Nvidia's Q1 Results Should Have Sparked A Bigger Rally, Says Gene Munster—Deserves An 8-10% Pop, Not Just 3%

Chipmaker Nvidia Corp.’s (NASDAQ:NVDA) better-than-expected first-quarter earnings resulted in a spike in the stock, but leading analysts and fund managers believe the market’s reaction didn’t go far enough.

What Happened: On Thursday, Gene Munster, Managing Partner of Deepwater Asset Management, posted on X expressing his disappointment in the market’s reaction to Nvidia’s strong first-quarter performance, amid substantial macroeconomic turmoil and uncertainties.

Munster believes just the company’s guidance alone should have sparked an 8% to 10% rally in the stock, referring to its $45 billion revenue forecast for the second quarter, despite losing $8 billion in potential sales due to export restrictions.

“Just based on the guid[ance] (excluding what could be said on the call and the shelf), the stock should be up 8-10%,” Munster said.

He argues that Wall Street is underestimating Nvidia's forward momentum and failing to properly adjust estimates based on the company's underlying growth, excluding the impact of U.S. export restrictions, which he says “will only last a year at most.”

Nvidia posted a 69% year-over-year growth in revenue during its first quarter, but Munster believes it would have been 79%, had it not been for the chip export restrictions to China. Similarly, he says, guidance for second-quarter sales growth would have been 76%, as opposed to 50%, due to the same reason.

Munster points out that the company’s revenue growth slowed slightly from the prior quarter, but he notes that it did so while operating off a much larger revenue base, which he finds “impressive.”

“That fractional decline of revenue growth quarter over quarter off of a much bigger base is impressive,” he said, framing it as “the latest evidence that the company's growth will be higher for longer.”

Despite these robust figures and fundamentals, the stock rallied a mere 3.25% on Thursday, which Munster finds too muted.

Why It Matters: Munster’s opinions were echoed by leading Wall Street banks and analysts, with as many as 12 institutions raising their Price Targets for the stock, following its results, as compiled and reported by Walter Bloomberg on X.

The stock now has an average consensus price target of $175.62, and $220.00 on the high side, representing an upside of 26.17% and 58% from current levels, respectively.

Analysts at Rosenblatt Securities referred to the company as the “Godfather of AI,” while forecasting “significant upside” and raising their price target to $200, from $178 prior to the results.

During its first quarter results on Wednesday, Nvidia reported $44.1 billion in revenue, up 69% year-over-year, and ahead of street estimates at $43.2 billion. It posted a profit of $0.81 per share, which, however, fell short of consensus figures at $0.88.

Price Action: Nvidia shares were up 3.25% on Thursday, trading at $139.19, but are down 1% after hours.

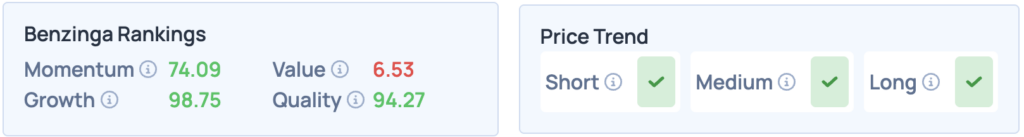

Nvidia scores high across the board in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium, and long term. Click here for deeper insights into the stock, its peers, and competitors.

Photo Courtesy: Hepha1st0s On Shutterstock.com

Read More:

Latest Ratings for NVDA

| Date | Firm | Action | From | To |

|---|---|---|---|---|

| Mar 2022 | Goldman Sachs | Reinstates | Neutral | |

| Feb 2022 | Summit Insights Group | Downgrades | Buy | Hold |

| Feb 2022 | Mizuho | Maintains | Buy |

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted-In: Deepwater Asset Management Gene Munster Rosenblatt Securities Walter BloombergEarnings News Markets Analyst Ratings