Wall Street's Most Accurate Analysts Weigh In On 3 Health Care Stocks With Over 3% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the health care sector.

Pfizer Inc. (NYSE:PFE)

Dividend Yield: 5.66%

- Cantor Fitzgerald analyst Louise Chen reiterated an Overweight rating with a price target of $45 on Sept. 16. This analyst has an accuracy rate of 70%.

- Wells Fargo analyst Mohit Bansal maintained an Equal-Weight rating and raised the price target from $28 to $30 on July 31. This analyst has an accuracy rate of 78%.

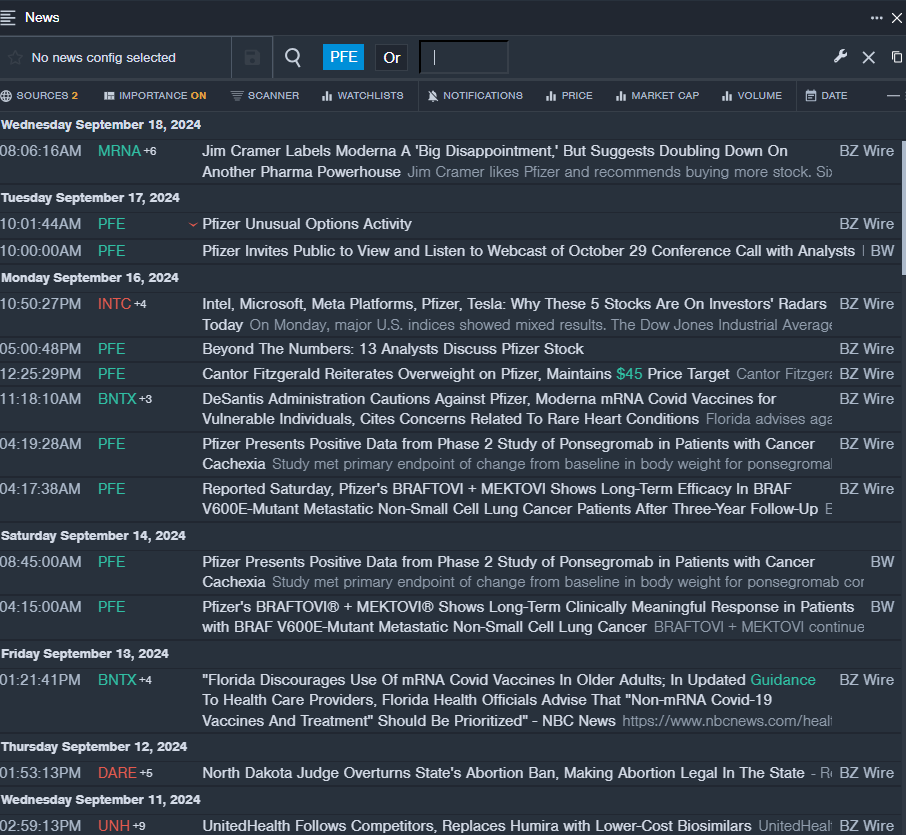

- Recent News: Pfizer recently presented positive data from Phase 2 study of Ponsegromab in Patients with cancer cachexia.

- Benzinga Pro's real-time newsfeed alerted to latest PFE news.

CVS Health Corporation (NYSE:CVS)

- Dividend Yield: 4.55%

- RBC Capital analyst Ben Hendrix reiterated an Outperform rating with a price target of $68 on Sept. 4. This analyst has an accuracy rate of 74%

- Barclays analyst Andrew Mok maintained an Equal-Weight rating and cut the price target from $65 to $63 on Aug. 8. This analyst has an accuracy rate of 79%.

- Recent News: Wednesday, Oak Street Health, a subsidiary of CVS Health, agreed to settle for $60 million following allegations that it violated the False Claims Act.

- Benzinga Pro’s charting tool helped identify the trend in CVS stock.

Gilead Sciences, Inc. (NASDAQ:GILD)

- Dividend Yield: 3.67%

- RBC Capital analyst Brian Abrahams maintained a Sector Perform rating and raised the price target from $72 to $74 on Sept. 4. This analyst has an accuracy rate of 65%.

- Needham analyst Joseph Stringer reiterated a Hold rating on Aug. 15. This analyst has an accuracy rate of 80%.

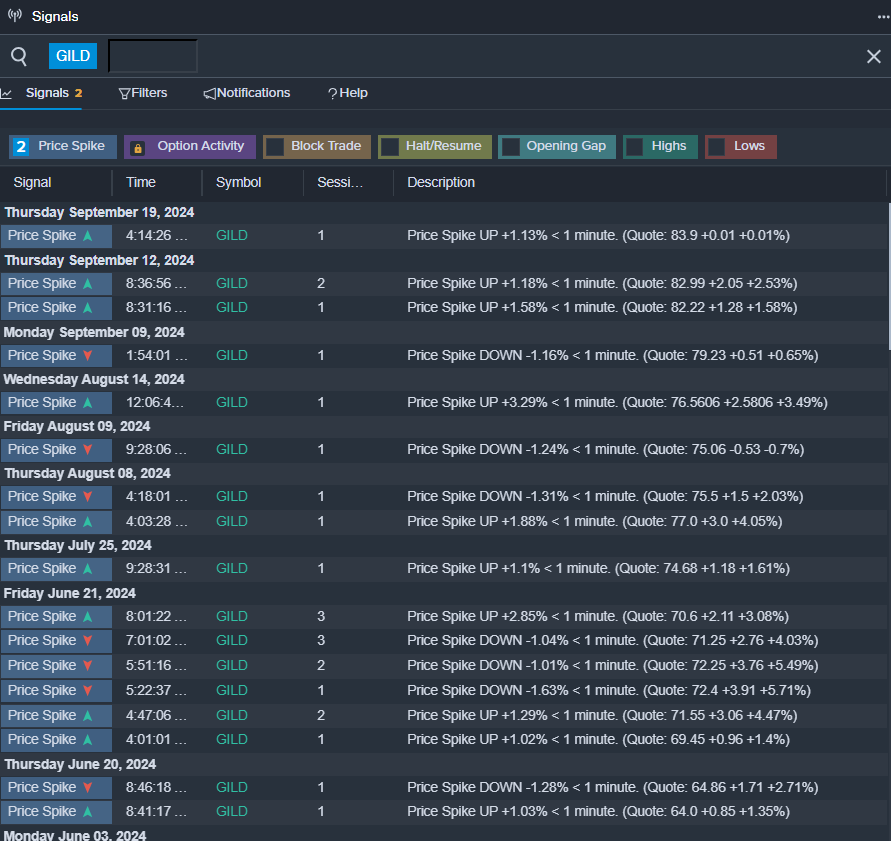

- Recent News: Gilead Sciences, last week, revealed the results of an interim analysis from a second Phase 3 trial investigating the use of the company's twice-yearly injectable HIV-1 capsid inhibitor, lenacapavir.

- Benzinga Pro’s signals feature notified of a potential breakout in GILD shares.

Read More:

Latest Ratings for PFE

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | Morgan Stanley | Maintains | Equal-Weight | |

| Jan 2022 | Wells Fargo | Maintains | Overweight | |

| Jan 2022 | B of A Securities | Upgrades | Neutral | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: dividend yieldNews Dividends Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas