Wall Street's Most Accurate Analysts' Views On 3 Materials Stocks With Over 3% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting our Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the materials sector.

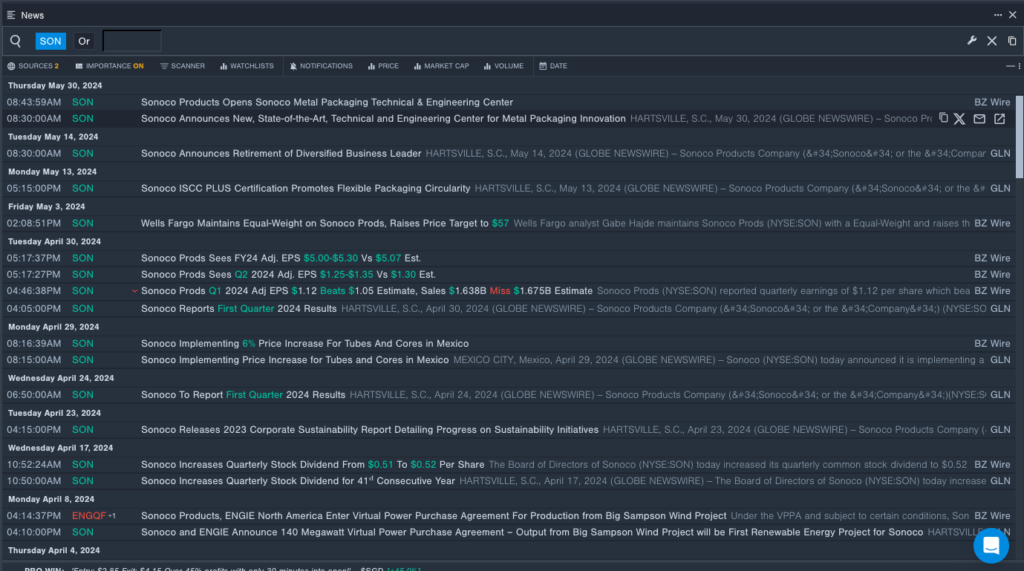

Sonoco Products Company (NYSE:SON)

- Dividend Yield: 3.47%

- Citigroup analyst Anthony Pettinari maintained a Buy rating and cut the price target from $66 to $65 on April 4. This analyst has an accuracy rate of 79%.

- Argus Research analyst David Coleman downgraded the stock from Buy to Hold on Aug. 3, 2023. This analyst has an accuracy rate of 63%.

- Recent News: On April 30, Sonoco posted better-than-expected quarterly earnings.

- Benzinga Pro's real-time newsfeed alerted to latest Sonoco news

Huntsman Corporation (NYSE:HUN)

- Dividend Yield: 4.05%

- Wells Fargo analyst Michael Sison upgraded the rating from Equal-Weight to Overweight on Feb. 23. This analyst has an accuracy rate of 72%.

- Stifel analyst Vincent Anderson maintained a Buy rating and cut the price target from $30 to $29 on Jan. 24. This analyst has an accuracy rate of 71%.

- Recent News: On May 2, Huntsman posted weak quarterly sales.

- Benzinga Pro's charting tool helped identify the trend in Huntsman's stock.

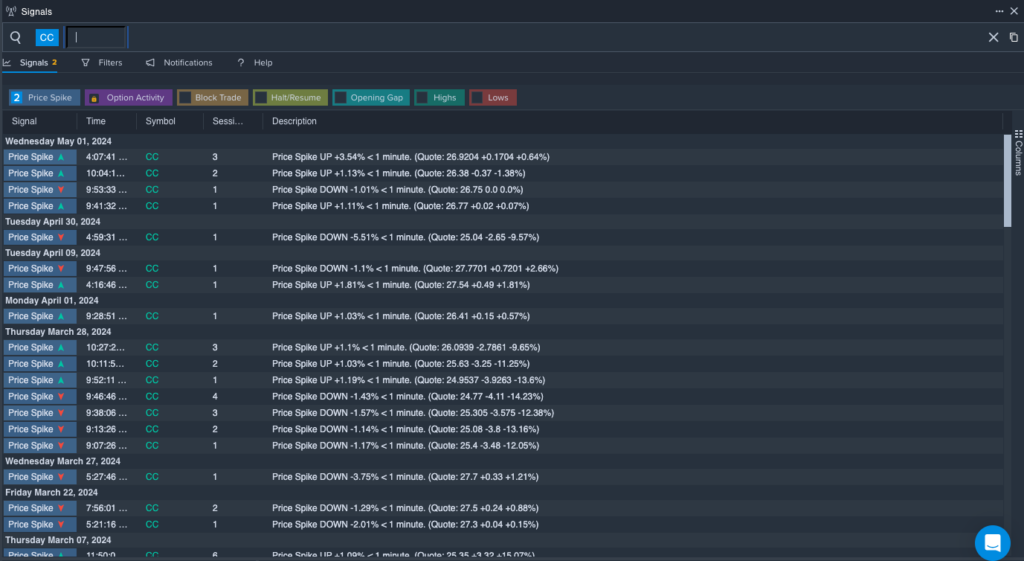

The Chemours Company (NYSE:CC)

- Dividend Yield: 3.91%

- BMO Capital analyst John McNulty upgraded the stock from Market Perform to Outperform and boosted the price target from $19 to $34 on April 9. This analyst has an accuracy rate of 65%.

- UBS analyst Joshua Spectormaintained a Neutral rating and raised the price target from $21 to $28 on April 2. This analyst has an accuracy rate of 65%.

- Recent News: On April 30, Chemours posted better-than-expected quarterly sales.

- Benzinga Pro's signals feature notified of a potential breakout in Chemours shares.

Read More: Dell, Asana And 3 Stocks To Watch Heading Into Friday

Latest Ratings for SON

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Wells Fargo | Maintains | Equal-Weight | |

| Jan 2022 | UBS | Maintains | Neutral | |

| Dec 2021 | Seaport Global | Upgrades | Neutral | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: dividend yieldNews Dividends Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas