Wall Street's Most Accurate Analysts Weigh In On 3 Health Care Stocks With Over 3% Dividend Yields

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the health care sector.

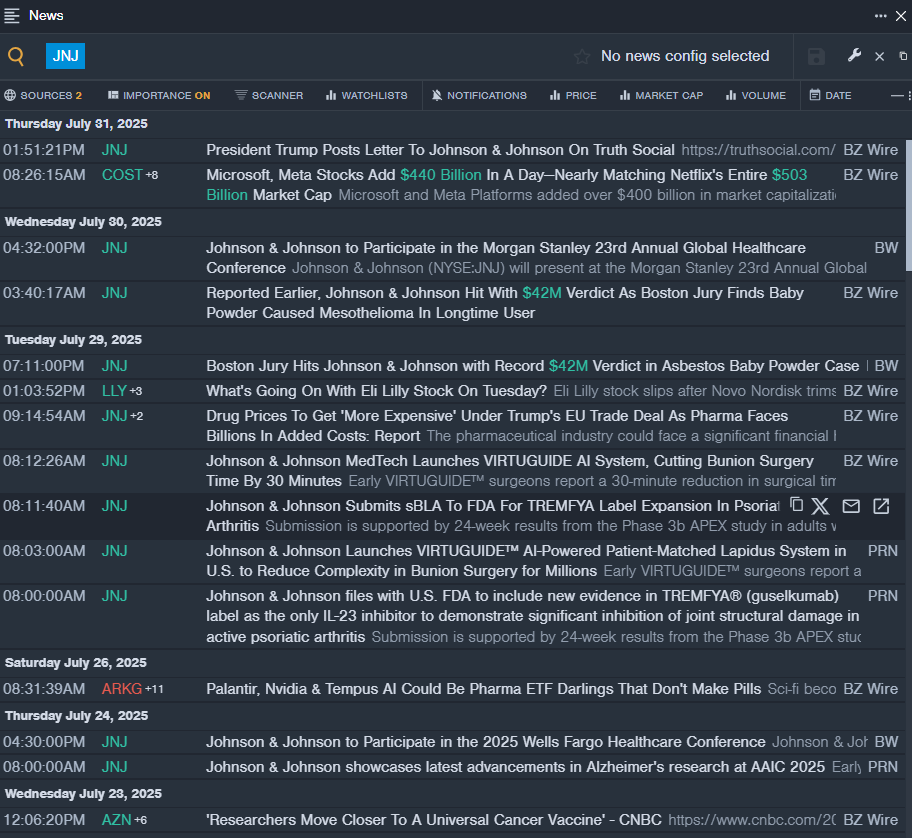

Johnson & Johnson (NYSE:JNJ)

- Dividend Yield: 3.16%

- Barclays analyst Matt Miksic maintained an Equal-Weight rating and raised the price target from $165 to $176 on July 17, 2025. This analyst has an accuracy rate of 65%.

- Guggenheim analyst Vamil Divan maintained a Neutral rating and boosted the price target from $164 to $167 on July 17, 2025. This analyst has an accuracy rate of 75%.

- Recent News: On July 29, Johnson & Johnson submitted sBLA to the FDA for TREMFYA label expansion in psoriatic arthritis.

- Benzinga Pro’s real-time newsfeed alerted to latest JNJ news.

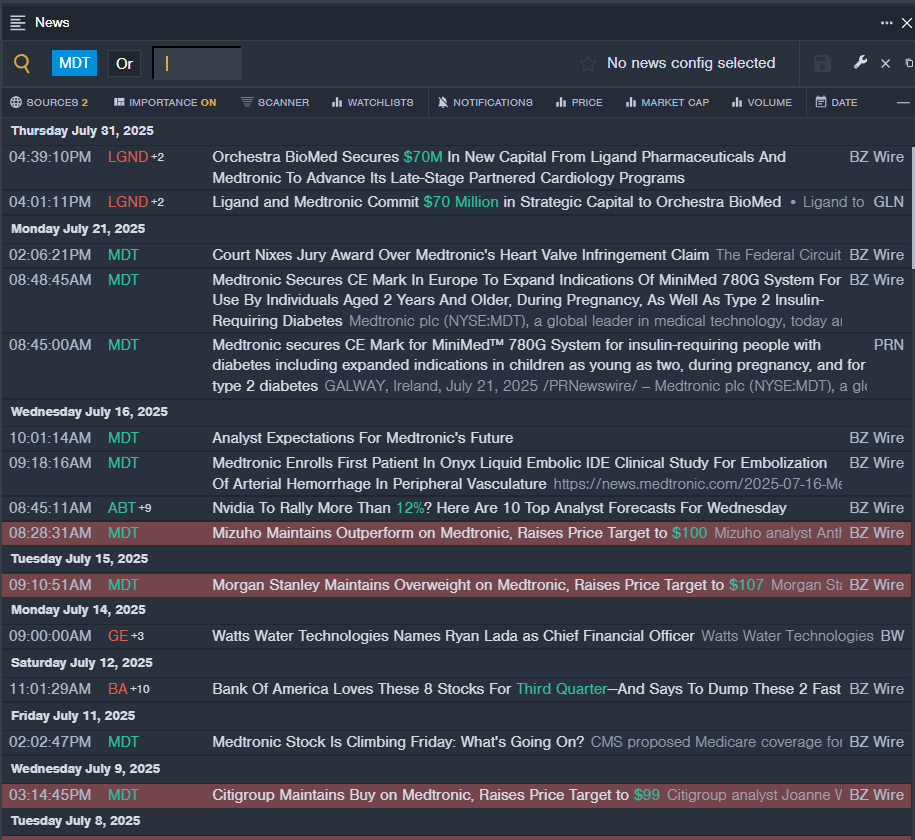

Medtronic plc (NYSE:MDT)

- Dividend Yield: 3.15%

- Mizuho analyst Anthony Petrone maintained an Outperform rating and raised the price target from $98 to $100 on July 16, 2025. This analyst has an accuracy rate of 63%.

- Citigroup analyst Joanne Wuensch maintained a Buy rating and increased the price target from $98 to $99 on July 9, 2025. This analyst has an accuracy rate of 74%.

- Recent News: On July 21, Medtronic secured CE Mark for MiniMed™ 780G System for insulin-requiring people with diabetes including expanded indications in children as young as two, during pregnancy, and for type 2 diabetes.

- Benzinga Pro's real-time newsfeed alerted to latest MDT news

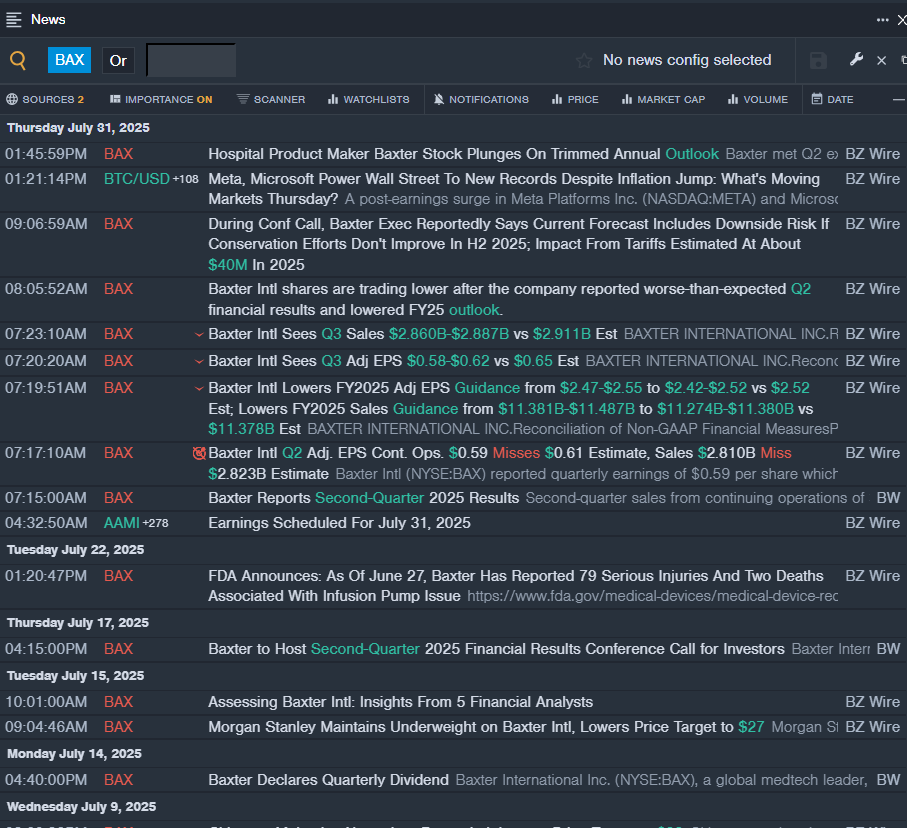

Baxter International Inc. (NYSE:BAX)

- Dividend Yield: 3.13%

- Citigroup analyst Joanne Wuensch maintained a Neutral rating and cut the price target from $34 to $32 on July 9, 2025. This analyst has an accuracy rate of 74%.

- Wells Fargo analyst Larry Biegelsen maintained an Equal-Weight rating and cut the price target from $36 to $33 on May 2, 2025. This analyst has an accuracy rate of 64%.

- Recent News: On July 31, Baxter Intl reported worse-than-expected second-quarter financial results and lowered FY25 outlook.

- Benzinga Pro’s real-time newsfeed alerted to latest BAX news

Read More:

Photo via Shutterstock

Posted-In: Long Ideas News Dividends Price Target Pre-Market Outlook Markets Analyst Ratings Trading Ideas