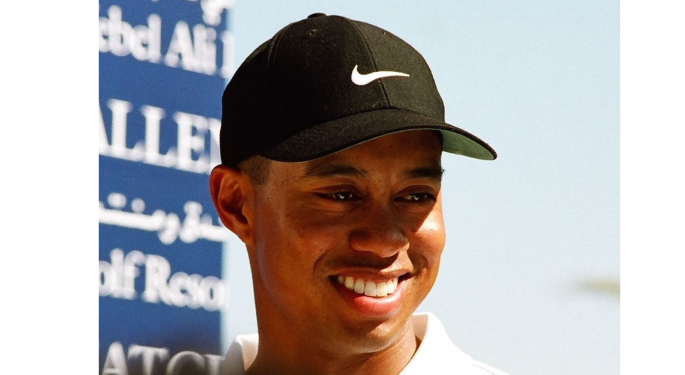

If You Invested $1,000 In Nike Stock After Tiger Woods Won The 1997 Masters, Here's How Much You'd Have Now

Tiger Woods took the golf world by storm in 1997 with a win at the Masters Tournament. The win and a surge in interest in golf also paid off for Nike Inc (NYSE: NKE), one of Woods’ main sponsors over the years.

What Happened: Tiger Woods entered the 1997 Masters as the betting favorite with odds of +800. The pick of Woods to win came after he missed the cut in the 1996 Masters, his only cut to date in the prestigious tournament.

Woods first competed in the Masters as an amateur in 1995 where he finished tied for 41st place at five over par.

Despite the 1997 Masters taking place so many years ago, Woods still holds the record as the youngest Masters Tournament winner at the age of 21.

Woods also holds the record for the largest victory margin when he won the 1997 Masters by 12 strokes.

Prior to the 2020 Masters, Woods also held the record for the lowest four-day score.

Nike signed Woods to an endorsement deal worth an estimated $40 million in 1996. Woods prominently wore Nike polos and featured Nike golf equipment.

The 1997 Masters win helped boost Nike’s place in the golf industry. Golf apparel sales increased 76% year-over-year and golf footwear sales increased 100% year-over-year for Nike in 1997. This followed the 1996 year that had already seen both categories report triple-digit growth.

Here’s just how well investors have fared with Nike over the years.

Related Link: How Have Golf Stocks Performed Since Tiger Woods Won The Masters In 2019

Investing $1,000 In Nike: The 1997 Masters was held April 10 through April 14. On April 14, the day after Woods’ first Masters win, Nike shares traded at $56.16.

A $1,000 investment in Nike shares could have bought 17.81 shares.

Three stock splits have happened for Nike shares since the hypothetical purchase, with splits in 2007, 2012 and 2015. The splits would take the number of shares to 142.48.

The 142.48 shares would be worth $18,287.31 based on a current share price of $128.35 for Nike.

This represents a gain of 1,729% for investors, or an average annual gain of 69.2%. Investors who bet on Nike and Tiger Woods have landed on the green and perhaps hit a hole in one.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Golf Golf Stocks if you invested 1000 catalystNews Sports Movers Trading Ideas General Best of Benzinga