and Waymo, give it an edge over AI platforms.

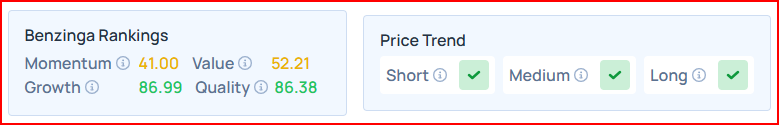

Alphabet offers strong Growth and Quality, with average scores on the Value and Quality metrics as per Benzinga’s Proprietary Edge Rankings.

READ MORE:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.