Oracle AI Push Could Make It 4th-Largest Hyperscaler — Stock May Jump 22%, Analyst Says

Oracle Corporation (NYSE:ORCL) is poised to become the fourth-largest global hyperscaler, according to a recent analysis by Bernstein.

Oracle Eyes 22% Upside As Cloud, AI Boosts Outlook

Oracle’s stock has been given an outperform rating by Bernstein analyst Mark Moerdler, who has raised the price target from $269 to $308, indicating a potential 22% upside for the stock, CNBC reported. The company’s shares have surged by approximately 51.5% this year.

Check out the current price of ORCL stock here.

Moerdler is optimistic about Oracle’s future, especially its transition to cloud services. He believes that Oracle Cloud Infrastructure (OCI) is set to become the fourth-largest global hyperscaler, with growth fueled by AI. He also noted that Oracle’s revenue and operating margins are expected to see significant increases over a period of five to 10 years.

"While most of the revenue today is from CPU-centric workloads, with the recent announcement of a mega contract, growth should further accelerate driven by AI, creating a substantial investment opportunity." stated Bernstein.

$3 Billion EU Investment Boosts AI Outlook Despite Margin Concerns

This prediction comes on the heels of Oracle’s strategic moves in the AI and cloud infrastructure space. In July, Oracle was reported to be investing $3 billion in AI and cloud infrastructure expansion across Germany and the Netherlands. This marked a significant expansion of its European operations in response to the accelerating demand for AI services.

Moreover, Oracle’s stock was upgraded in July by Piper Sandler analyst Brent Bracelin to Overweight, with the price target raised from $190 to $270. Bracelin noted that Oracle is poised to benefit from the rising enterprise demand for AI infrastructure.

Despite acknowledging that Oracle’s shift to the cloud might initially impact margins, Moerdler is confident in the company’s ability to offset these effects. He highlighted the possible impact of operating leverage, citing Microsoft (NASDAQ:MSFT) as an example and expressing his expectation that Oracle will also drive sustained operating leverage.

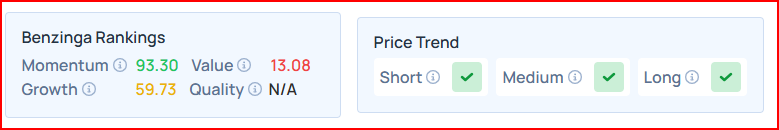

Benzinga’s Edge Rankings place Oracle in the 93rd percentile for momentum and the 13th percentile for value, reflecting its mixed performance. Check the detailed report here.

READ MORE:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: News