Starbucks To Rally Around 43%? Here Are 10 Top Analyst Forecasts For Tuesday

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.

- Baird raised the price target for Starbucks Corporation (NASDAQ:SBUX) from $81 to $110. Baird analyst David Tarantino upgraded the stock from Neutral to Outperform. Starbucks shares gained 2.6% to close at $77.03 on Monday. See how other analysts view this stock.

- Ladenburg Thalmann increased the price target for Alliant Energy Corporation (NYSE:LNT) from $50 to $62.5. Ladenburg Thalmann analyst Paul Fremont upgraded the stock from Neutral to Buy. Alliant Energy shares fell 0.2% to close at $55.96 on Monday. See how other analysts view this stock.

- Barclays raised Sempra (NYSE:SRE) price target from $81 to $87. Barclays analyst Eric Beaumont maintained an Overweight rating. Sempra shares rose 0.7% to close at $78.99 on Monday. See how other analysts view this stock.

- Morgan Stanley cut the price target for DraftKings Inc. (NASDAQ:DKNG) from $51 to $47. Morgan Stanley analyst Stephen Grambling maintained an Overweight rating. DraftKings shares fell 1.6% to close at $29.85 on Monday. See how other analysts view this stock.

- Morgan Stanley slashed 10x Genomics, Inc. (NASDAQ:TXG) price target from $50 to $46. Morgan Stanley analyst Tejas Savant maintained an Overweight rating. 10x Genomics shares fell 3.8% to close at $19.65 on Monday. See how other analysts view this stock.

- Wedbush increased KeyCorp (NYSE:KEY) price target from $16 to $17. Wedbush analyst David Chiaverini maintained a Neutral rating. KeyCorp shares gained 9.1% to close at $15.94 on Monday. See how other analysts view this stock.

- B. Riley Securities increased the price target for DoubleDown Interactive Co., Ltd. (NASDAQ:DDI) from $24 to $26. B. Riley Securities analyst David Bain maintained a Buy rating. DoubleDown Interactive shares gained 1.5% to close at $12.06 on Monday. See how other analysts view this stock.

- Stifel raised Coherent Corp. (NYSE:COHR) price target from $68 to $75. Stifel analyst Ruben Roy maintained a Buy rating. Coherent shares gained 5.3% to close at $66.70 on Monday. See how other analysts view this stock.

- Stifel boosted Walmart Inc. (NYSE:WMT) price target from $71 to $73. Stifel analyst Mark Astrachan maintained a Hold rating. Walmart shares rose 1.1% to close at $68.70 on Monday. See how other analysts view this stock.

- Citigroup boosted Hormel Foods Corporation (NYSE:HRL) price target from $33 to $37. Citigroup analyst Thomas Palmer upgraded the stock from Neutral to Buy. Hormel shares fell 2.4% to close at $31.25 on Monday. See how other analysts view this stock.

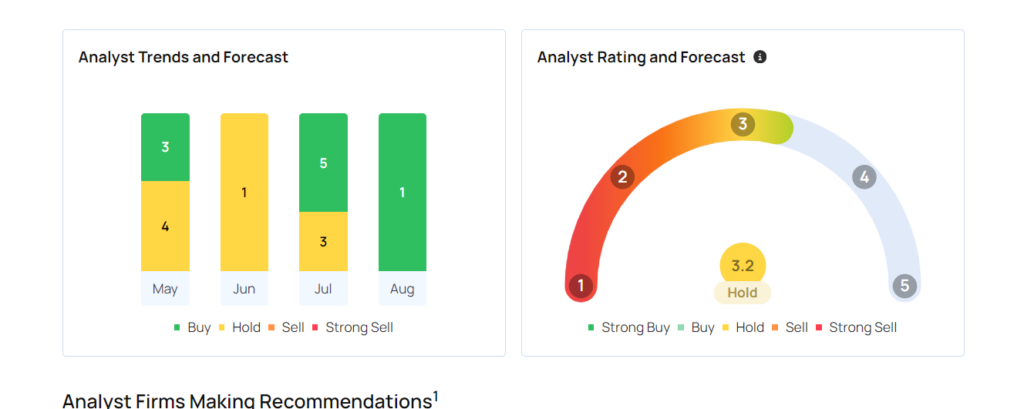

Considering buying SBUX stock? Here’s what analysts think:

Latest Ratings for SBUX

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Deutsche Bank | Maintains | Buy | |

| Feb 2022 | MKM Partners | Maintains | Buy | |

| Feb 2022 | Credit Suisse | Maintains | Outperform |

Posted-In: analyst forecasts PT ChangesNews Price Target Pre-Market Outlook Markets Analyst Ratings