Zions Bancorp Analysts Increase Their Forecasts After Upbeat Q2 Earnings

Zions Bancorporation (NASDAQ:ZION) reported better-than-expected earnings for the second quarter on Monday.

The company posted quarterly earnings of $1.63 per share which beat the analyst consensus estimate of $1.30 per share. The company reported quarterly sales of $838.00 million which beat the analyst consensus estimate of $810.38 million.

Harris H. Simmons, Chairman and CEO of Zions Bancorporation, said, “We’re very pleased with the quarter’s strong financial results, with earnings per share up 27% over the prior year period, and adjusted pre-provision net revenue up 14%. The net interest margin continued to improve, increasing to 3.17% from 2.98% a year ago, and customer-related noninterest income rose 7%.”

Zions Bancorp shares gained 0.9% to trade at $57.07 on Tuesday.

These analysts made changes to their price targets on Zions Bancorp following earnings announcement.

- Jefferies analyst David Chiaverini upgraded Zions Bancorp from Underperform to Hold and raised the price target from $45 to $60.

- RBC Capital analyst Jon Arfstrom maintained the stock with a Sector Perform rating and raised the price target from $57 to $62.

- DA Davidson analyst Peter Winter maintained the stock with a Buy and raised the price target from $57 to $66.

- JP Morgan analyst Anthony Elian maintained Zions Bancorp with a Neutral and raised the price target from $55 to $63.

- Baird analyst David George maintained the stock with a Neutral and boosted the price target from $60 to $65.

- Morgan Stanley analyst Manan Gosalia maintained Zions Bancorp with an Equal-Weight rating and raised the price target from $60 to $66.

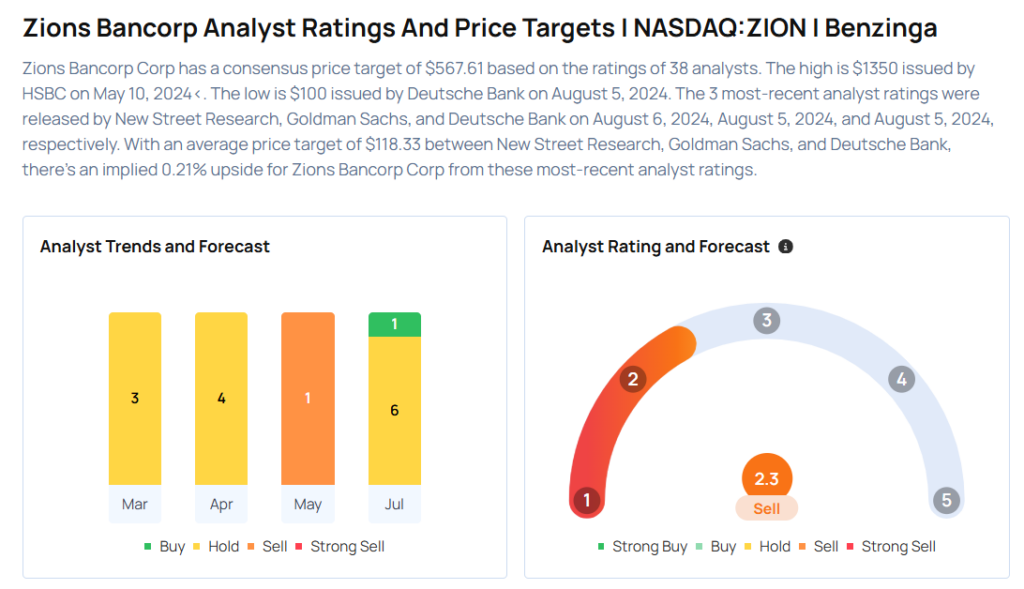

Considering buying ZION stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for ZION

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Raymond James | Maintains | Strong Buy | |

| Feb 2022 | Jefferies | Upgrades | Hold | Buy |

| Jan 2022 | Raymond James | Maintains | Strong Buy |

Posted-In: PT ChangesEarnings News Price Target Analyst Ratings Trading Ideas