PANW CEO Warns Traditional IT Can't Handle AI's Next Phase: '...The Conversation Is Shifting To Agentic AI'

At Palo Alto Networks Inc. (NASDAQ:PANW), the tone around AI is evolving rapidly and while the world still plays catch-up, the company is already setting its sights on what comes next, agentic AI.

What Happened: During its third quarter earnings call on Tuesday, the company’s CEO, Nikesh Arora, said that AI has become a central theme in virtually every customer conversation. But what’s notable now, he said, is the pivot to a new phase.

“During every conference, every customer conversation, the topic of AI transformation is more and more frequent, and now the conversation is shifting to agentic AI,” Arora said.

This shift underscores the growing urgency across leading organizations to rethink traditional IT architecture, which Arora warns is not built to handle the scale and complexity of AI.

As enterprises move deeper into AI infrastructure, the conversation is no longer just about adoption, he says, it's about protection. Arora called AI security “a strategic imperative,” noting that bad actors are already using AI to simulate entire ransomware attacks in under 25 minutes.

To address this, Palo Alto is expanding its portfolio with tools like XSIAM, its AI-powered security operations platform, and the recently launched Prisma AIRS, which scans and protects AI artifacts in production. The company also announced the acquisition of Protect.ai to bolster its model testing and red-teaming capabilities.

“As AI becomes more deeply integrated into our customers’ businesses,” Arora says, “the need to protect the underlying data, models, and infrastructure will become paramount.”

Why It Matters: On Tuesday, Wedbush analyst Dan Ives reiterated his “Outperform” rating on Palo Alto, citing strong cybersecurity deal activity across enterprises, with a price target of $225, or an upside of 15.6% from current levels.

Recently, Stephanie Link of Hightower Advisors doubled down on the company, calling it a “must-own in a sector where bigger is better.”

The company released its third quarter results on Tuesday, reporting $2.29 billion in revenue, up 15.3% year-over-year, and beating consensus estimates at $2.28 billion. It posted a profit of $0.80 per share, ahead of estimates at $0.77.

Price Action: The stock was up 0.09% on Tuesday, trading at $194.48 per share, but is down 5.13% after hours, following its third quarter results.

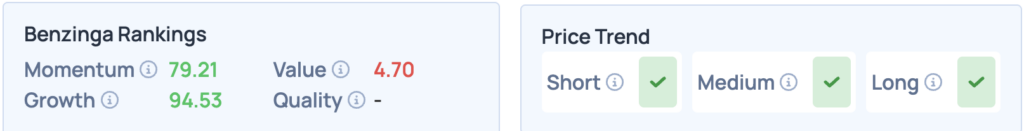

According to Benzinga’s Edge Stock Rankings, Palo Alto shares score well on Momentum and Growth, and have a favorable price trend in the short, medium, and long term. Click here for deeper insights into the stock.

Read More:

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Agentic AI Dan Ives Nikesh Arora Protect.Ai Stephanie LinkEarnings News Markets