Energy ETFs Surge Into High-Demand Summer Months

With the summer driving season rapidly approaching and growing demand reducing energy stockpiles, the price of crude oil has continued to surge higher.

As of Tuesday, the price of West Texas Intermediate Crude Oil was nearing the significant $105 mark, ahead of the Department of Energy’s weekly inventory report.

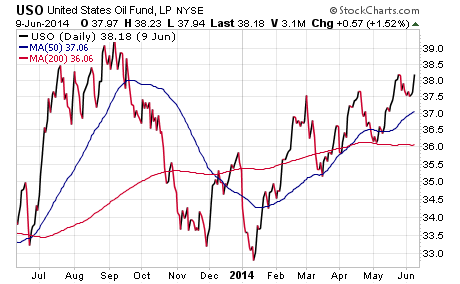

Speculation over an additional reduction in stockpiles has energy traders making increasing bullish bets on crude oil ahead of the report. This speculation, in turn, has lifted the United States Oil Fund (NYSE: USO) more than eight percent so far this year and added to gains in energy stocks as well.

USO currently trades near the top end of its 2014 highs, but it could easily surge back above $39 if new data points to constrained supply or increasing demand. Energy prices are particularly sensitive this time of year, as cyclical forces impact this economically sensitive commodity.

This most recent surge in crude oil will likely be followed by another lift in gasoline prices as well. The United States Gasoline Fund (NYSE: UGA) has only increased two percent in 2014, but could find itself moving much higher if crude continues its ascent.

As previously mentioned, gasoline consumption typically rises significantly during the summer months as a result of more people traveling. In addition, gasoline sold during the summer is switched to a seasonal blend that is more expensive to produce.

The Energy Select Sector SPDR (NYSE: XLE) also just recently hit a new, all-time high -- as a result of these strengthening commodity prices increasing the appeal of integrated oil companies. Exxon Mobil (NYSE: XOM) and Chevron (NYSE: CVX) make up the top holdings in this market cap-weighted ETF.

XLE is also in the top 10 ETFs for new asset flows this year, with $2.954 billion in new money attributed to the outperformance in energy stocks. This trend could certainly continue if oil prices press higher over the next quarter.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: automotive industry energySector ETFs Commodities Travel Trading Ideas ETFs General Best of Benzinga