These OTC Securities Had the Most Trading Activity in November

Photo by Markus Winkler on Unsplash

The following post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga.

November was an interesting month for OTC Markets securities.

As the S&P 500 Exchange-Traded Fund (SPY) experienced a pullback that erased the entirety of its November gains, the OTCQB recorded a 65% increase in trading volume among its top securities compared to October. Investors flocking to the OTC Markets as large, medium, and mega caps retracted may provide a potential explanation for this dramatic increase in month-over-month volume.

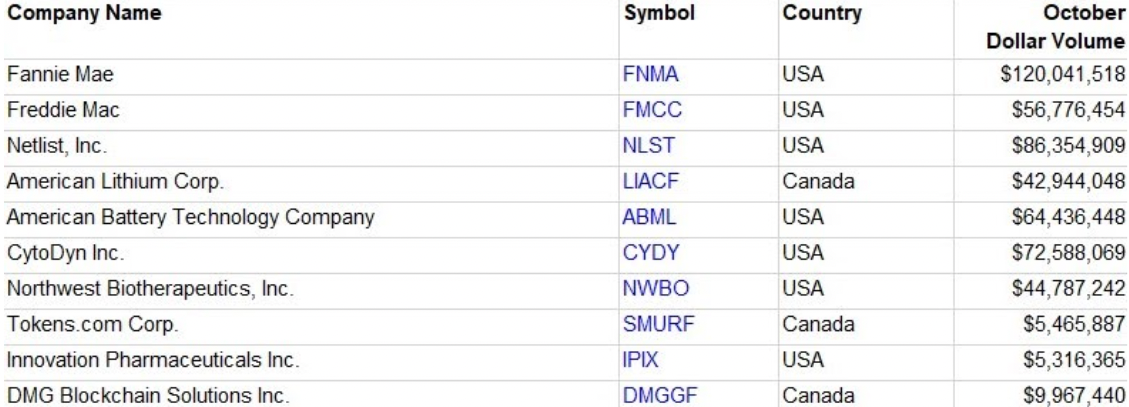

OTCQB

Regardless of the cause, the OTCQB witnessed over $1.1 billion worth of trading volume in its top 31 traded securities in November. Fannie Mae (OTCQB: FNMA), Freddie Mac (OTCQB: FMCC) and Netlist Inc. (OTCMKTS: NLST) retained their spots as 1st-, 2nd- and 3rd-most traded securities, respectively, while trading volume on Tokens.com Corp. (OTCQB: SMURF) and Innovation Pharmaceuticals Inc. (OTCQB: IPIX) increased approximately 6-fold from the prior month. Of the 31 top traded securities on the OTCQB, only 9 experienced a reduction in trading volume.

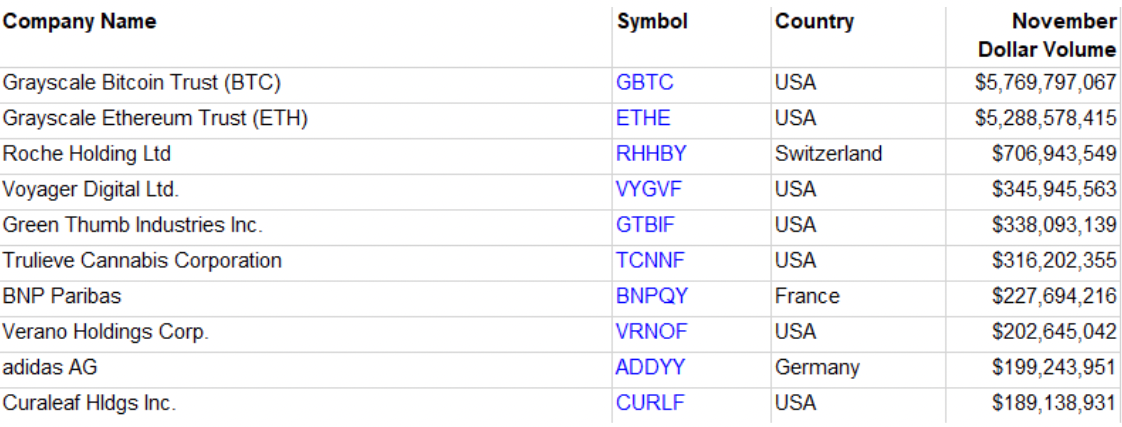

OTCQX: Cannabis Operators Command Attention

While only 8 of the top 31 traded securities on the OTCQX experienced a reduction in trading volume, these reductions significantly impacted total volume, resulting in a 7% decline in total volume compared to October.

Cannabis operators accounted for the majority of volume increases. Verano Holdings Corp. (OTCQX: VRNOF), for example, experienced a 207% increase in trading volume compared to last month. Cannabis operators Ayr Wellness Inc. (OTCQX: AYRWF) and TerrAscend Corp. (NASDAQ: TRSSF) followed suit with 244% and 195% increases in monthly volume, respectively.

Despite significant drawbacks in the prices of Bitcoin (BTC) and Ether (ETH), Grayscale Bitcoin Trust (OTCQX: GBTC) and Grayscale Ethereum Trust (OTCQX: ETHE) retained their spots as the 1st and 2nd most-traded securities on the OTCQX, amassing a collective dollar volume of more than $11 billion in November. The 2 companies have held their titles for months, demonstrating a significant hold on investors’ attention.

Grayscale’s Litecoin Trust (OTCQX: LTCN) was even more sturdy than its Ethereum and Bitcoin counterparts; its volume increased by 131%, marking the 4th-highest month-on-month increase and the top among non-cannabis operators in the OTCQX’s top 31.

International Presence

Nearly ½ of the top 31 traded securities on the OTCQX come from outside North America. Switzerland’s Roche Holdings AG (OTCQX: RHHBY) was the 3rd-most traded OTCQX security, while France’s BNP Paribas SA (OTCQX: BNPQY) came in 7th and Germany’s adidas AG (OTCQX: ADDYY) came in 9th. Nearly one-third of international companies experienced reductions in trading volume, while the remaining two-thirds experienced rises.

Among international operators, United Kingdom’s Anglo American plc (OTCQX: NGLOY) experienced the worst volume drawback, absorbing a 66% month-on-month decrease. Meanwhile, Australia’s Novonix Ltd. (OTCQX: NVNSX) experienced the largest volume increase with an 84% change compared to October.

Canadian Operators

November was a particularly interesting month for the top Canadian companies on the OTC Market. Of the 16 companies between the OTCQX and OTCQB, 14 experienced month-on-month increases in total dollar volume. TerrAscend Corp.’s 195% increase marks the 4th-greatest volume increase on the OTCQX, while American Lithium Corp.’s (OTCQB: LIACF) November dollar volume places it in 4th place on the OTCQB.

The Top 10s

Below are the top 10 most actively traded securities on the OTCQB and OTCQX markets in November.

OTCQB

OTCQX

The preceding post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga. Although the piece is not and should not be construed as editorial content, the sponsored content team works to ensure that any and all information contained within is true and accurate to the best of their knowledge and research. This content is for informational purposes only and not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: OTC Markets Group Partner ContentNews Penny Stocks Small Cap Markets