Intel CEO Says He's 'Making Hard But Necessary Decisions' As Chipmaker Announces Massive Layoffs, Project Cancellations

Intel Corporation (NASDAQ:INTC) is undertaking sweeping layoffs and global project cuts as part of a major overhaul aimed at restoring its competitive edge in the AI-dominated semiconductor landscape.

What Happened: On Thursday, after posting its second-quarter earnings, Intel CEO Lip-Bu Tan shared a memo with employees saying that the company will reduce its workforce to 75,000 employees by the end of the year through layoffs and attrition.

According to an Associated Press report, this figure represents a 31% drop from the 108,900 employees Intel reported at the end of last year.

"I know the past few months have not been easy," Tan wrote. "We are making hard but necessary decisions to streamline the organization, drive greater efficiency and increase accountability at every level of the company."

See Also: American Airlines CFO Declares Worst Is Over, But Cautious Outlook Sinks Stock

Earlier, Intel announced that it is reducing 15% to 20% of jobs within its Foundry division.

Alongside the layoffs, Intel is scrapping expansion plans in Germany and Poland and relocating some assembly and testing operations from Costa Rica to Vietnam and Malaysia. The Costa Rica site will continue to host key engineering and corporate teams.

In the U.S., construction of a much-anticipated semiconductor facility in Ohio will be "further" delayed, Tan said in the memo.

Why It's Important: Intel posted second-quarter revenue of $12.86 billion, surpassing the $11.91 billion expected by analysts. However, the company recorded an adjusted loss of 10 cents per share for the quarter, falling short of projections that had forecast a modest profit of one cent per share.

The company has been struggling to keep pace with the rapid evolution of computing. It missed the mobile revolution and now trails competitors like Nvidia Corporation (NASDAQ:NVDA), whose chips dominate the surging AI market.

As of Thursday's market close, Intel's market capitalization stood at $98.71 billion—starkly overshadowed by Nvidia's $4.24 trillion valuation.

Price Action: On Thursday, Intel shares fell 3.66% during the regular trading session and declined an additional 4.64% in after-hours trading, according to Benzinga Pro.

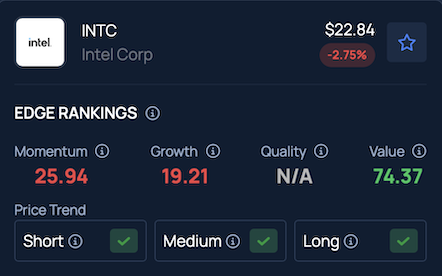

Benzinga’s Edge Stock Rankings indicate that INTC maintains solid momentum across short, medium and long-term periods. However, while the stock scores well on value, its growth rating remains relatively weak. Additional performance details are available here.

Read Next:

Photo: Tada Images/ Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: News