Simon Property Group - Final Offer, Or Initial Salvo To Buy Rival Macerich?

Giant mall landlord Simon Property Group Inc (NYSE: SPG) has been searching for the best way to acquire its smaller rival Macerich Co (NYSE: MAC) in order to add to its impressive portfolio of Class-A regional mall assets.

However, based on information contained in the David Simon letter released Monday, Macerich CEO Arthur Coppola was not interested in negotiating a deal.

Simon's unsolicited offer to Macerich shareholders was a bid of $91 per share – to be paid 50/50 in cash and SPG shares – or about a 5 percent premium over the Macerich $86.72 closing price of Friday, March 6.

The Simon offer valued Macerich at approximately $16 billion – net of $4.4 billion of assumed debt.

Simon Already Owns MAC Shares

Simon had previously acquired 3.9 percent of Macerich common shares, which were trading at $69.88 prior to Simon disclosing this initial stake this past November 19, or approximately 30 percent below the current Simon hostile offer of $91 per share.

After the dust settled on Monday, Macerich shares closed at $92.76.

Apparently, smart money on Wall St. feels that Simon will end up ponying up more per share in order to win the support of Macerich management and the majority of the current board.

Another Big Player

Macerich had announced back on November 17, 2014, that it acquired the 49 percent joint-venture interest in five "super-regional malls" held by Ontario Teachers' Pension Plan Board: "Total consideration was $1.89 billion (USD) including the assumption of $673 million of property level debt [...] $1.22 billion of Macerich common stock at a fixed price of $71 per share, representing a 10.9 percent common ownership stake in the Company."

This block of Ontario Teachers' Pension Fund shares will play a critical part in the ultimate success of failure of Simon's bid. Regardless, the Ontario Teachers' stake is up approximately 22 percent since Simon began to accumulate Macerich shares.

Notably, Macerich management was willing to make an exception to its 5 percent ownership threshold in conjunction with this deal.

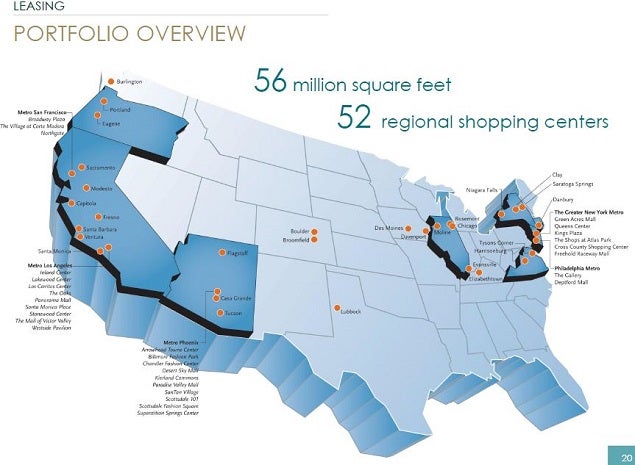

The Macerich Portfolio

Source: Macerich Investor Day

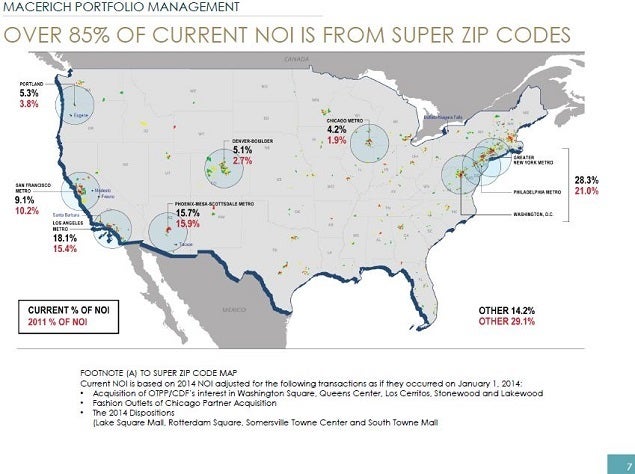

Source: Macerich Investor Day

More than 85 percent of the Macerich portfolio NOI is derived from so-called super zip codes. These are densely populated, high barrier-to-entry markets with higher than average income per household.

Source: Macerich Investor Day

Source: Macerich Investor Day

There is a finite quantity of markets that can support Class-A mall assets that generate $600 of sales per square foot, or more. Many of Santa Monica, California-based Macerich malls are located in high barrier to entry West Coast markets.

Analysts Weigh In

According to a Bloomberg article late Monday, Stifel analyst Nathan Isbee feels that Macerich will seek other bids, possibly even from General Growth Properties Inc (NYSE: GGP); notwithstanding that GGP was mentioned in the Simon release as having agreed in principle to buy a select group of the Macerich assets, upon closing of the Simon purchase of Macerich.

In the same article, Bank of Montreal's Paul Adornato indicated that $91 per share was probably just an initial offer based upon a cap-rate of 4.8 percent. "Assuming Simon can pay a 4.5 percent cap rate, that implies a takeout price of $99 a share for Macerich, or $115 at a 4 percent rate," he said.

Investor Takeaway

David Simon also made these points clear to his own shareholders, "Macerich's assets represent a strong strategic and geographic fit for Simon, and we believe this is an attractive opportunity to create long-term value for Simon shareholders. We expect the transaction to be immediately accretive to FFO, and that we can improve the operations of these assets."

According to the Simon news release, "Neither transaction financing nor the sale of assets to General Growth will be a condition to closing the proposed transaction."

The Simon deal effectively has no contingencies, which certainly raises the bar for other potential suitors.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Arthur Coppola Bank of Montreal Bloomberg David Simon Nathan IsbeeREIT General Real Estate Best of Benzinga