'Google Is At A Crossroads': T. Rowe Price Portfolio Manager Flags ChatGPT As Key Disruption Risk—As Search Giant Transitions From 'Librarian' To 'Expert'

As Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) prepares to report earnings this week, T. Rowe Price portfolio manager Tony Wong believes Google is facing a pivotal moment, one that is defined by the rise of generative AI and the ongoing disruption by ChatGPT.

Check out the current price of GOOG stock here.

What Happened: “Google is at a crossroads here with a new technology coming out with generative AI,” Wong said on CNBC’s “Closing Bell Overtime” on Monday.

He drew a sharp contrast between Google's traditional search model and the emerging AI paradigm. “Google Search is like [a] librarian, [it] goes and looks through the books, and gives you a bunch of books.” With generative AI, on the other hand, “the librarian is like an expert,” he says.

This shift, Wong says, raises major questions about the company's business model, particularly regarding its search revenue, as Google’s AI mode begins to gain steam.

He also highlighted the importance of how Alphabet handles its capital expenditures in this new era, questioning whether the company's push in this regard will yield the desired results.

Yet, Wong makes it clear that the biggest concern for the company is the disruption risk of OpenAI’s ChatGPT.

Why It Matters: The search giant’s core business model has come under attack in recent months. Perplexity AI, an AI-enabled web search engine, launched a browser recently, aimed at challenging the dominance of Google’s Chrome web browser.

The company’s CEO, Aravind Srinivasan, had recently stated that this was the first time in two decades that Google was vulnerable to disruption.

Alphabet is set to release its second quarter results on Tuesday, with analysts expecting robust results, while also warning that “AI Search remains Google's war to lose.”

Price Action: Alphabet’s shares were up 2.80% on Monday, trading at $191.15, and are up 0.18% after hours, leading up to its second quarter results.

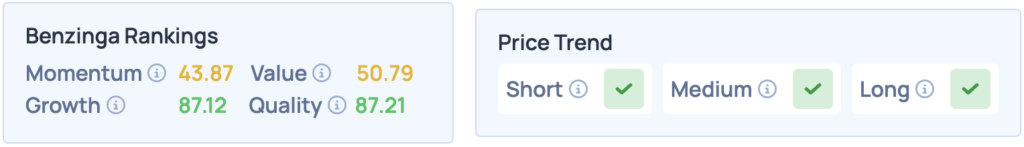

According to Benzinga’s Edge Stock Rankings, Alphabet’s shares score high on Growth and Quality, while sporting a favorable price trend in the short, medium and long term. Click here for deeper insights into the stock.

Read More:

Photo courtesy: JHVEPhoto / Shutterstock.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Tech