Wall Street's Most Accurate Analysts Give Their Take On 3 Defensive Stocks With Over 3% Dividend Yields

During times of turbulence and uncertainty in the markets, even when markets are at all-time highs, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting our Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the consumer staples sector.

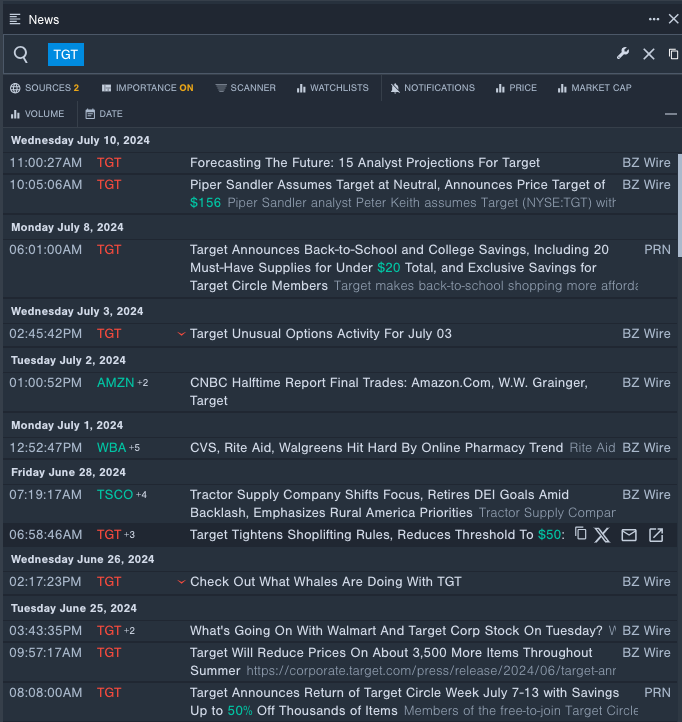

Target Corporation (NYSE:TGT)

- Dividend Yield: 3.07%

- Piper Sandler analyst Peter Keith assumed a Neutral rating with a price target of $156 on July 10. This analyst has an accuracy rate of 72%.

- UBS analyst Michael Lasser maintained a Buy rating and cut the price target from $191 to $185 on May 23. This analyst has an accuracy rate of 79%.

- Recent News: Target is reportedly intensifying its efforts to combat shoplifting by lowering the threshold for staff to intervene in thefts.

- Benzinga Pro's real-time newsfeed alerted to latest TGT's news

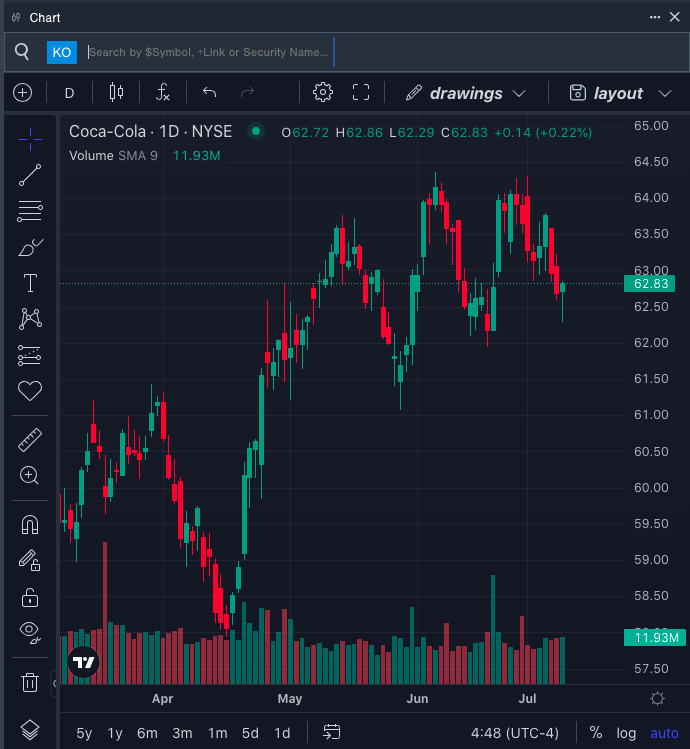

The Coca-Cola Company (NYSE:KO)

- Dividend Yield: 3.09%

- B of A Securities analyst Bryan Spillane maintained a Buy rating and raised the price target from $68 to $70 on July 10. This analyst has an accuracy rate of 68%.

- Morgan Stanley analyst Dara Mohsenianmaintained an Overweight rating and raised the price target from $68 to $70 on June 10. This analyst has an accuracy rate of 74%.

- Recent News: The Coca-Cola Company said it will release second quarter financial results on July 23, before the opening bell.

- Benzinga Pro's charting tool helped identify the trend in KO's stock.

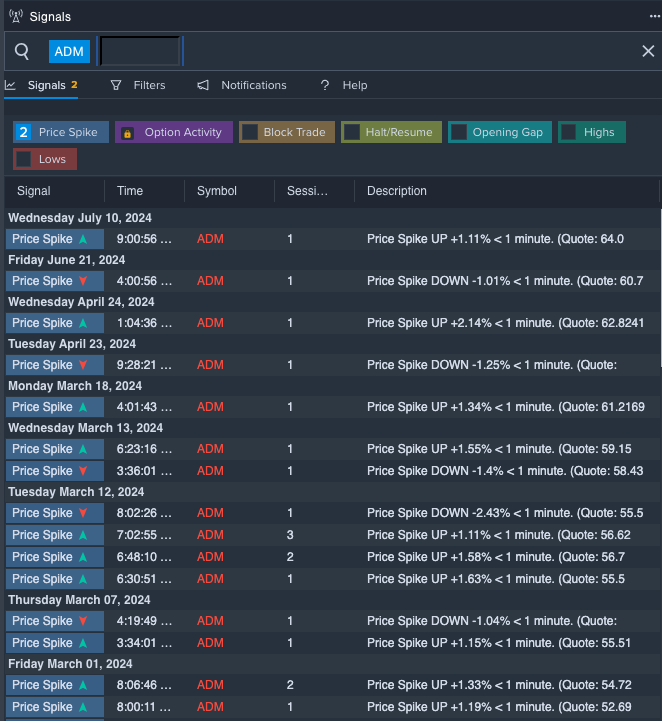

Archer-Daniels-Midland Company (NYSE:ADM)

- Dividend Yield: 3.11%

- BMO Capital analyst Andrew Strelzik maintained a Market Perform rating and cut the price target from $66 to $60 on March 13. This analyst has an accuracy rate of 81%.

- Stifel analyst Vincent Anderson downgraded the stock from Buy to Hold and slashed the price target from $116 to $56 on Jan. 22. This analyst has an accuracy rate of 72%.

- Recent News: On July 10, ADM named Monish Patolawala as Executive Vice President and Chief Financial Officer.

- Benzinga Pro's signals feature notified of a potential breakout in ADM's shares.

Read More:

- S&P 500 Settles Above 5,600 For First Time Ahead Of Inflation Data, Fear Index Moves To ‘Greed’ Zone

Latest Ratings for TGT

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Raymond James | Maintains | Strong Buy | |

| Mar 2022 | JP Morgan | Maintains | Overweight | |

| Mar 2022 | Deutsche Bank | Maintains | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: consumer staplesNews Dividends Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas