Wall Street's Most Accurate Analysts Give Their Take On 3 Financial Stocks With Over 15% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the financial sector.

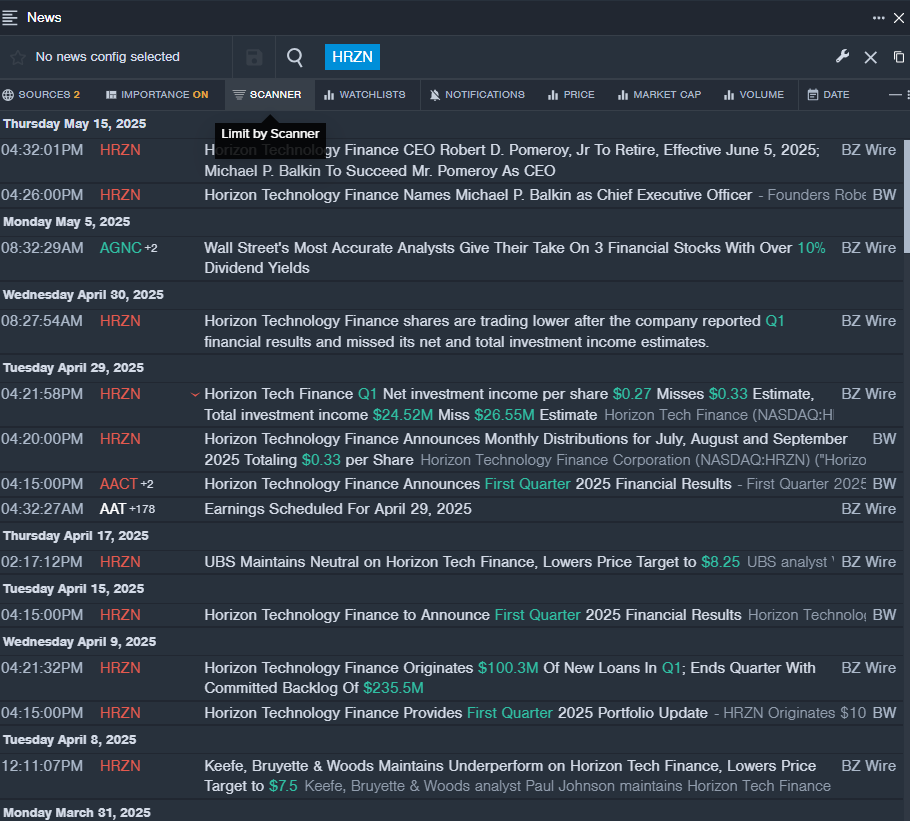

Horizon Technology Finance Corporation (NASDAQ:HRZN)

- Dividend Yield: 17.77%

- Keefe, Bruyette & Woods analyst Paul Johnson maintained an Underperform rating and cut the price target from $8 to $7.5 on April 8, 2025. This analyst has an accuracy rate of 69%.

- Compass Point analyst Casey Alexander upgraded the stock from Sell to Neutral with a price target of $8.25 on Dec. 17, 2024. This analyst has an accuracy rate of 68%.

- Recent News: On May 15, Horizon Technology Finance named Michael P. Balkin as Chief Executive Officer.

- Benzinga Pro’s real-time newsfeed alerted to latest HRZN news.

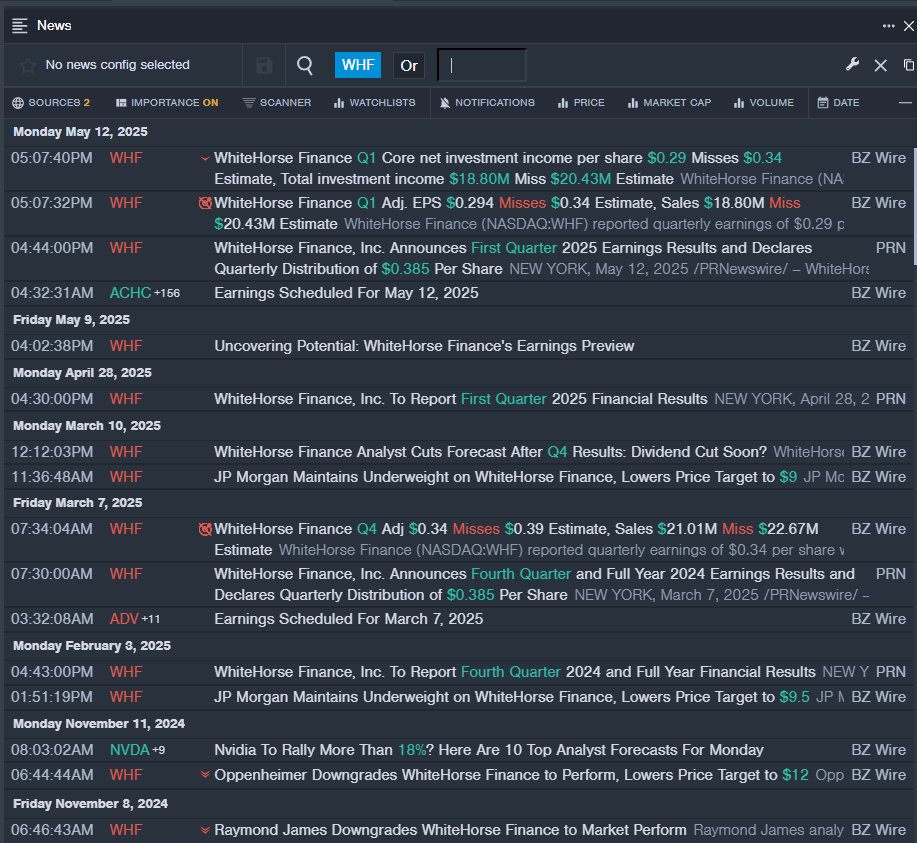

WhiteHorse Finance, Inc. (NASDAQ:WHF)

- Dividend Yield: 17.13%

- Raymond James analyst Robert Dodd downgraded the stock from Outperform to Market Perform on Nov. 8, 2024. This analyst has an accuracy rate of 64%.

- JP Morgan analyst Richard Shane maintained an Underweight rating and cut the price target from $12.5 to $11.5 on July 29, 2024. This analyst has an accuracy rate of 68%.

- Recent News: On May 12, WhiteHorse Finance posted weaker-than-expected quarterly results.

- Benzinga Pro's real-time newsfeed alerted to latest WHF news

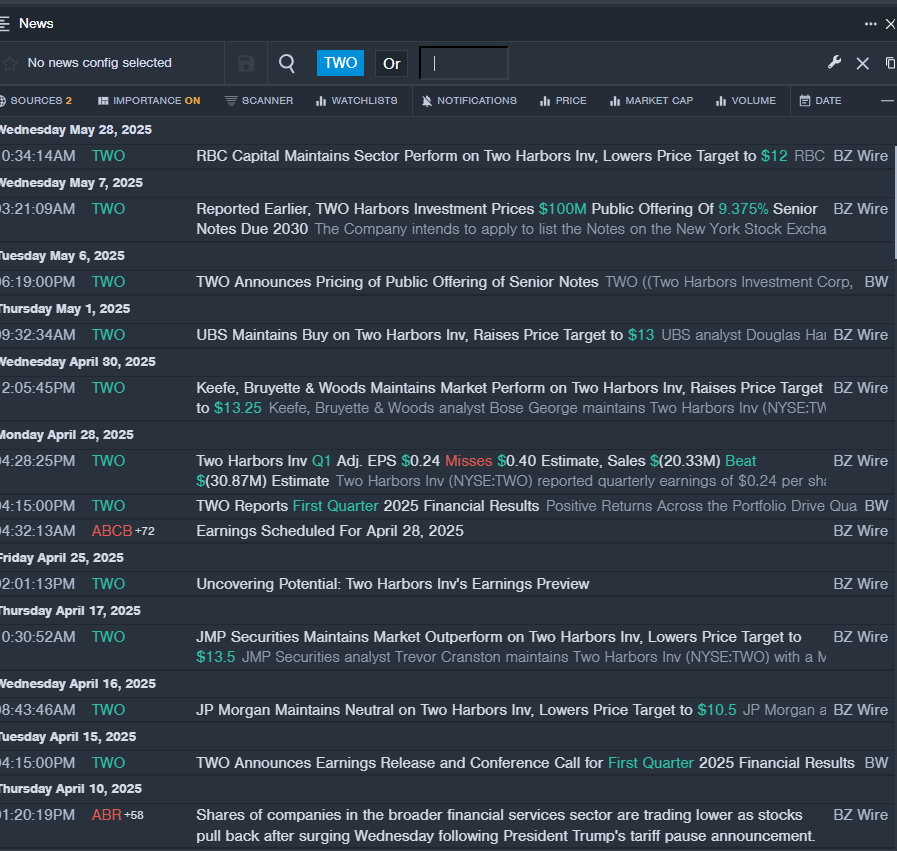

Two Harbors Investment Corp. (NYSE:TWO)

- Dividend Yield: 16.92%

- RBC Capital analyst Kenneth Lee maintained a Sector Perform rating and cut the price target from $13 to $12 on May 28, 2025. This analyst has an accuracy rate of 65%.

- UBS analyst Douglas Harter maintained a Buy rating and increased the price target from $12 to $13 on May 1, 2025. This analyst has an accuracy rate of 67%.

- Recent News: On May 6, TWO Harbors Investment priced its $100 million public offering of 9.375% senior notes due 2030.

- Benzinga Pro’s real-time newsfeed alerted to latest TWO news

Read More:

Photo via Shutterstock

Posted-In: Long Ideas News Dividends Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas