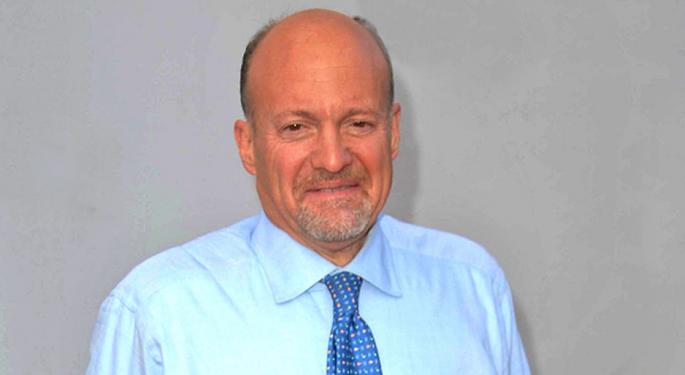

Jim Cramer Asks, 'Do We Just Keep Selling Because Everyone Is Selling?'—Calls It The 'Every Day Lower Prices Walmart White House'

Wall Street is in turmoil again, and CNBC's Jim Cramer is voicing what many investors are wondering: "Do we just keep selling because everyone is selling?" The stock market saw another sharp drop on Thursday, with the S&P 500 falling 1.8%, the Dow Jones Industrial Average losing 427 points, and the Nasdaq tumbling 2.6%.

Cramer followed up his first tweet with another, calling the current administration the "Every Day Lower Prices Walmart White House." His comments reflect frustration over the volatility caused by President Trump's tariffs and economic policies.

Don't Miss:

- Deloitte's fastest-growing software company partners with Amazon, Walmart & Target – Many are rushing to grab 4,000 of its pre-IPO shares for just $0.26/share.

- Maker of the $60,000 foldable home has 3 factory buildings, 600+ houses built, and big plans to solve housing — this is your last chance to become an investor for $0.80 per share.

Tariff Uncertainty Adds to the Sell-Off

Investors are struggling to keep up with the back-and-forth on tariffs. Trump announced a one-month reprieve on some tariffs for Mexico and Canada, but concerns remain as new tariffs are still set to take effect in April. "These exemptions don't do much to resolve the general air of uncertainty," said Yung-Yu Ma, chief investment officer at BMO Wealth Management, according to media reports. Businesses are cautious, and consumers are bracing for inflation.

Trump, however, dismissed concerns that his tariff policies are rattling markets. "I'm not even looking at the market," he said in the Oval Office on Thursday, blaming falling stock prices on "globalist countries and companies that won't be doing as well because we're taking back things that have been taken from us many years ago."

AI Stocks and Retail Struggles Weigh on Wall Street

Adding to the market's pain, AI stocks—once Wall Street's biggest winners—are seeing losses. Marvell Technology (NASDAQ:MRVL) dropped nearly 20% despite reporting solid earnings. Nvidia (NASDAQ:NVDA) fell 5.7%, and Broadcom (NASDAQ:AVGO) slipped 6.3% ahead of its earnings report. Investors who had grown accustomed to AI stocks consistently outperforming expectations are now re-evaluating their positions.

Retailers are also feeling the pressure. Macy's (NYSE:M) reported weaker-than-expected revenue, and Victoria's Secret (NYSE:VSCO) fell 8.2% after giving a disappointing forecast. These reports signal that consumer spending, a key pillar of economic stability, may be softening.

See Also: Mark Cuban Backs This Innovative Startup That Turns Videos into Games — Claim Your Share Now

Larry Fink: Buy the Dip Despite Market Turmoil

While some fear more losses ahead, BlackRock (NYSE:BLK) CEO Larry Fink sees an opportunity. Speaking at the recent RBC Capital Markets Global Financial Institutions Conference in New York, he reassured investors: "The world's fine… The United States will get by." He acknowledges 2025 will be volatile but believes in long-term growth. "If there's a big dip, good. Good time to buy."

Fink highlighted AI's potential, though he admitted its high costs are keeping it out of reach for smaller companies. He also pointed to Europe's economic rebound, citing increased defense spending and financial reforms.

With uncertainty high, Cramer's question—"Do we just keep selling because everyone is selling?"—captures the mood on Wall Street. Whether investors follow Larry Fink's advice to buy the dip or continue the sell-off remains to be seen.

Read Next:

- Inspired by Uber and Airbnb – Deloitte's fastest-growing software company is transforming 7 billion smartphones into income-generating assets – with $1,000 you can invest at just $0.26/share!

- If there was a new fund backed by Jeff Bezos offering a 7-9% target yield with monthly dividends would you invest in it?

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: news access test accessNews