Wall Street's Most Accurate Analysts Spotlight On 3 Health Care Stocks Delivering High-Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the health care sector.

Organon & Co. (NYSE:OGN)

- Dividend Yield: 6.36%

- JP Morgan analyst Chris Schott downgraded the stock from Neutral to Underweight and raised the price target from $18 to $20 on Sept. 6. This analyst has an accuracy rate of 60%.

- Piper Sandler analyst David Amsellem maintained an Overweight rating and raised the price target from $22 to $24 on April 29. This analyst has an accuracy rate of 68%

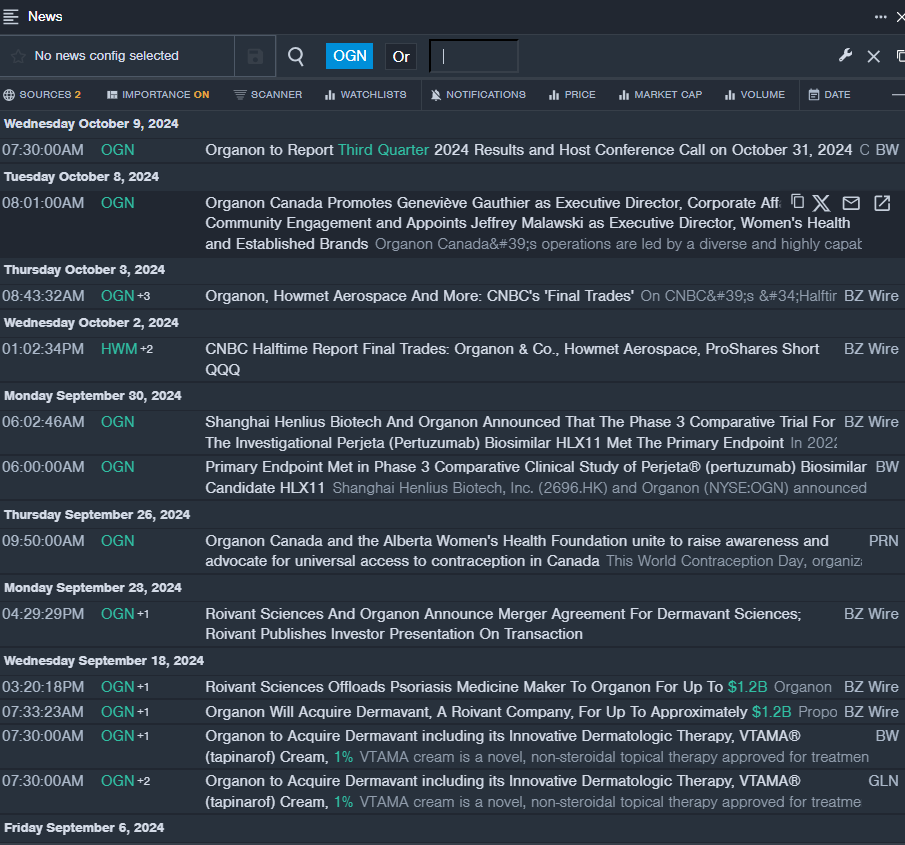

- Recent News: Organon will release its third quarter financial results on Oct. 31.

- Benzinga Pro's real-time newsfeed alerted to latest OGN news.

Premier, Inc. (NASDAQ:PINC)

- Dividend Yield: 4.15%

- Benchmark analyst Bill Sutherland downgraded the stock from Buy to Hold on Aug. 26. This analyst has an accuracy rate of 64%.

- Baird analyst Eric Coldwell maintained a Neutral rating and cut the price target from $22 to $19 on Aug. 21. This analyst has an accuracy rate of 61%.

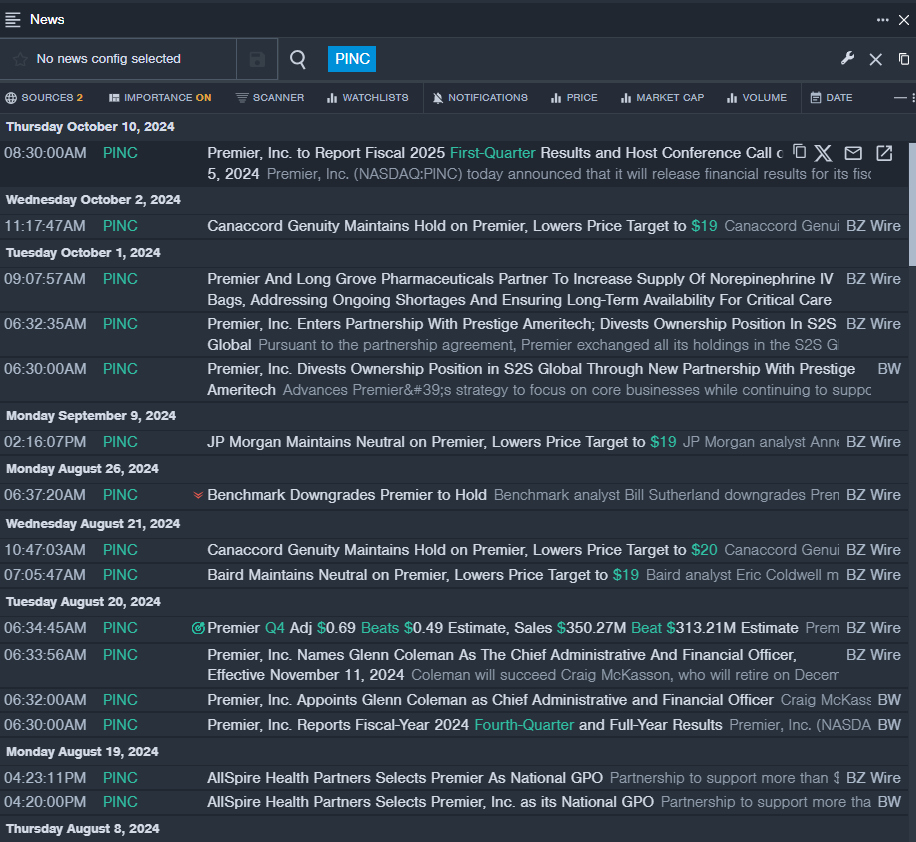

- Recent News: Premier will release financial results for its fiscal 2025 first quarter on Tuesday, Nov. 5.

- Benzinga Pro's real-time newsfeed alerted to latest PINC news.

GSK plc (NYSE:GSK)

- Dividend Yield: 3.97%

- Jefferies analyst Peter Welford maintained a Buy rating and raised the price target from $52.5 to $53 on July 2. This analyst has an accuracy rate of 68%.

- Guggenheim analyst Seamus Fernandez upgraded the stock from Neutral to Buy on March 4. This analyst has an accuracy rate of 62%.

- Recent News: On Oct. 16, the FDA accepted GSK's marketing application seeking approval for gepotidacin, an investigational, oral antibiotic for adult and adolescent females with uncomplicated urinary tract infections (uUTIs).

- Benzinga Pro’s charting tool helped identify the trend in GSK stock.

Read More:

Latest Ratings for GSK

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Feb 2022 | DZ Bank | Downgrades | Buy | Hold |

| Nov 2021 | Barclays | Upgrades | Underweight | Equal-Weight |

| Mar 2021 | SVB Leerink | Downgrades | Outperform | Market Perform |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: dividend yieldNews Dividends Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas