Mastercard Gears Up For Q2 Print; Here Are The Recent Forecast Changes From Wall Street's Most Accurate Analysts

Mastercard Incorporated (NYSE:MA) will release earnings results for the second quarter before the opening bell on Thursday, July 31.

Analysts expect the Purchase, New York-based company to report quarterly earnings at $4.02 per share, up from $3.59 per share in the year-ago period. Mastercard is projected to report quarterly revenue of $7.98 billion, compared to $6.96 billion a year earlier, according to data from Benzinga Pro.

Mastercard on July 16 announced it is launching a new set of benefits called The Mastercard Collection to meet a major shift in how people, especially Americans, want to spend their time and money.

Mastercard shares fell 0.8% to close at $559.11 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

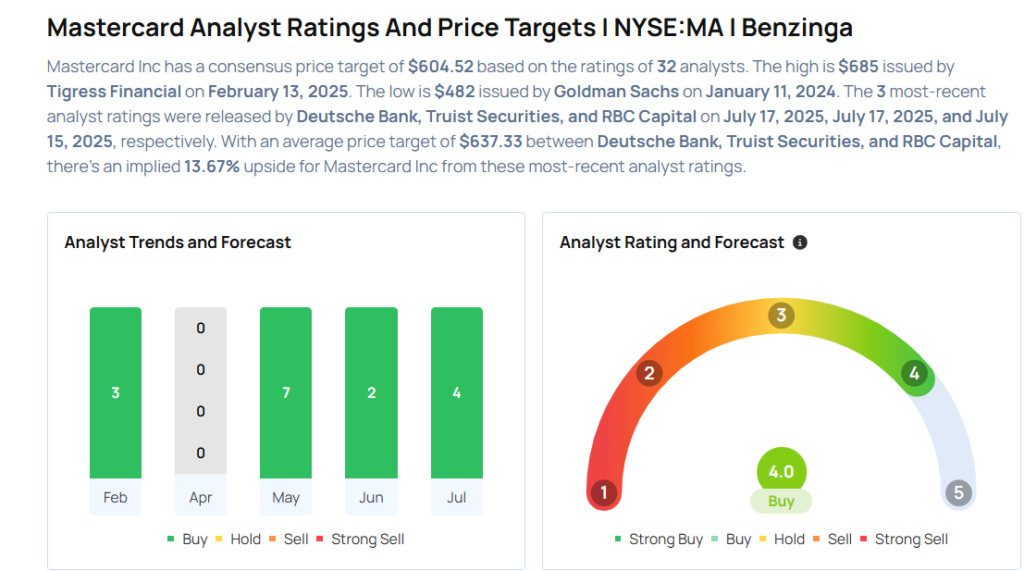

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Deutsche Bank analyst Bryan Keane reinstated a Buy rating with a price target of $650 on July 17, 2025. This analyst has an accuracy rate of 72%.

- UBS analyst Timothy Chiodo maintained a Buy rating and raised the price target from $660 to $670 on June 3, 2025. This analyst has an accuracy rate of 60%.

- Jefferies analyst Trevor Williams maintained a Buy rating and increased the price target from $630 to $655 on May 27, 2025. This analyst has an accuracy rate of 67%.

- Keybanc analyst Jeffrey Hammond maintained an Overweight rating and raised the price target from $630 to $635 on May 2, 2025. This analyst has an accuracy rate of 75%.

- Macquarie analyst Paul Golding maintained an Outperform rating and cut the price target from $645 to $610 on May 2, 2025. This analyst has an accuracy rate of 71%

Considering buying MA stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Latest Ratings for MA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Jan 2022 | Morgan Stanley | Maintains | Overweight | |

| Jan 2022 | Raymond James | Maintains | Outperform | |

| Jan 2022 | Raymond James | Maintains | Outperform |

Posted-In: Expert IdeasEarnings News Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas