Stryker To Acquire MAKO Surgical For $1.65 Billion

In an announcement Wednesday morning, Stryker (NYSE: SYK), a leading medical technology company, announced they have come to an agreement to acquire MAKO Surgical (NASDAQ: MAKO) for $1.65 billion.

Stryker will acquire all of the outstanding shares of MAKO for $30.00 per share in cash. The transaction is subject to customary closing conditions, including MAKO stockholder approval.

It also contemplates the issuance by MAKO of an additional 3.953 million shares in connection with an anticipated acquisition which Stryker expects MAKO will consummate as part of MAKO's normal course of business.

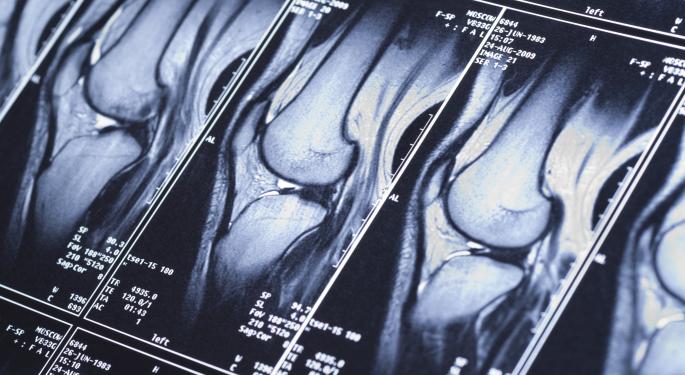

According to Kevin Lobo, Stryker President and Chief Executive Officer, "The acquisition of MAKO combined with Stryker's strong history in joint reconstruction, capital equipment (operating room integration and surgical navigation) and surgical instruments will help further advance the growth of robotic assisted surgery. Our combined expertise offers the potential to simplify joint reconstruction procedures, reduce variability and enhance the surgeon and patient experience. We look forward to welcoming the MAKO team to Stryker."

MAKO Surgical's overall option implied volatility of 49 is below its 26-week average of 55 according to Track Data, suggesting decreasing price movement into Stryker acquiring all of the outstanding shares of MAKO for $30.00 per share in cash

When MAKO resumed trading, shares were up 82 percent to $29.50 after buyout. Shares of Intuitive Surgical (NASDAQ: ISRG), another robotic surgical equipment marker, are up four percent to $378.79 following the MAKO deal and a positive analyst note out of SunTrust.

Upon closing, the transaction is expected to be dilutive to Stryker's adjusted EPS excluding acquisition and integration-related charges by approximately 10c-12c in the first full year, neutral in year two and accretive thereafter according to Reuters.

Additionally, the transaction is expected to be slightly accretive to adjusted cash earnings per share, excluding acquisition and integration-related charges in the first full year.

As of June 30, Stryker's cash and cash equivalent balances totaled $4.7 billion with an additional $2.8 billion in debt.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Kevin Lobo Maurice Ferre ReutersM&A News Best of Benzinga