Wall Street's Most Accurate Analysts Spotlight On 3 Tech And Telecom Stocks Delivering High-Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting our Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the communication services sector.

Shutterstock, Inc. (NASDAQ:SSTK)

- Dividend Yield: 3.02%

- Truist Securities analyst Youssef Squali maintained a Buy rating and cut the price target from $70 to $65 on May 6. This analyst has an accuracy rate of 80%.

- Morgan Stanley analyst Brian Nowak assumed an Equal-Weight rating with a price target of $55 on Feb. 22. This analyst has an accuracy rate of 68%.

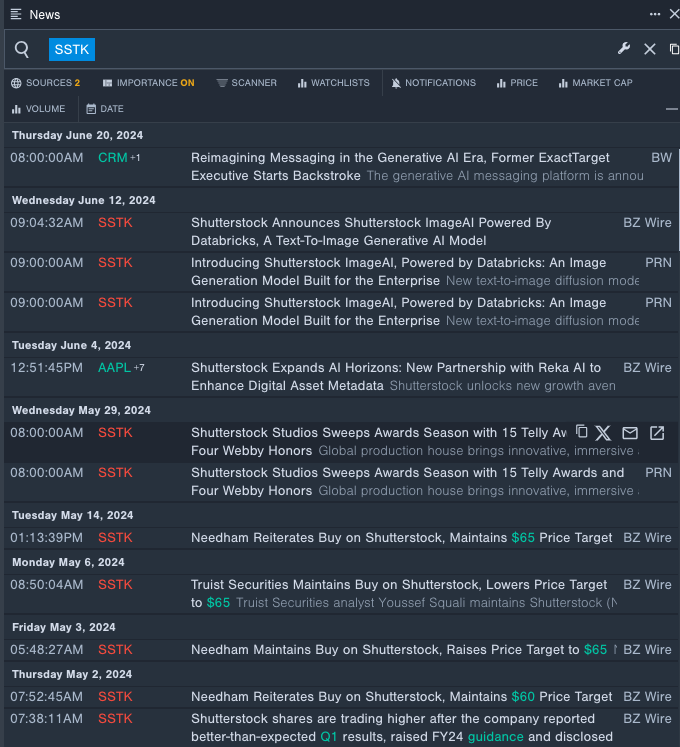

- Recent News: On May 2, Shutterstock reported better-than-expected first-quarter results, raised FY24 guidance and disclosed plans to acquire Envato, a digital creative assets and templates company.

- Benzinga Pro's real-time newsfeed alerted to latest Shutterstock's news

Omnicom Group Inc. (NYSE:OMC)

- Dividend Yield: 3.12%

- MoffettNathanson analyst Michael Nathanson maintained a Neutral rating and raised the price target from $89 to $93 on April 17. This analyst has an accuracy rate of 61%.

- JP Morgan analyst David Karnovsky maintained an Overweight rating and raised the price target from $104 to $108 on April 17. This analyst has an accuracy rate of 66%.

- Recent News: On May 30, Omnicom named Mazen Abd Rabbo as SVP of newly formed Omnicom Group Qatar.

- Benzinga Pro's charting tool helped identify the trend in Omnicom's stock.

Cable One, Inc. (NYSE:CABO)

- Dividend Yield: 3.31%

- Wells Fargo analyst Steven Cahall maintained an Underweight rating and cut the price target from $400 to $350 on May 3. This analyst has an accuracy rate of 62%.

- MoffettNathanson analyst CraigMoffettupgraded the stock from Neutral to Buy with a price target of $615 on March 5. This analyst has an accuracy rate of 60%.

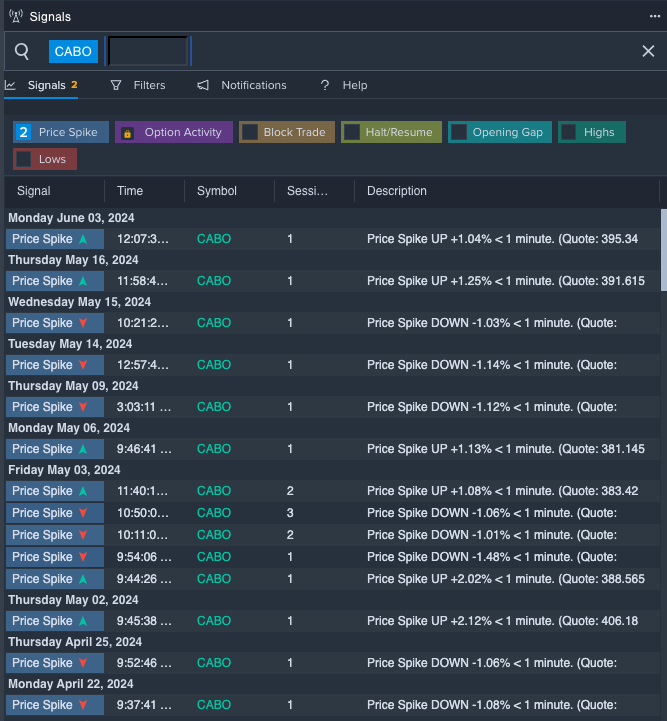

- Recent News: On May 2, Cable One posted weaker-than-expected quarterly sales.

- Benzinga Pro's signals feature notified of a potential breakout in Cable One's shares.

Check This Out: How to Find Dividend Stocks: Scan, Analyze, and Capture with Benzinga Pro

Latest Ratings for SSTK

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Needham | Maintains | Buy | |

| Oct 2021 | Needham | Maintains | Buy | |

| Jul 2021 | Needham | Maintains | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: communication services dividend yieldNews Dividends Price Target Markets Analyst Ratings Trading Ideas