Wall Street's Most Accurate Analysts Give Their Take On 3 Consumer Stocks Delivering High-Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the consumer staples sector.

Walgreens Boots Alliance, Inc. (NASDAQ:WBA)

- Dividend Yield: 9.16%

- Morgan Stanley analyst Erin Wright maintained an Underweight rating and cut the price target from $9 to $7 on Oct. 11. This analyst has an accuracy rate of 75%.

- Truist Securities analyst David Macdonald maintained a Hold rating and cut the price target from $13 to $10 on Oct. 7. This analyst has an accuracy rate of 74%

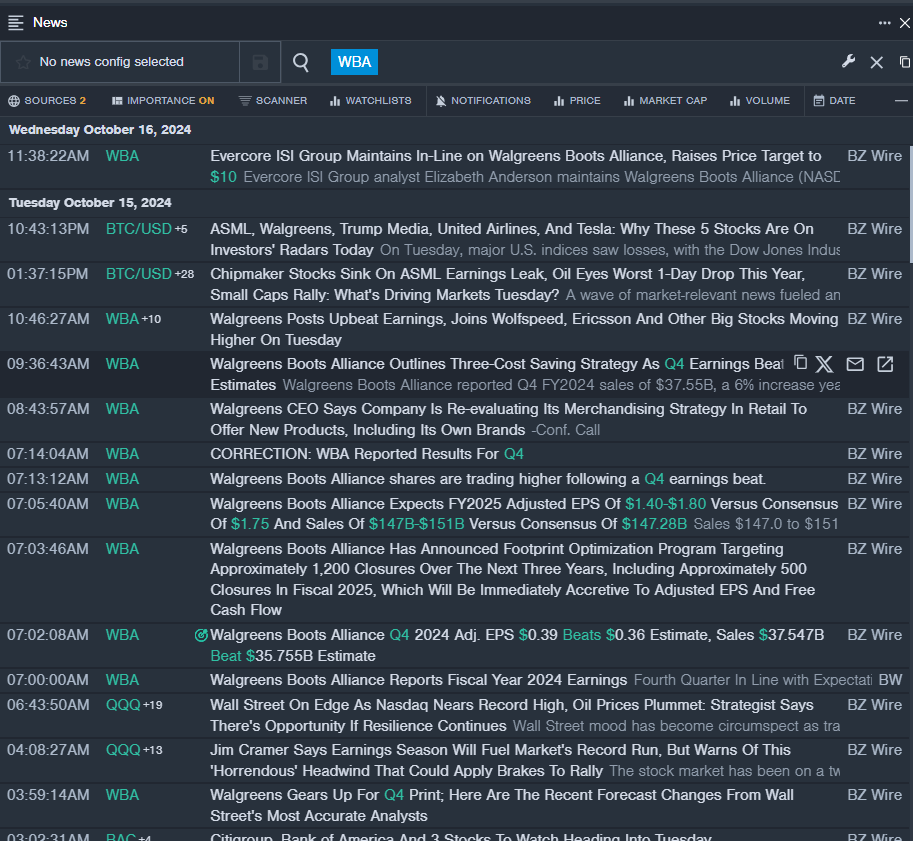

- Recent News: On Tuesday, Walgreens reported fourth-quarter fiscal year 2024 sales of $37.55 billion, up 6% year over year (+6.1% on constant currency), beating the consensus of $35.76 billion, reflecting sales growth across all segments.

- Benzinga Pro's real-time newsfeed alerted to latest WBA news.

Conagra Brands, Inc. (NYSE:CAG)

- Dividend Yield: 4.73%

- B of A Securities analyst Bryan Spillane maintained a Neutral rating and cut the price target from $34 to $33 on Oct. 3. This analyst has an accuracy rate of 65%.

- Evercore ISI Group analyst David Palmer maintained a Neutral rating and lowered the price target from $32 to $31 on July 12. This analyst has an accuracy rate of 68%.

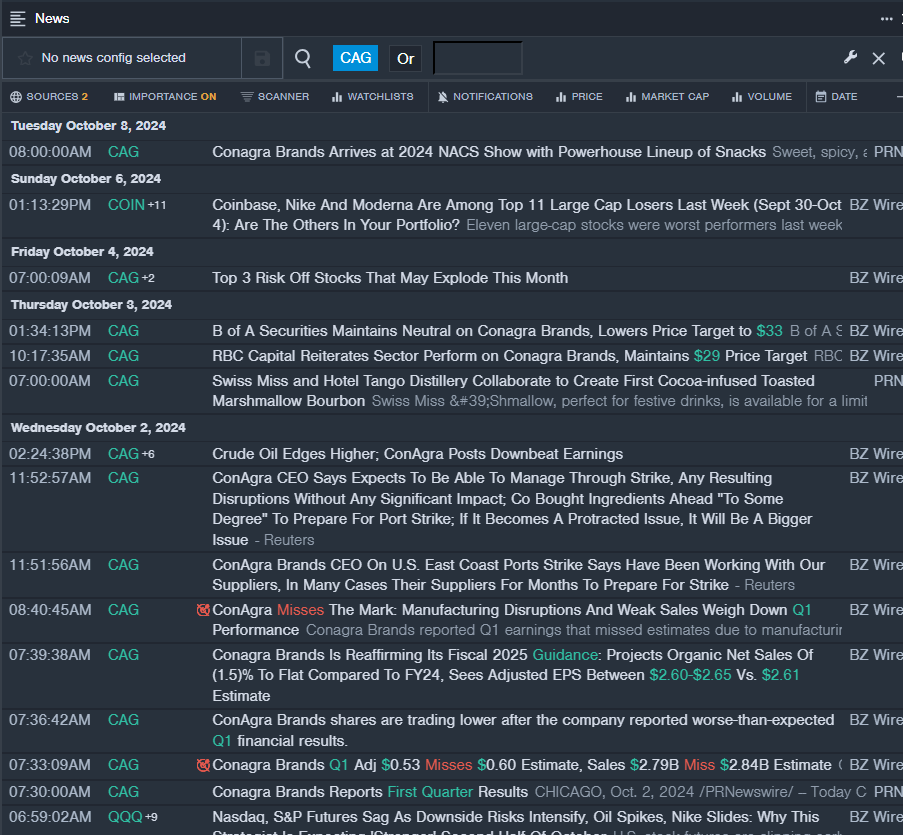

- Recent News: On Oct. 2, ConAgra Brands reported worse-than-expected first-quarter financial results.

- Benzinga Pro's real-time newsfeed alerted to latest CAG news.

Philip Morris International Inc. (NYSE:PM)

- Dividend Yield: 4.47%

- Goldman Sachs analyst Bonnie Herzog maintained a Buy rating and raised the price target from $126 to $140 on Sept. 26. This analyst has an accuracy rate of 69%.

- Barclays analyst Gaurav Jain maintained an Overweight rating and boosted the price target from $130 to $145 on Sept. 9. This analyst has an accuracy rate of 68%.

- Recent News: Philip Morris will host a live audio webcast on Tuesday, Oct. 22 to discuss its third-quarter results.

- Benzinga Pro’s charting tool helped identify the trend in PM stock.

Latest Ratings for WBA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Dec 2021 | UBS | Maintains | Neutral | |

| Dec 2021 | Morgan Stanley | Downgrades | Equal-Weight | Underweight |

| Dec 2021 | Morgan Stanley | Downgrades | Equal-Weight | Underweight |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: consumer staples dividend yieldNews Dividends Price Target Markets Analyst Ratings Trading Ideas