Alcoa Warns Tariffs Could Cost $425 Million Annually: 'This Is The Most Material Impact' Says CEO

Alcoa Corp. (NYSE:AA), the largest aluminum producer in the United States, reported $20 million in additional costs during its first quarter, stemming from newly imposed tariffs on Canadian aluminum imports last month.

What Happened: During its first quarter earnings call on Wednesday, Alcoa’s CFO, Molly Bierman, said the 25% tariffs, which took effect on March 12th, have already impacted the company's bottom line, to the tune of $20 million, and expects tariff-related expenses to climb to $90 million during the second quarter.

Following up on this, CEO William F. Oplinger said the tariff poses a significant challenge for the company. "This is the most material impact to Alcoa, as approximately 70% of our aluminum produced in Canada is destined for U.S. customers," Oplinger said.

He estimated the annual cost of the 25% tariff could reach as high as $425 million.

Besides this, a portion of raw materials sourced from China is now subject to higher tariffs, according to Oplinger. He estimates those added costs will increase annual input expenses by $10 million to $15 million, citing a lack of viable alternative suppliers.

The company, however, expects to offset some of these costs with a high Midwest Premium, which refers to the added costs the buyers pay for aluminum, in addition to the base price. With this premium, Oplinger believes the net annual result is a negative $100 million for Alcoa.

Why It Matters: Recently, Bank of America Corp. (NYSE:BAC) analysts double-downgraded the stock, from “Buy” to “Underperform,” while slashing its Price Target from $58 to $26, representing a downward revision of 55%, citing lower aluminum prices and tariff pressures, reports Barron’s.

Alcoa’s CEO William Oplinger has been a vocal critic of the tariffs, saying that they could wipe out 100,000 U.S. jobs as far back as February, as reported by Investopedia.

Price Action: Alcoa stock was up 1.58% on Wednesday, but is down 1.48% in after-hours trading following its first quarter earnings release that fell short of estimates.

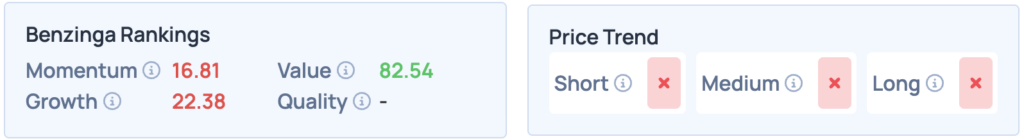

According to Benzinga’s Edge Stock Rankings, Alcoa is trending weak in the short, medium, and long term, while only scoring well on value, at 82.54. For more insights on this stock, its peers, and competitors, consider signing up for Benzinga Edge Stock Rankings.

Read More:

Photo courtesy: Wirestock Creators / Shutterstock.com

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Aluminum Donald Trump Midwest Premium Tariff tariffsEarnings Markets