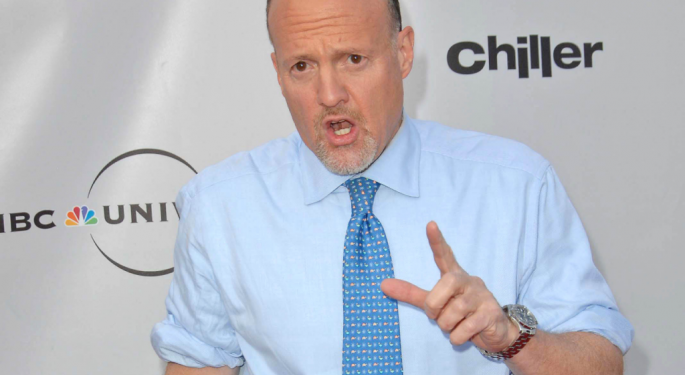

Jim Cramer Predicts Potential Stock Market Rally Triggered By Jobs Report: 'Certainly Have Plenty Of Tinder'

Jim Cramer indicated that a market rally could be on the horizon, driven by the upcoming September jobs report. This comes after a few challenging weeks for Wall Street.

CNBC reported Cramer stating, “We certainly have plenty of tinder for a rally — there are some Kingsfords lying around, maybe even a Duraflame or two,” suggesting that a weak payroll number could lead to a rebound similar to what was seen in March.

The nonfarm payroll report, with its “true staying power,” is the key data point to watch, according to Cramer. He believes that if the figures show a higher-than-expected number of layoffs, the Federal Reserve might hesitate to raise interest rates, potentially pleasing the market.

See Also: US Manufacturing PMI Tops Expectations In September, Hits 10-Month Peak

However, Cramer also warned that this potential economic weakness might negatively impact various sectors, including retail, banking, and housing. He drew parallels to the market conditions in February and March when stocks were sold off due to concerns about aggressive rate hikes by the Fed and the collapse of several regional banks gave way to a tech-led rally.

According to Cramer, the potential rally could once again be led by mega-cap tech stocks from the Nasdaq Composite, including the likes of Apple Inc. (NASDAQ:AAPL), Amazon.com Inc. (NASDAQ:AMZN), Alphabet Inc. (NASDAQ:GOOGL) (NASDAQ:GOOG), Microsoft Corporation (NASDAQ:MSFT), Nvidia Corporation (NASDAQ:NVDA), Meta Platforms Inc. (NASDAQ:META) and Tesla Inc. (NASDAQ:TSLA).

Cramer isn’t certain whether the pervasive negative sentiment on Wall Street indicates a market bottom, but he considers it a possibility.

“Maybe all that needs to happen is for the frantic bond sellers to slow the pace of their sales… Once that happens, we can finally focus on the myriad stocks that’ve been crushed for weeks now,” he said.

Read Next: You don't need to be an art major to rake in great profits from fine art. Seasoned curators have created a selection of promising pieces you can invest in today. Click here to check them out.

Image via Shutterstock

Engineered by

Benzinga Neuro, Edited by

Pooja Rajkumari

The GPT-4-based Benzinga Neuro content generation system exploits the

extensive Benzinga Ecosystem, including native data, APIs, and more to

create comprehensive and timely stories for you.

Learn more.

Latest Ratings for TSLA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Daiwa Capital | Upgrades | Neutral | Outperform |

| Feb 2022 | Piper Sandler | Maintains | Overweight | |

| Jan 2022 | Credit Suisse | Upgrades | Neutral | Outperform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: bonds Fed Rate HikesNews Bonds Markets Analyst Ratings Media General