Nikkei Roars Into Bear Market Territory Overnight as Dollar Plummets Against the Yen

In what has been an all-too constant story over the past two weeks, the Nikkei Index has finally entered a bear market. Overnight, the index dropped to a new intra-day low which now places the index in bear market territory.

Massive Retracement

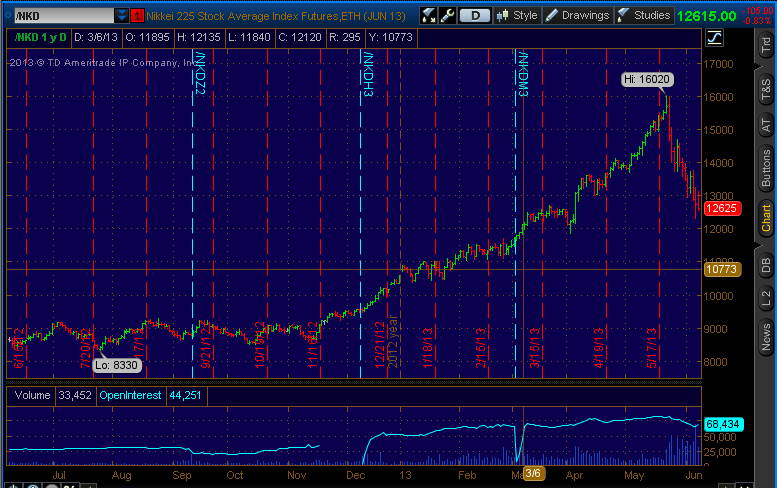

The Nikkei Index closed down 0.21 percent overnight, although shares traded lower intraday. Futures have already made a bear market and are down about 27 percent from the intraday high of 16,020 on May 22 to the new low of 12,645.

The index itself is also now in a bear market. From an intraday high of 15,942.60 on May 22, the Nikkei 225 Index has declined 23.8 percent to Friday's close of 12,877.53. From the highest closing high, the index is down 21.35 percent, so no matter how you slice it, the index is in bear market territory.

Abenomics

The Nikkei was at one point up nearly 100 percent from its 52-week low of 8,328.02 made last July so a retracement of the move is no surprise. However, the sheer magnitude of the drop coupled with the velocity of the move downwards has raised fears that the government has lost control of its new policies, aimed at restarting the economy.

Prime Minister Shinzo Abe launched what has now been coined the 2-2-2-2 plan late last year which outlined the government's, alongside the Bank of Japan's, plan to kick start the economy. Abe, alongside BoJ Governor Kuroda, plan to double the money supply over two years to achieve two percent inflation while doubling the average duration (measure of time risk of a fixed income portfolio) of the Bank of Japan's holdings.

The USD/JPY had also been moving on the news, from a low below 80 last summer to a recent high above 103. However, the recent fears over the sustainability and future success of the plan have sent the yen downwards, to a new 2-month low this morning of 95.2701.

Inflation Fears

One fear that investors have seen is the fear that the Bank of Japan has launched a new wave of inflation that is unstoppable. Inflation has ticked up in recent months and the fear is that the Bank of Japan will overshoot its 2 percent target and launch a wave of uncontrollable inflation.

Other arguments for the move lower in Japanese assets of late is simply that the market went too far too fast. Stocks nearly doubled in 10 months and the yen devalued by about 30 percent against the dollar. These moves happened seemingly without pause and investors may be booking gains, hedging positions, or waiting for better entry points.

Domestic Optimism

Recently, domestic funds have been flowing into equities and other assets, a sign that the locals are seeing a change in investment profiles. Historically, the Japanese were conservative investors and owned mostly government bonds.

Recent data has shown a shift in psychology which has seen some money flow into stocks domestically, although not at the rate that economists were hoping. However, the Government Pension Allocation Fund, the world's largest pension fund with over $1 trillion in assets, indicated that it will begin allocating more funds to domestic equities and away from bonds. The fund is boosting its allocation to equities by about 6 percent which would see a minimum of $60 billion flow into Japanese equities.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Bank of Japan Haruhiko KurodaNews Futures Econ #s Economics Markets Movers Best of Benzinga