These Analysts Revise Their Forecasts On BlackRock After Q2 Earnings

BlackRock, Inc. (NYSE:BLK) reported better-than-expected earnings for the second quarter on Tuesday.

The company reported that second-quarter 2025 revenue grew 13% year-over-year to $5.42 billion, beating the consensus of $5.34 billion. Adjusted EPS increased 16% to $12.05, beating the consensus of $10.80.

Laurence Fink, Chairman and CEO, commented, "Our expanding client relationships are resonating in higher, more diversified organic base fee growth. We generated 6% organic base fee growth for the second quarter and the first half of 2025, and 7% over the last twelve months."

BlackRock shares gained 2.5% to trade at $1,072.52 on Wednesday.

These analysts made changes to their price targets on BlackRock following earnings announcement.

- B of A Securities analyst Craig Siegenthaler maintained BlackRock with a Buy and raised the price target from $1,214 to $1,224.

- Keefe, Bruyette & Woods analyst Aidan Hall maintained the stock with an Outperform rating and lowered the price target from $1,260 to $1,215.

- Morgan Stanley analyst Mike Cyprys maintained BlackRock with an Overweight rating and lowered the price target from $1,247 to $1,224.

- Wells Fargo analyst Michael Brown maintained BlackRock with an Overweight rating and lowered the price target from $1,180 to $1,170.

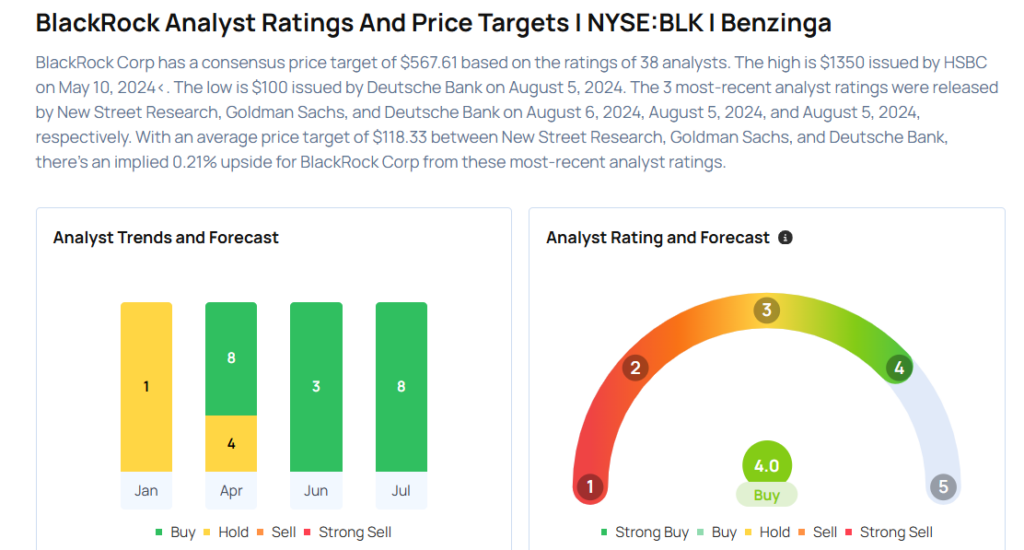

Considering buying BLK stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for BLK

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Exane BNP Paribas | Downgrades | Outperform | Neutral |

| Feb 2022 | Deutsche Bank | Maintains | Buy | |

| Jan 2022 | Morgan Stanley | Maintains | Overweight |

Posted-In: PT ChangesEarnings News Price Target Markets Analyst Ratings Trading Ideas