US Stocks Mixed: Banks Rally While Tech Falls On Less Dovish Fed, Analyst Warns 'No News Would Be Good News'

Overall risk sentiment is picking up after fears of a systemic financial crisis have relaxed. Overnight, First Citizens Bancshares Inc.’s (NASDAQ: FCNCA) announced the buyout of Silicon Valley Bank, easing concerns about the banking sector's stability. Regional bank shares skyrocketed on the news, with First Republic Bank (NYSE: FRC) surging 14%.

Cues From Monday’s Trading:

Large cap and blue chip stocks were up, with banks outperforming other sectors. Traders' expectations for Fed rates have risen as their confidence in the banking sector's health grew. According to the CME Group Fed Watch Tool, the odds of a 25-basis-point hike in May have risen from 17% Friday to 36.8% now. Treasury yields also rose. This prevented rate-sensitive industries such as tech and real estate stocks from joining the rally.

See Also: Best Swing Trade Stocks

The S&P 500 Index was flat on the day, while the Dow Jones Industrial added 150 points or 0.45%. The Nasdaq Composite fell 30 points or 0.2%. The Russell 2000 index gained 0.4%.

| Index | Performance (+/-) | Value | |

|---|---|---|---|

| Nasdaq Composite | -0.22% | 11,798.04 | |

|

S&P 500 Index |

+0.3% | 3,982.07 | |

| Dow Industrials | +0.45% | 32,425.76 | |

| Russell 2000 | +0.4% | 1,746.70 |

Analyst Color:

More important than any economic indicators this week will be whether there is more bad news indicating the banking crisis is far from over, according to Yardeni Research. “No news would be good news. That’s what we’re rooting for,” it added.

The firm expects consumer-related indicators to show modest improvements but did not rule out the banking crisis weighing down on consumers. The Federal Reserve’s H.8 data on bank deposits and assets will likely shed more light on how the crisis in the banking system is playing out, it added.

Goldman Sachs Research became very bullish on artificial intelligence, predicting a $7-trillion increase in global GDP over the next decade and increasing its price targets for Microsoft (NASDAQ: MSFT), Salesforce (NASDAQ: CRM) and Adobe Systems (NASDAQ: ADBE).

Major U.S. Equity ETFs Today

As of midday trading on Friday, the SPDR S&P 500 ETF Trust (NYSE: SPY) rose 0.26%, to $396.78, the SPDR Dow Jones Industrial Average ETF (ARCA: DIA) was 0.6% lower to $324.1, and the Invesco QQQ Trust (NASDAQ: QQQ) moved down 0.4%, to $309.79, according to Benzinga Pro data.

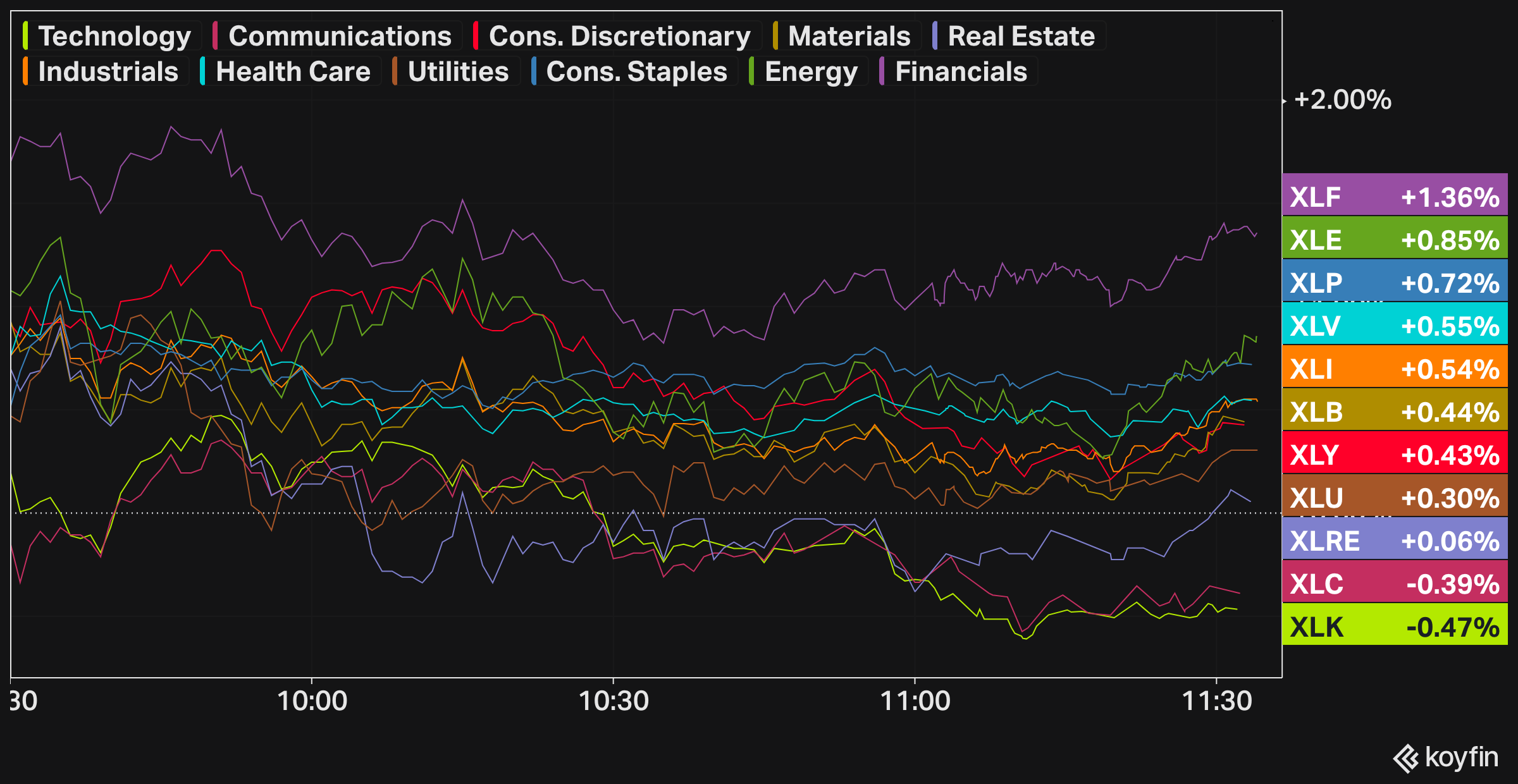

U.S. Sectors Today

The Financial Select Sector SPDR Fund (ARCA: XLF) rose 1.4% on the day, outperforming all other ten sectors. The Energy Select Sector SPDR Fund (ARCA: XLE) ticked 0.9% higher, amid solid gains in oil prices.

The Technology Select Sector SPDR Fund (ARCA: XLK) and the Communication Services Select Sector SPDR Fund (ARCA: XLC), lost 0.5% and 0.4%, respectively, amid higher rate expectations. The Real Estate Select Sector SPDR Fund (ARCA: XLRE) also underperformed the market.

Latest Economic Data:

The Federal Reserve Bank of Dallas' general business activity index for manufacturing in Texas decreased for the second consecutive month in March 2023, falling to -15.7 from -13.5 in February.

Fed Governor Philip Jefferson is scheduled to speak at 5 p.m. EDT. He is also a member of the Federal Open Market Committee, the policy-setting arm of the Federal Reserve.

Stocks In Focus:

- First Republic Bank (NYSE: FRC) rallied 14% on the day following the news of the takeover of SVB by First Citizens.

- Carnival Corporation (NYSE: CCL) fell 4%, despite reporting higher-than-expected EPS (a negative 0.603 vs a negative 0.55) and slightly better quarterly revenues ($4.432bn vs $4.318bn) as the cruise provided a negative outlooks for second-quarter and full-year.

- BioNTech SE (NASDAQ: BNTX) had a volatile session following the earning report. The company stated that this year's COVID-19 vaccine sales to be substantially lower than last year. The stock fell as much as 7% at the open, before rallying and posting a 1% daily loss. EPS were 19% higher than predicted (9.876 vs 8.296) and also revenues beat Wall Street's estimates ($4.563bn vs $3.897bn).

Top Analyst Calls

Pinterest (NYSE: PINS): Citi upgrades from Neutral to Buy and lowers price target from $25 to $35.

- M&T Bankcorp. (NYSE: MTB): Citi upgrades from Neutral to Buy and lowers price target from $178 to $155.

- KeyBanc Corp. (NYSE: KEY): Citi upgrades from Neutral to Buy with a $20 price target.

- Corning Inc. (NYSE: GLW): Deutsche Bank upgrades from Hold to Buy and ups price target from $35 to $38.

- United Rentals Inc. (NYSE: URI): Baird downgrades from Neutral to Underperform and lowers price target from $425 to $300.

- Caterpillar Inc. (NYSE: CAT): Baird downgrades from Neutral to Underperform and lowers price target from $230 to $185.

Commodities, Bonds, Other Global Equity Markets:

Crude oil prices rallied 3% on Monday, and barrel of WTI-grade crude rose to $71.26.

The benchmark 10-year Treasury yield fell to 3.49%, up by 11 basis points. The yield on the two-year yield Treasury Note surged nearly 20 basis points to 3.96%.

The major European markets ended Monday's session in the green. The iShares MSCI Eurozone ETF (ARCA: EZU) rose 0.6%.

Gold dropped 1% to $1,957/oz, with the SPDR Gold Trust (ARCA: GLD) down 0.9%. Silver also fell 1% to $22.97, with iShares Silver Trust (ARCA: SLV) down 0.4%.

Read Next: 3 Winners And 3 Losers In Real Estate As Pressure Grows On Commercial Properties

Staff writer Piero Cingari updated this story midday Monday.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Earnings News Penny Stocks Futures Previews Top Stories Economics Federal Reserve Best of Benzinga