Intel's High-Stakes 18A Chip Ambition Faces Quality Setback Amid 'Hail Mary' Foundry Push: Report

Intel Corporation’s (NASDAQ:INTC) 18A process, touted as critical to regaining its technological lead, has reportedly hit yield issues, jeopardizing its ability to profitably produce advanced chips.

18A Yield Woes Threaten Foundry Ambitions

The 18A process, developed over several years and backed by multibillion-dollar factory investments, underpins Intel's plan to become a top-tier foundry rivaling Taiwan Semiconductor Manufacturing Co. (NYSE:TSM). But only a small fraction of 18A-produced Panther Lake chips have met quality standards, raising concerns over Intel's readiness to deliver high-end components at scale, reported Reuters on Tuesday.

Check out the current price of INTC stock here.

The metric in question—yield—is vital in semiconductor economics. Lower yield increases production costs and delays volume deployment. Intel's lag here could undermine its effort to win major contract manufacturing deals, especially as clients demand reliability for AI and mobile chip applications.

This percentage, referred to as yield, suggests that Intel may face challenges in profitably producing its high-end laptop chip in the near term.

Intel aimed to close the performance gap with TSMC but set itself up for failure by pushing an aggressive rollout of unproven systems, sources told the publication. One described the move as a “Hail Mary” attempt.

Intel Faces Pressure Amid Rival Gains, Exec Exits, Delays

The timing is especially delicate. Intel is already under pressure from rivals AMD (NASDAQ:AMD) and Qualcomm (NASDAQ:QCOM), who are gaining ground in key market segments. Last week, Fitch downgraded Intel's credit rating, citing uncertain profitability in its foundry pivot and intense competition.

In parallel, Intel is grappling with executive instability. Multiple senior executives have exited, while CEO Lip-Bu Tan has initiated a workforce reduction and delayed the company’s Ohio fab project—moves signaling operational turbulence.

Despite a better-than-expected Q2 sales report, analysts say Intel's turnaround will take years. “Achieving leading-edge foundry status requires more than capex—it demands execution,” stated Benchmark Securities.

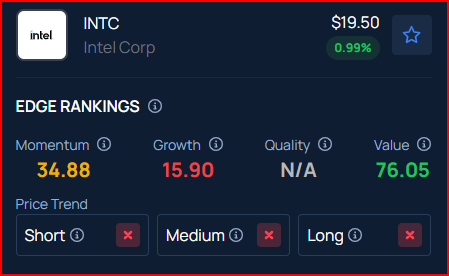

Benzinga's Edge Rankings place Intel in the 85th percentile for momentum and the 76th percentile for value, reflecting its strong performance in both areas. Check the detailed report here.

READ MORE:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: News