Wall Street's Most Accurate Analysts' Views On 3 Tech Stocks Delivering High-Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the information technology sector.

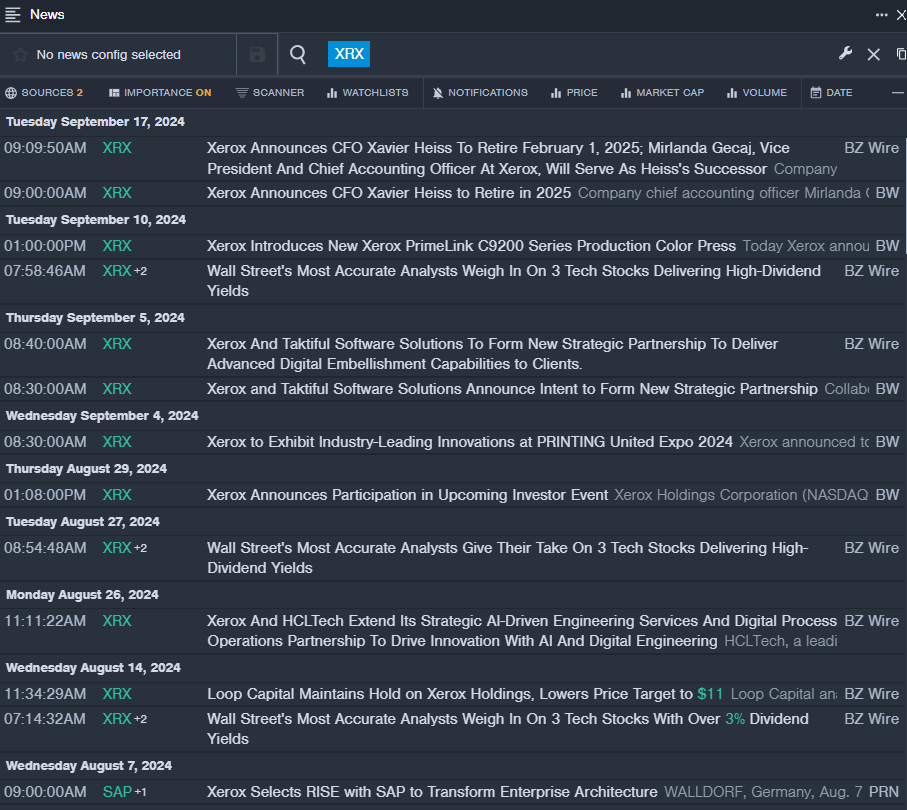

Xerox Holdings Corporation (NASDAQ:XRX)

- Dividend Yield: 9.83%

- Loop Capital analyst Ananda Baruah maintained a Hold rating and cut the price target from $14 to $11 on Aug. 14. This analyst has an accuracy rate of 74%.

- Citigroup analyst Asiya Merchant initiated coverage on the stock with a Sell rating and a price target of $11 on June 28. This analyst has an accuracy rate of 73%.

- Recent News: On Sept. 17, Xerox said CFO Xavier Heiss will retire on Feb. 1, 2025.

- Benzinga Pro's real-time newsfeed alerted to latest XRX news.

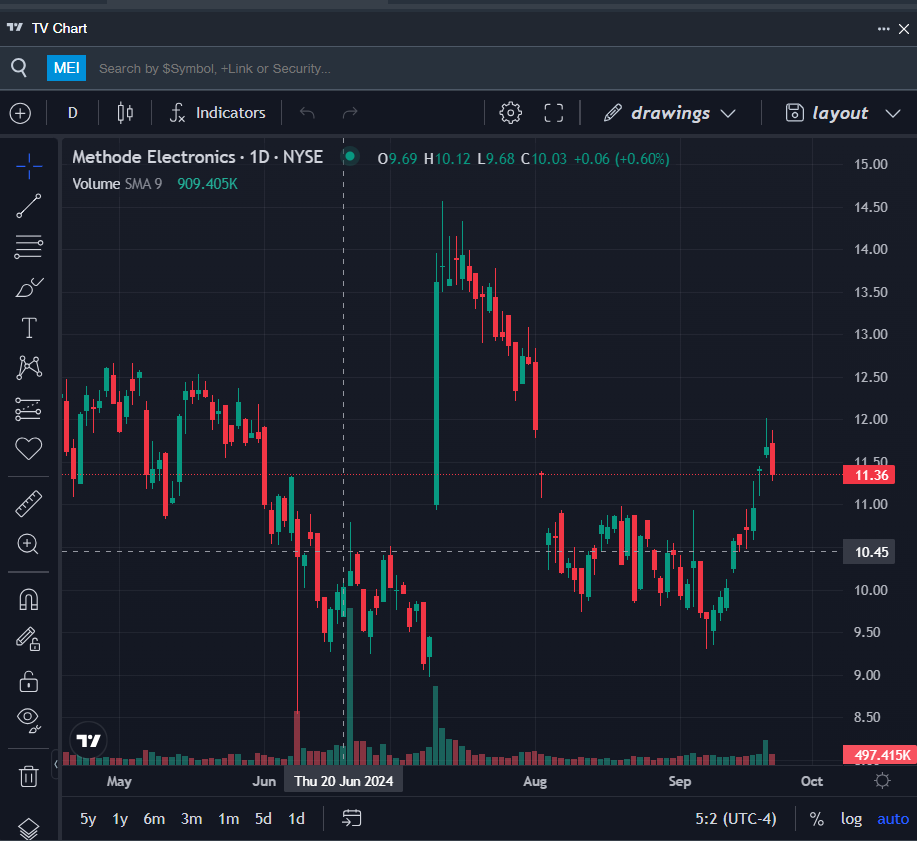

Methode Electronics, Inc. (NYSE:MEI)

- Dividend Yield: 4.93%

- Jefferies analyst Saree Boroditsky initiated coverage on the stock with a Hold rating and a price target of $12 on April 9. This analyst has an accuracy rate of 60%

- Sidoti & Co. analyst John Franzreb downgraded the stock from Buy to Neutral on March 7. This analyst has an accuracy rate of 75%.

- Recent News: On Sept. 12, Methode Electronics’ board named Mark Schwabero as new Chairman of the Board.

- Benzinga Pro’s charting tool helped identify the trend in MEI stock.

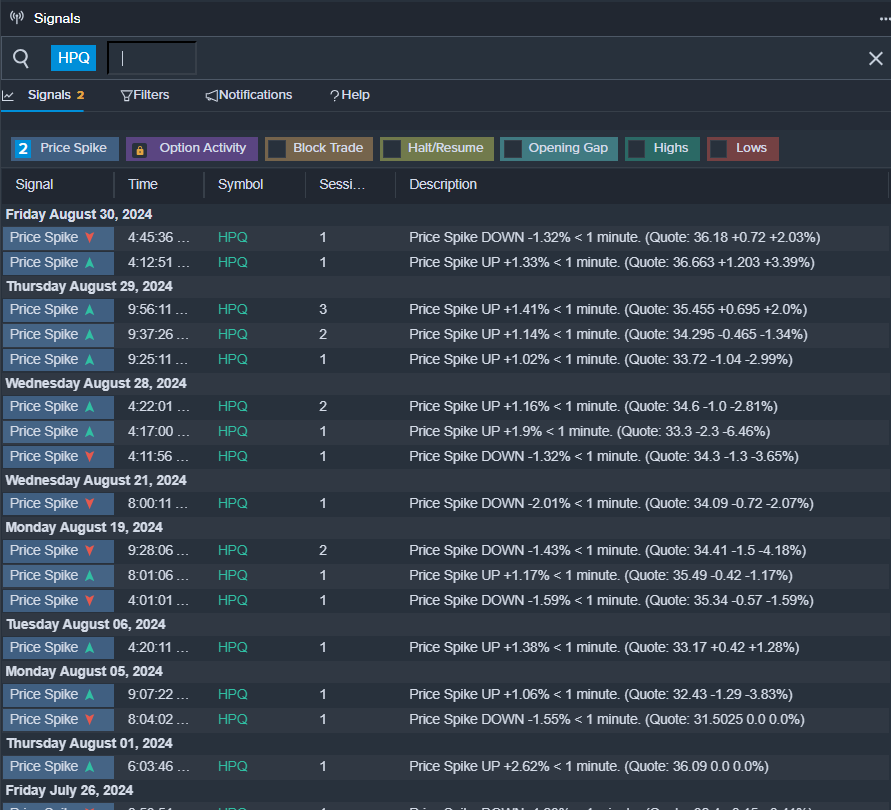

HP Inc. (NYSE:HPQ)

- Dividend Yield: 3.13%

- Loop Capital analyst Ananda Baruah maintained a Hold rating and cut the price target from $37 to $35 on Sept. 5. This analyst has an accuracy rate of 75%.

- Barclays analyst Tim Long maintained an Equal-Weight rating and lowered the price target from $33 to $32 on Aug. 29. This analyst has an accuracy rate of 74%.

- Recent News: On Aug. 28, HP reported better-than-expected third-quarter financial results and increased its share repurchase authorization to $10 billion in total.

- Benzinga Pro’s signals feature notified of a potential breakout in HPQ shares.

Read More:

Latest Ratings for HPQ

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Barclays | Maintains | Underweight | |

| Oct 2021 | Credit Suisse | Maintains | Neutral | |

| Sep 2021 | JP Morgan | Downgrades | Overweight | Neutral |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: dividend yieldNews Dividends Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas