Wireless REIT Crown Castle International: Solely Focused On U.S. Markets & Fiber

It's now official, wireless tower REIT Crown Castle International Corp (NYSE: CCI) will be solely focused on growing its U.S. wireless network, having announced the $1.6 billion sale of its Australian CCAL cell tower subsidiary on May 14, to a group led by Macquarie Group Ltd.

According to the announcement, "CCAL was expected to contribute approximately US$58 million to US$63 million to Crown Castle's previously provided full year 2015 Outlook for Adjusted Funds from Operations of $1.450 billion to $1.465 billion, respectively."

Crown Castle owns 77.6 percent of CCAL, and stands to net ~$1.3 billion USD based upon an exchange rate of 0.80 USD to 1.00 Australian dollar.

Shares Modestly Up

During the past 52-weeks, shares of $27.6 billion cap Crown Castle have traded in a range of $70.62 - $88.58 per share, closing at $82.76, up half a point on the day.

Notably, CCI pays a REIT dividend currently yielding just under 4 percent.

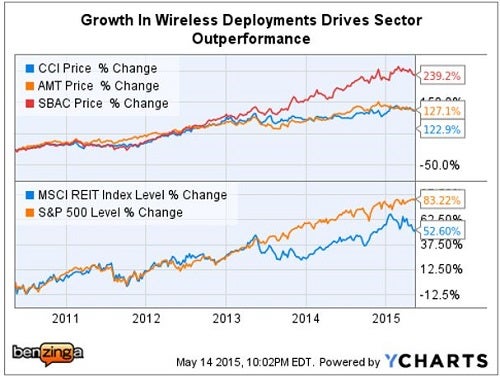

Tale Of The Tape - Past 5 Years

Crown Castle competes with both $40.1 billion cap American Tower Corp. (NYSE: AMT) and $15 billion cap SBA Communications (NASDAQ: SBAC) to own and operate cell towers leased on a long-term basis to leading wireless carriers in each market.

The exponential growth of wireless data and advanced spectrum deployments have both been catalysts for large scale capex spending by U.S. wireless carriers: AT&T, Verizon, T-Mobile US, and Sprint.

CCI - The Next Big Thing Is Small

Crown Castle has recently embarked down a different path than its sector peers when it comes to building out its U.S. network.

On April 30, CCI announced the $1 billion purchase of Quanta Services Inc. (NYSE: PWR) subsidiary Quanta Fiber Networks, Inc., more commonly referred to as "Sunesys."

Upon closing of the Sunesys acquisition, Crown Castle will own or have rights to more than 16,000 miles of fiber.

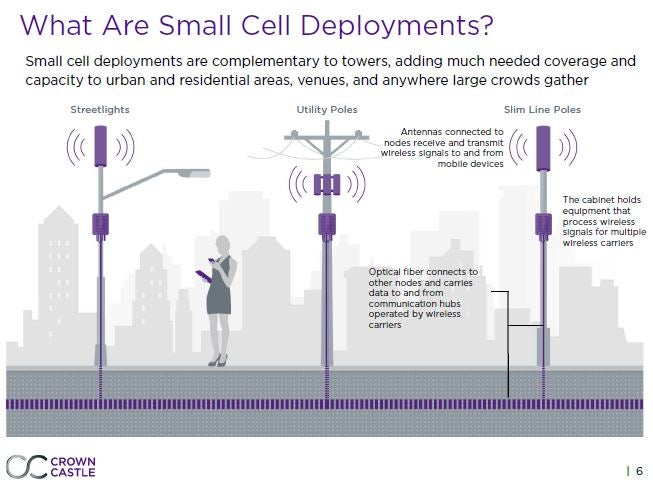

This acquisition represents is a large scale ramp up of small cell deployments in dense urban areas where carriers are not able to provide adequate cell coverage solely from tower mast and rooftop antenna networks.

CCI - A New Direction

"The sale of CCAL allows us to redeploy capital towards our growing small cell networks, which we expect will be accretive to our long-term AFFO and dividend per share growth rates," stated Ben Moreland, Crown Castle's President and Chief Executive Officer. "We believe we are in the early stages of small cells deployment and are excited by the opportunities that we see ahead of us.

Investor Takeaway

Both American Tower and SBA Communications believe that the markets with the highest ROIC potential are outside of the U.S.

Crown Castle is choosing to give up the risks and rewards associated with developing networks around the globe in favor of doubling down on U.S. wireless growth and pioneering large scale U.S. small-cell network deployments.

That said, AMT has recently expanded its U.S. tower footprint by ~11,500 sites with its $5 billion Verizon tower deal, a deal which many believed would be won by CCI.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Ben Moreland CCALLong Ideas REIT Top Stories Tech Trading Ideas Real Estate Best of Benzinga