AUD/USD Forecast: Retains Its Neutral-To-Bullish Stance In The Near-Term

AUD/USD Current Price: 0.7430

- The Australian November AIG Performance of Services Index resulted in 52.9.

- China announced it suspended imports from another Australian beef supplier.

- AUD/USD retains its neutral-to-bullish stance in the near-term.

The AUD/USD pair has traded in a wider-than-usual range this Monday but closed the day unchanged around the 0.7430 level. The aussie fell on sentiment, and despite Australia published encouraging data at the beginning of the day. The November AIG Performance of Services Index resulted in 52.9, better than the previous 51.4. On a down note, China announced it suspended imports from another Australian beef supplier, adding another company to the list of banned commodities.

Australia will publish this Tuesday, November NAB’s Business Confidence, previously at 5, and NAB’s Business Conditions for the same month, previously at 1.

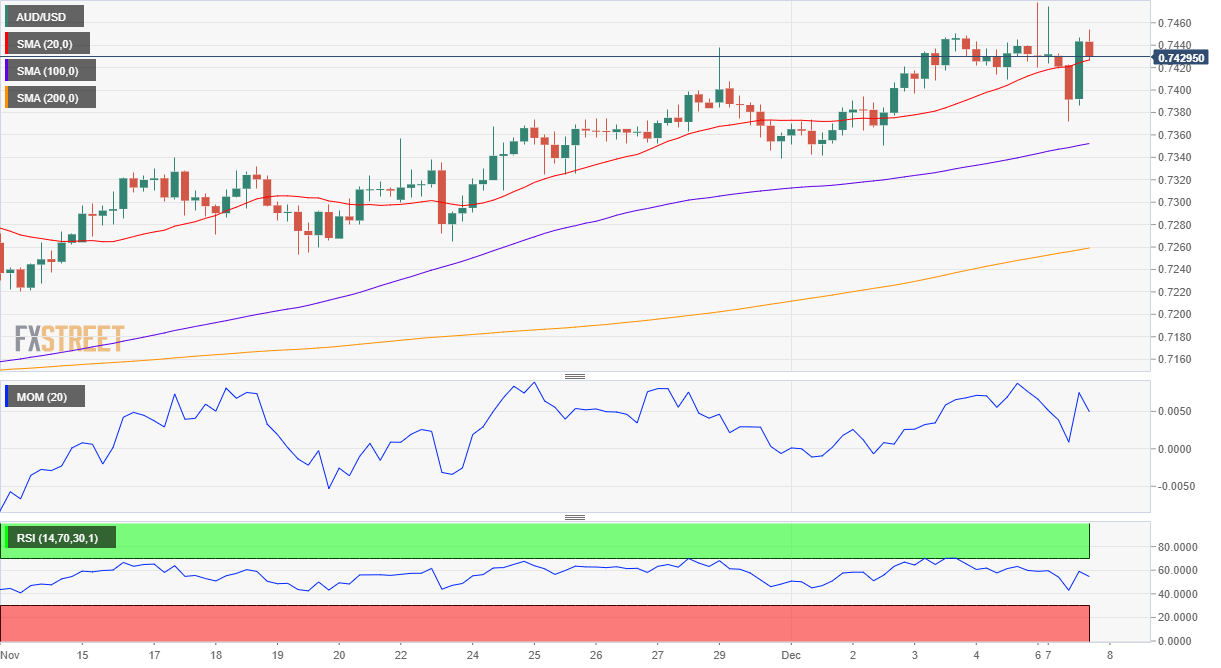

AUD/USD Short-Term Technical Outlook

The AUD/USD pair offers a neutral-to-bullish stance in the near term, as it extended its yearly advance by a couple of pips to 0.7453. The 4-hour chart shows that the pair is currently developing above a bullish 20 SMA, which keeps advancing below the larger ones. Technical indicators, in the meantime, have turned lower but remain within positive levels. The pair has room to break higher and extend its advance beyond 0.7500 should the risk sentiment improve in the upcoming sessions.Support levels: 0.7415 0.7375 0.7330

Resistance levels: 0.7450 0.7490 0.7530

View Live Chart for the AUD/USD

Image sourced from Pixabay

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.